BMW 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

78 GROUP FINANCIAL STATEMENTS

78 Income Statements

78 Statement of

Comprehensive Income

80 Balance Sheets

82 Cash Flow Statements

84 Group Statement of Changes

in Equity

86 Notes

86 Accounting Principles

and Policies

100 Notes to the Income

Statement

107 Notes to the Statement

of Comprehensive Income

108

Notes to the Balance Sheet

129 Other Disclosures

145 Segment Information

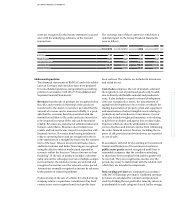

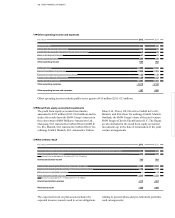

(b) Financial reporting pronouncements issued

by the IASB, but not yet applied

The following Standards, Revised Standards and Amend-

ments issued by the IASB during previous accounting

periods, were not mandatory for the period under report

and were not applied in the financial year 2012:

Standard / Interpretation

Date of Date of Date of Expected impact

issue by IASB mandatory mandatory on BMW Group

application application

IASB EU

IFRS 1 Amendments with Respect to Fixed

Transition Dates and Severe Inflation

20. 12. 2010 1. 7. 2011 1. 1. 2013 None

Amendments relating to Government

Loans at a Below Market Rate of Interest

13. 3. 2012 1. 1. 2013 No

None

7

New financial reporting rules

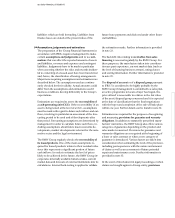

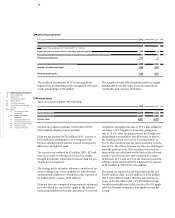

(a) Financial reporting rules applied for the first time in the financial year 2012

The following revised Standard was applied for the first time in the financial year 2012.

Standard

Date of Date of Endorsed Expected impact

issue by IASB mandatory by the EU on BMW Group

application

IASB

IFRS 7 Disclosure Requirements in the Event of

the Transfer of Financial Assets

7. 10. 2010 1. 7. 2011* 1. 7. 2011*

Insignificant

* Mandatory application in annual periods beginning on or after 1 July 2011.

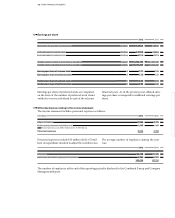

for litigation and liability risks are recognised when an

outflow of resources is probable and a reliable estimate

can be made of the amount of the obligation. Manage-

ment is required to make assumptions with respect to

the probability of occurrence, the amount involved and

the duration of the legal dispute. For these reasons,

the recognition and measurement of provisions for litiga-

tion

and liability risks are subject to uncertainty. Fur-

ther information is provided in note 35.

The calculation of pension provisions requires assump-

tions to be made with regard to discount factors, salary

trends, employee fluctuation, the life expectancy of

employees and the expected rate of return on plan assets.

Discount factors are determined annually by reference

to market yields at the end of the reporting period on

high quality corporate bonds. A company-specific default

risk is not taken into account. The salary level trend re-

fers to the expected rate of salary increase which is

esti-

mated annually depending on inflation and the career

development of employees within the Group. The ex-

pected rate of return on plan assets is based on market

expectations prevailing at the beginning of the report-

ing period for investment income over the remaining

period of the obligation and is determined for the

relevant asset classes in which plan assets are invested,

taking account of costs and unplanned risks. Further

information is provided in note 34.

The calculation of deferred tax assets requires

assump-

tions to be made with regard to the level of future

taxable income and the timing of recovery of deferred

tax assets. These assumptions take account of forecast

operating results and the impact on earnings of the

reversal of taxable temporary differences. Since future

business developments cannot be predicted with cer-

tainty and to some extent cannot be influenced by the

BMW Group, the measurement of deferred tax assets

is subject to uncertainty. Further information is pro-

vided in note 15.