BMW 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

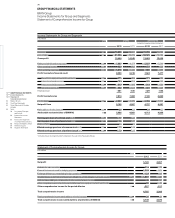

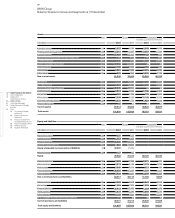

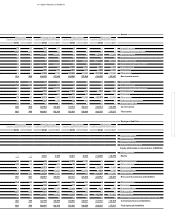

75 COMBINED GROUP AND COMPANY MANAGEMENT REPORT

are forecast to remain flat in Germany, France and Spain

and decrease marginally in the UK and Italy.

The car market in Japan could see a drop of 4 % to 5.0 mil-

lion

units as the catch-up effect begins to wane.

A growth rate of around 10 % is forecast for the Russian

car market in 2013, which would entail a volume of

some 3.0 million units. Demand for cars in India is pre-

dicted to rise by 7 % to 2.9 million units in 2013. The

corresponding figures for Brazil are 9 % and 3.95 million

units respectively.

Motorcycle markets in 2013

Overall, we expect the world’s motorcycle markets in

the 500 cc plus class to grow slightly in 2013. In Europe,

however, the negative trend is quite likely to continue,

with only the German market looking set to remain

stable. Modest growth is forecast for the USA and Japan.

The motorcycle market in Brazil is also likely to con-

tinue expanding, even if not quite as dynamically as in

recent years.

The financial services market in 2013

The forecast of moderate growth for the global econ-

omy in the current year is likely to be achieved – among

other factors – on the back of looser monetary policies

in the USA, China and some growth markets. Down-

beat economic prospects will probably ensure that i

n-

flationary pressures in industrialised countries do not

rise further. We are assuming that the world’s major

central banks continue their expansionary monetary

policies throughout the current year. Both the European

Central Bank (ECB) and the US Reserve Bank have an-

nounced their intention to keep interest rates at their

current low level during 2013. Refinancing conditions

for the whole sector are likely to remain volatile for

the foreseeable future given the pervading nervousness

on the world’s capital markets.

There is also unlikely to be any change in the divergent

development of vehicle residual values over the course

of 2013. The economic situation will remain particularly

tense in southern Europe. At present, it is difficult to

assess the extent to which the sovereign debt crisis will

affect other European countries. For the time being, it

seems reasonable to assume that used car markets out-

side Europe will remain more or less stable in average

terms.

A similarly heterogeneous picture is also likely to apply

for the credit risk situation over the course of 2013.

Compared to the ongoing tenseness in southern Europe,

the overall situation elsewhere is expected to improve

marginally.

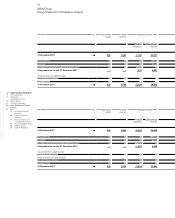

Outlook for the BMW Group in 2013

High public-sector debt levels and the prospect of con-

solidation in spending, particularly in Europe, remain a

source of uncertainty in 2013. Other concerns for the

global economy have been kindled by slower growth in

China and political instability in a number of regions.

The situation is exacerbated by the fact that greater vola-

tility in forecasting parameters currently makes it more

difficult for the BMW Group to predict future perfor-

mance

with any degree of accuracy.

Our answer to uncertainties in a volatile environment is

to follow our Strategy Number ONE, which we

have

been actively implementing for several years now.

The

strategic aim we are pursuing is clearly reflected

in the

excellent figures reported for the past year and

en ables

us to look forward with confidence to 2013. We intend

to continue the success story with our strong brands,

all of which enjoy a global presence. We will be

aided in

this endeavour by our attractive range of models

and

services, comprehensively designed to meet the needs

of individual mobility. With our focus on “premium”,

as the world’s leading provider we benefit to an

excep-

tional extent from the high demand for premium seg-

ment

vehicles.

We forecast that vehicle sales will again rise to new re-

cord levels in 2013, enabling the BMW Group to remain

the world’s foremost premium car manufacturer.

Demand for our models remains high, particularly for

the BMW 1, 3, 5 and 6 Series and the BMW X family.

The launches of the BMW 3 Series Touring on European

markets and the BMW 3 Series Sedan (with xDrive four-

wheel-drive system) in the USA have also driven sales

momentum, right from the outset. Further impetus will

come from the BMW X1, which is now also available in

China and the USA. Our exceptionally strong sales per-

formance in some parts of the world, such as in China

and the USA, is more than compensating the market

weakness a number of European countries are currently

experiencing. Even here, however, we are still achieving

good growth in a host of countries.