BMW 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

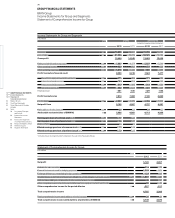

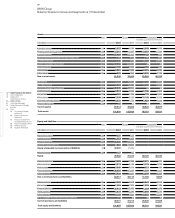

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

21 General Economic Environment

24 Review of Operations

44 BMW Stock and Capital Market

47 Disclosures relevant for takeovers

and explanatory comments

50 Financial Analysis

50 Internal Management System

52 Earnings Performance

54 Financial Position

57 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

65 Internal Control System and

explanatory comments

66 Risk Management

74 Outlook

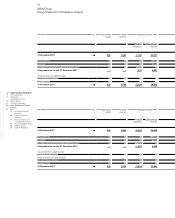

The assessments contained in the “Outlook” section

are based on the forecasts made by BMW AG for the

years 2013 and 2014 and reflect the most recent status.

The basis of preparation of our forecasts, which take ac-

count of consensual opinions of leading organisations,

such as banks and economic research institutes, is set

out below. These assumptions flow into the targets set

for the segments.

Our continuous forecasting process ensures that the

BMW Group is always ready to take advantage of oppor-

tunities as they arise. The principle risks facing the busi-

ness are described in detail in the risk report.

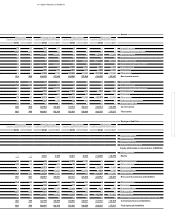

Economic outlook for 2013

The global economy is expected to stabilise at a slower

growth rate of approximately 2 % in 2013. However, in

view of burgeoning public-sector debt in Europe, the

USA

and Japan, substantial over-capacities in China and

conflict hot spots in the Middle East, the outlook is over-

shadowed by a number of major risks.

Output in the eurozone is set to stagnate in 2013 at the

previous year’s level. The German economy, the largest

in Europe, is forecast to grow again in 2013, albeit at the

modest rate of 0.7 %. The French economy is expected

to remain flat for the time being, a prediction fraught

with major uncertainty in view of the prevailing risks.

Based on forecasts, Italy’s gross domestic product (GDP)

is set to contract by approximately 1.0 %. In Spain the

downward trend is likely to continue, with economic

output down by a further 1.6 %. A growth rate of 0.9 % is

predicted for the UK, Europe’s largest market outside

the eurozone.

Again this year the recovery in the USA looks set to

continue and growth in the region is predicted to run at

around 2.0 %. The looming tax rises and expenditure

cuts previously planned for the turn of the financial

year 2013 were reduced. However, the negative impact

on purchasing power should be offset by growing

vitality on the job and property markets. Overall, how-

ever, growth is likely to remain at roughly the previous

year’s level and the US economy is set to continue its

upward trend.

The performance of the Japanese economy in 2013 will

depend largely on the policymaking skills of the newly

elected government. Having slipped back into

recession

at the end of 2012, Japan is at best likely to achieve

only modest growth of some 0.8 % in 2013, even with

the help of generous expansionary monetary and fiscal

policies.

The Chinese economy is likely to gather pace again in

the course of the current year. Positive early indicators

as well as the announcement made by the Chinese

government of further programmes to stimulate the

economy give reason to believe that GDP in China

will rise by 8.0 %. High property price levels and over-

capacities in the construction and heavy industries sec-

tor, could, however, hold down the growth rate in the

region.

The economies of India and Brazil are expected to grow

by 6.0 % and 3.5 % respectively. Russia’s GDP is likely to

expand by about 3.4 %, roughly in line with the previous

year.

Fluctuations on currency markets

High public-sector debt in Europe, the USA and Japan

are likely to cause continued fluctuations on the world’s

currency markets. The US dollar / euro exchange rate

is expected to average out at previous year’s levels. The

Chinese renminbi will probably remain coupled to the

US dollar, with only minor fluctuations between the two

currencies. The budget situation and greater expansion-

ary monetary policies in Japan could cause the Japanese

yen to drop further in value. The British pound is fore-

cast to appreciate modestly against the euro, assuming

the UK can maintain stable economic growth.

Car markets in 2013

Taken as a whole, the world’s car markets are expected

to grow by some 4.0 % in the current year to a total of

75.5 million units. High demand for replacement vehicles

after a number of weak years should boost volumes sold

in the USA by approximately 2.1 % to 14.8 million units.

The Chinese passenger car market is forecast to grow by

approximately 8.5 % to 14.4 million units. The regional

spread of sales in China is likely to shift increasingly in-

land, away from the coast towards the interior provinces,

which are now entering a catch-up phase.

The downward trend seen in Europe in recent years is

set to continue, with the market as a whole contracting

by 1.8 % to 12.3 million units. Following a period of

drastic decreases, however, the market could well now

consolidate at approximately this level. Sales volumes

Outlook