BMW 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

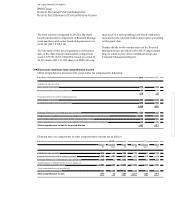

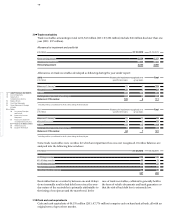

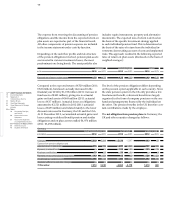

117 GROUP FINANCIAL STATEMENTS

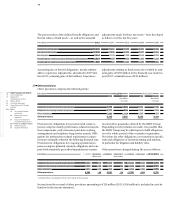

32

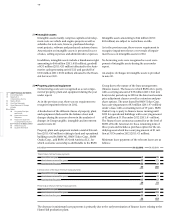

At 31 December 2012 common stock issued by BMW AG

was divided, as at the end of the previous year, into

601,995,196 shares of common stock with a par-value of

€ 1. Preferred stock issued by BMW AG was divided into

53,994,217 shares (2011: 53,571,372 shares) with a par-

value of € 1. Unlike the common stock, no voting rights

are attached to the preferred stock.

All of the Company’s

stock is issued to bearer. Preferred

stock bears an addi-

tional dividend of € 0.02 per share.

In 2012, a total of 422,905 shares of preferred stock was

sold to employees at a reduced price of € 31.45 per share

in conjunction with an

Employee Share Scheme

. These

shares are entitled to receive dividends with effect from

the financial year 2013. 60 shares of preferred stock were

bought back via the stock exchange in conjunction with

the Company’s

Employee Share Scheme

.

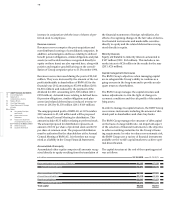

Assets held for sale and liabilities in conjunction

with assets held for sale

In the fourth quarter of the financial year 2012 the Board

of Management of BMW AG decided to realign its stra-

tegic direction for the Motorcycles segment in view of

the changing nature of motorcycle markets, demographic

developments and stricter environmental requirements.

The BMW Group intends to broaden its product range,

in particular in the fields of urban mobility and e-mo-

bility, in order to open up future growth opportunities.

In line with the decision to focus on the BMW Motorrad

brand, and considering the declining size of the rele-

vant markets, it is considered a sensible move to sell the

Husqvarna Motorcycles brand.

In December 2012, BMW AG, Munich, and Pierer Industrie

AG, Wels, reached agreement with regard to the sale of

Husqvarna Motorcycles S.r.l., Cassinetta di Biandronno,

and Husqvarna Motorcycles NA, LLC, Wilmington, DE,

to Pierer Industrie AG, Wels. Subject to approval of the

transaction by the Austrian Merger Control Authorities,

the sale will be completed during the first half of 2013.

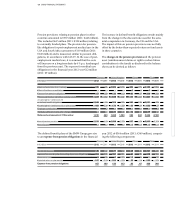

Further information on share-based remuneration is

pro-

vided in note 18.

Issued share capital increased by € 0.4 million as a result

of the issue to employees of 422,845 shares of non-voting

preferred stock. The Authorised Capital of BMW AG

amounted to € 3.2 million at the end of the reporting

period. The Company is authorised to issue shares of

non-voting preferred stock amounting to nominal

€ 5.0 million prior to 13 May 2014. The share premium

of € 18.2 million arising on the share capital increase in

2012 was transferred to capital reserves.

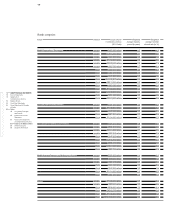

Capital reserves

Capital reserves include premiums arising from the

issue of shares and totalled € 1,973 million (2011:

€ 1,955 million). The change related to the share capital

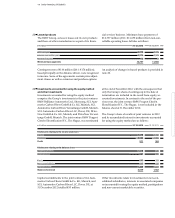

At 31 December 2012, the Husqvarna Group accordingly

meets the criteria for classification as a “disposal group”

in accordance with IFRS 5. The carrying amount of prop-

erty, plant and equipment and intangible assets attribut-

able to the Husqvarna Group has been written down

to fair value less costs to sell. All assets of the Husqvarna

Group are reported separately in the balance sheet on

the line “Assets held for sale” within the Motorcycles seg-

ment. Similarly, its liabilities are reported separately in

the balance sheet on the line “Liabilities in conjunction

with assets held for sale” within the Motorcycles segment.

The remeasurement of assets in accordance with IFRS 5

resulted in the recognition of an impairment loss of

€ 13 million on property, plant and equipment which is

reported in “Other operating expenses”.

Assets held for sale comprise mainly inventories (€ 24 mil-

lion)

,

other assets (€ 10 million) and trade receivables

(€ 11 million). Liabilities in conjunction with assets held

for sale comprise mainly pension provisions (€ 2 million),

other provisions (€ 7 million), trade payables

(€ 16 mil-

lion) and other liabilities (€ 3 million).

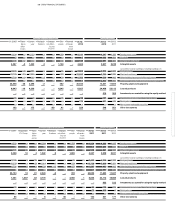

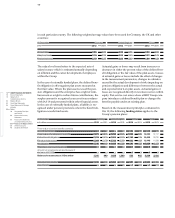

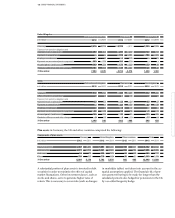

33

Equity

Number of shares issued

Preferred stock Common stock

2012 2011 2012 2011

Shares issued / in circulation at 1 January 53,571,372 53,163,412 601,995,196 601,995,196

Shares issued in conjunction with Employee Share Scheme 422,905 408,140 – –

less: shares repurchased and re-issued 60 180 – –

Shares issued / in circulation at 31 December 53,994,217 53,571,372 601,995,196 601,995,196