Cisco 2012 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2012 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

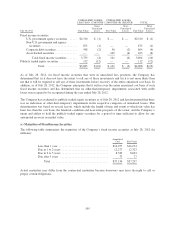

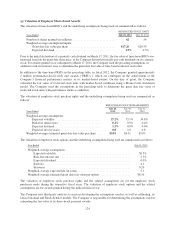

(b) Purchase Commitments with Contract Manufacturers and Suppliers

The Company purchases components from a variety of suppliers and uses several contract manufacturers to

provide manufacturing services for its products. During the normal course of business, in order to manage

manufacturing lead times and help ensure adequate component supply, the Company enters into agreements with

contract manufacturers and suppliers that either allow them to procure inventory based upon criteria as defined

by the Company or establish the parameters defining the Company’s requirements. A significant portion of the

Company’s reported purchase commitments arising from these agreements consists of firm, noncancelable, and

unconditional commitments. In certain instances, these agreements allow the Company the option to cancel,

reschedule, and adjust the Company’s requirements based on its business needs prior to firm orders being placed.

As of July 28, 2012 and July 30, 2011, the Company had total purchase commitments for inventory of $3,869

million and $4,313 million, respectively.

The Company records a liability for firm, noncancelable, and unconditional purchase commitments for quantities

in excess of its future demand forecasts consistent with the valuation of the Company’s excess and obsolete

inventory. As of July 28, 2012 and July 30, 2011, the liability for these purchase commitments was $193 million

and $168 million, respectively, and was included in other current liabilities.

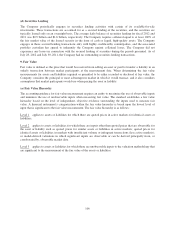

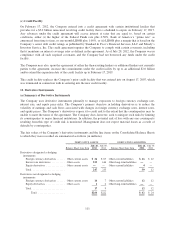

(c) Other Commitments

In connection with the Company’s business combinations and asset purchases, the Company has agreed to pay

certain additional amounts contingent upon the achievement of certain agreed-upon technology, development,

product, or other milestones or the continued employment with the Company of certain employees of the

acquired entities. The Company recognized such compensation expense of $50 million, $127 million, and $120

million during fiscal 2012, 2011, and 2010, respectively. As of July 28, 2012, the Company estimated that future

compensation expense and contingent consideration of up to $789 million may be required to be recognized

pursuant to the applicable business combination and asset purchase agreements, which included the $750 million

milestone payments related to Insieme as discussed later.

The Company also has certain funding commitments, primarily related to its investments in privately held

companies and venture funds, some of which are based on the achievement of certain agreed-upon milestones,

and some of which are required to be funded on demand. The funding commitments were $120 million and $192

million as of July 28, 2012 and July 30, 2011, respectively.

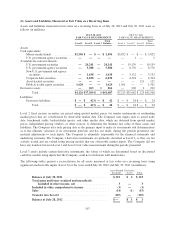

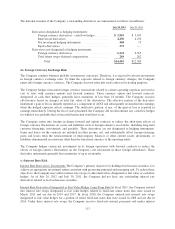

(d) Variable Interest Entities

VCE Joint Venture VCE is a joint venture that the Company formed in fiscal 2010 with EMC Corporation

(“EMC”), with investments from VMware, Inc. (“VMware”) and Intel Corporation. VCE helps organizations

leverage best-in-class technologies and disciplines from Cisco, EMC, and VMware to enable the transformation

to cloud computing.

As of July 28, 2012, the Company’s cumulative gross investment in VCE was approximately $392 million,

inclusive of accrued interest, and its ownership percentage was approximately 35%. The Company invested

approximately $276 million in VCE during fiscal 2012 and $90 million during fiscal 2011.

The Company accounts for its investment in VCE under the equity method, and its portion of VCE’s net loss is

recognized in other income, net. The Company’s consolidated share of VCE’s losses, based upon its portion of

the overall funding, was approximately 36.8%, 36.8%, and 35.0% for the fiscal years ended July 28,

2012, July 30, 2011, and July 31, 2010, respectively. As of July 28, 2012, the Company has recorded cumulative

losses from VCE of $239 million since inception, of which $160 million, $76 million, and $3 million were

recorded for the fiscal years ended July 28, 2012, July 30, 2011, and July 31, 2010, respectively. The Company’s

carrying value in VCE as of July 28, 2012 was $153 million and the balance was recorded in other assets.

115