BMW 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

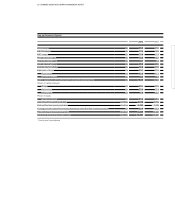

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

21 General Economic Environment

24 Review of Operations

44 BMW Stock and Capital Market

47 Disclosures relevant for takeovers

and explanatory comments

50 Financial Analysis

50 Internal Management System

52 Earnings Performance

54 Financial Position

57 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

65 Internal Control System and

explanatory comments

66 Risk Management

74 Outlook

used and that risks pertaining to information technol-

ogy (IT risks) are dealt with transparently. Regular com-

munication, awareness-raising activities and training

measures (e. g. online training on information and data

protection issues) create a high degree of security and

risk awareness among the employees involved. Employees

also receive training from the Group’s Compliance

Organisation to ensure compliance with legal and regu-

latory requirements.

Potential IT and data protection risks resulting from

the use of information technology and the processing

of information are monitored on a regular basis and

managed by the departments responsible.

The technical data protection procedures used primarily

involve process-specific security measures. Standard

activities such as virus scanners, firewall systems, access

controls at both operating system and application level,

internal testing procedures and the regular backing up

of data are also employed. A security network is in place

group-wide to ensure that stipulated requirements are

complied with. A high level of protection is afforded

by

regular analyses, detailed up-front controls (such as

compliance with mandatory data protection require-

ments) and rigorous security management (for instance

in the form of our centralised Security Operation Cen-

tre, which is responsible for monitoring internal net-

work traffic). The IT data protection and security strategy

adopted in 2011 has not only tightened security within

the BMW Group, it also helps to identify IT risks and

enables appropriate action to be taken. At the same time,

the Group’s data protection strategy was adopted and

a set of data protection rules published, which apply for

all of the Group’s employees.

In the case of cooperation arrangements and business

partner relationships we protect our intellectual property

as well as customer and employee data by stipulating

clear instructions with regard to data protection and the

use of information technology. Information underlying

key areas of expertise is subject to particularly stringent

security measures.

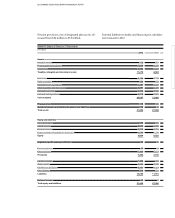

Financial risks and those relating to the provision of

financial services

Currency risks

The sale of vehicles outside the eurozone gives rise

to exchange risks. The BMW Group’s currency risk in

2012 was dominated by the US dollar, the Chinese

renminbi, the British pound, the Russian rouble and

the Japanese yen. Foreign currency risks are determined

for forecast exposures measured using cash flow-at-

risk models and scenario analyses. Operational currency

management is based on the results provided by these

tools.

The BMW Group manages currency risks both at a

stra-

tegic (medium and long term) and at an operating

level

(short and medium term). In the medium and long

term, foreign exchange risks are managed by “natural

hedging”, in other words by increasing the volume of

purchases denominated in foreign currency or increas-

ing the volume of local production. In this context,

the expansion of the plant in Spartanburg, USA, and

the opening of the BMW Brilliance joint venture’s new

plant in Tiexi in 2012 at the Shenyang site, China, are

helping to reduce foreign exchange risks in two major

sales markets.

For operating purposes (short and medium term),

cur-

rency risks are hedged on the financial markets.

Hedging transactions are entered into only with finan-

cial partners of good credit standing. A description of

the methods applied for risk measurement and hedging

is provided in the notes to the Group Financial State-

ments. Counterparty risk management procedures are

carried out continuously to monitor the creditworthi-

ness of business partners.

Raw material risks

The availability of specific groups of raw materials and

changes in raw materials prices both represent signifi-

cant risks for the BMW Group. In order to safeguard

the supply of production materials and reduce cost

risks, commodities markets are closely monitored and

analysed.

Financial derivatives are employed to hedge against

price risks arising for precious metals (i. e. platinum,

palladium and rhodium) and non-ferrous metals (i. e.

aluminium, copper and lead) and, to some extent,

steel and steel ingredients such as iron ore. Medium

and long-term purchase contracts with fixed pricing

arrangements for raw materials such as steel and plas-

tics are also in place. A description of the methods

applied for risk measurement and hedging is provided

in the notes to the Group Financial Statements.

Changes in the price of crude oil (as a basic ingredient

in many of our components) have an indirect impact on

our production costs. Crude oil prices (and exchange