BMW 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

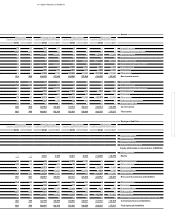

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

21 General Economic Environment

24 Review of Operations

44 BMW Stock and Capital Market

47 Disclosures relevant for takeovers

and explanatory comments

50 Financial Analysis

50 Internal Management System

52 Earnings Performance

54 Financial Position

57 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

65 Internal Control System and

explanatory comments

66 Risk Management

74 Outlook

Credit risks arise in conjunction with lending to retail

customers and major corporate customers, the latter

relating primarily to the dealer, fleet and importer

financing / leasing lines of business. Counterparty de-

fault risk, by contrast, refers to the risk that banks or

financial institutes with which financial instruments

have been transacted are unable to meet their payment

obligations.

Lending to retail customers is largely based on auto-

mated scoring techniques. In the case of major cor-

porate customers, creditworthiness is checked using

internal rating models, which take account of financial

statement data and supplementary qualitative evalua-

tions. Customer creditworthiness is tested at least once

a year and revised accordingly. The approval for lend-

ing to major corporate customers is primarily based on

a standardised method of measuring the value of the

vehicle(s) or other object(s) serving as collateral. The re-

coverability of the value of items accepted as collateral

is regularly reviewed, measured and evaluated with

a view to assessing the impact on the level of risk not

covered by collateral.

In order to minimise risk from lending, we employ

standardised instruments such as subsequent security,

additional collateral, retention of vehicle documents

or

higher upfront payments. In addition, the levels

of authority and responsibility of those involved in the

lending process are clearly defined. Local, regional and

centralised credit audits are also regularly performed

by Internal Audit to check compliance with lending

approval and authorisation rules procedures as well as

the processes and IT systems involved.

We continue to develop standardised credit decision pro-

cesses

for the BMW Group worldwide. The focus here

is

on improving the quality of credit applications, the

Group’s rating methodology and procedures used to se-

lect employees within the worldwide credit and coun-

terparty risk network.

In the case of vehicles which remain with the Financial

Services segment at the end of a contract (leases and

credit financing arrangements with option of return),

there is a residual value risk if the residual value calcu-

lated at the inception of the contract is not recovered

when the vehicle is sold (residual value risk). Residual

values are calculated uniformly throughout the BMW

Group in accordance with mandatory guidelines. For risk

management purposes, the expected risk-free residual

value of a vehicle is measured on the basis of external

and internal information. These amounts are checked

regularly and adjusted as appropriate. Residual values

of vehicles on used car markets are continuously moni-

tored and reported on. In addition to internal informa-

tion, our assessments also take account of external mar-

ket data. The BMW Group strives to mitigate effectively

against declining residual values by actively managing

the life cycles of current models, optimising reselling

processes on international markets and implementing

targeted price and volume measures. Potential losses

are measured by comparing forecasted market values

and contractual residual values by model and market.

The scope of procedures applied to manage operational

risks is based on Basel II requirements. This includes

identifying and measuring potential risk scenarios, com-

puting

and monitoring key risk indicators on an ongoing

basis, the systematic recording of loss claims and a

range of coordinated measures aimed at mitigating risk.

Both qualitative and quantitative aspects are taken into

account in the decision-making process. The latter is

backed up by various system-based solutions, all of

which follow the principles of operational risk manage-

ment, such as the segregation of duties, dual control,

documentation and transparency. In addition, both the

effectiveness and efficiency of the internal control system

are tested regularly.

Legal risks

Acting responsibly and complying with the law are the

basic prerequisites for our success. Current legislation

provides the binding framework for our wide range of

activities around the world. The growing international

scale of operations of the BMW Group, the complexity

of the business world and the whole gamut of complex

legal regulations increase the risk of laws being broken,

simply because they are not known or fully understood.

The BMW Group has established a Compliance Or-

ganisation

aimed at ensuring that its representative

bodies, managers and staff act in a lawful manner at

all

times. Further information on the BMW Group’s

Compliance Organisation can be found in the section

“Corporate Governance”.

Like all enterprises, the BMW Group is, or could be,

confronted with the risk of legal disputes relating, among

other things, to warranty claims, product liability,

in-

fringement of protected rights or proceedings initiated

by government agencies. Any of these matters could