BMW 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89 GROUP FINANCIAL STATEMENTS

Accounting policies

The financial statements of BMW AG and of its subsid-

iaries

in Germany and elsewhere have been prepared

for consolidation purposes using uniform accounting

policies in accordance with IAS 27 (Consolidated and

Separate Financial Statements).

Revenues from the sale of products are recognised when

the risks and rewards of ownership of the goods are

transferred to the dealer or customer, provided that the

amount of revenue can be measured reliably, it is prob-

able that the economic benefits associated with the

transaction will flow to the entity and costs incurred or

to be incurred in respect of the sale can be measured

reliably. Revenues are stated net of settlement discount,

bonuses and rebates. Revenues also include lease

rentals

and interest income earned in conjunction with

financial services. Revenues from leasing instalments

relate to operating leases and are recognised in the in-

come statement on a straight line basis over the relevant

term of the lease. Interest income from finance leases

and from customer and dealer financing are recognised

using the effective interest method and reported as

revenues within the line item “Interest income on loan

financing”. If the sale of products includes a determi-

nable

amount for subsequent services (multiple-compo-

nent contracts), the related revenues are deferred and

recognised as income over the relevant service period.

Amounts are normally recognised as income by reference

to the pattern of related expenditure.

Profits arising on the sale of vehicles for which a Group

company retains a repurchase commitment (buy-back

contracts) are not recognised until such profits have

been realised. The vehicles are included in inventories

and stated at cost.

Cost of sales comprises the cost of products sold and

the acquisition cost of purchased goods sold. In addi-

tion to directly attributable material and production

costs, it also includes research costs and development

costs not recognised as assets, the amortisation of

capitalised development costs as well as overheads (in-

cluding depreciation of property, plant and equipment

and amortisation of other intangible assets relating to

production) and write-downs on inventories. Cost of

sales also includes freight and insurance costs relating

to deliveries to dealers and agency fees on direct sales.

Expenses which are directly attributable to financial

services business and interest expense from refinancing

the entire financial services business, including the ex-

pense

of risk provisions and write-downs, are reported

in cost of sales.

In accordance with IAS 20 (Accounting for Government

Grants and Disclosure of Government Assistance),

public sector grants are not recognised until there is

reasonable assurance that the conditions attaching

to them have been complied with and the grants will

be received. They are recognised as income over the

periods necessary to match them with the related costs

which they are intended to compensate.

Basic earnings per share are computed in accordance

with IAS 33 (Earnings per Share). Undiluted earnings

per share are calculated for common and preferred

stock by dividing the net profit after minority interests,

as attributable to each category of stock, by the average

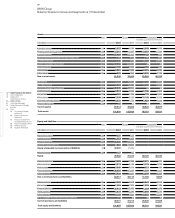

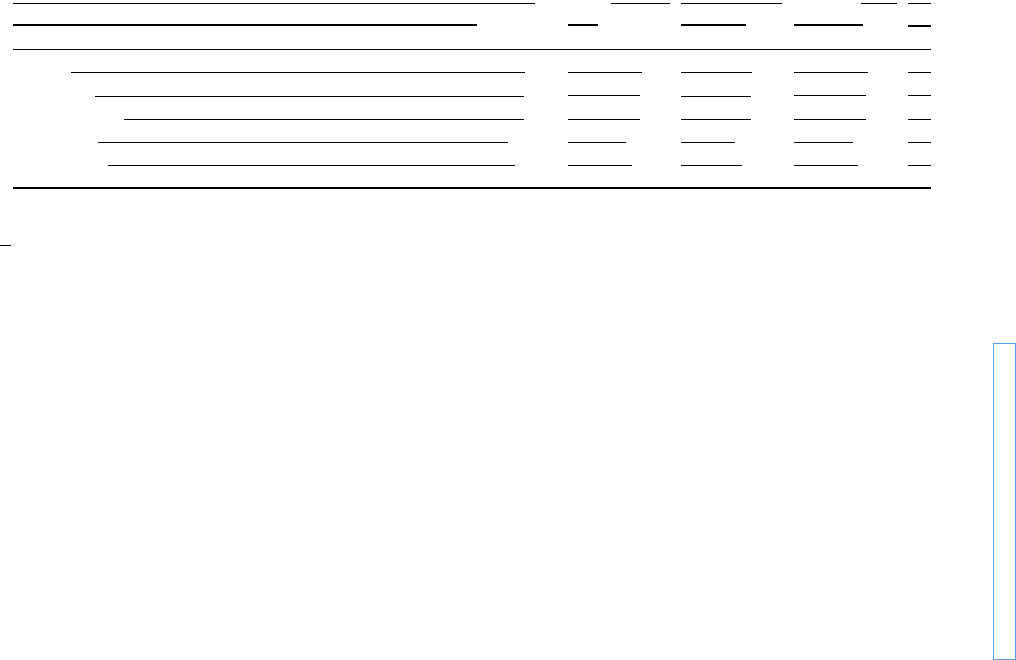

Closing rate Average rate

31. 12. 2012 31. 12. 2011 2012 2011

US Dollar 1.32 1.30 1.29 1.39

British Pound 0.81 0.84 0.81 0.87

Chinese Renminbi 8.23 8.17 8.11 9.00

Japanese Yen 114.10 100.15 102.63 111.00

Russian Rouble 40.41 41.69 39.91 40.88

5

ment are recognised in the income statement in accord-

ance with the underlying substance of the relevant

transactions.

The exchange rates of those currencies which have a

material impact on the Group Financial Statements

were as follows: