BMW 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

21 General Economic Environment

24 Review of Operations

44 BMW Stock and Capital Market

47 Disclosures relevant for takeovers

and explanatory comments

50 Financial Analysis

50 Internal Management System

52 Earnings Performance

54 Financial Position

57 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

65 Internal Control System and

explanatory comments

66 Risk Management

74 Outlook

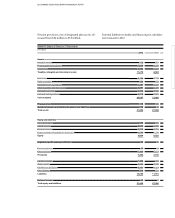

Free cash flow of the Automotive segment can be

analysed as follows:

Refinancing

Operating cash flow provides a solid financial basis

for the BMW Group. We are also able to call on a broadly

based range of instruments to refinance our world-

wide operations via international money and capital

markets. Almost all of the funds raised are used to

finance the BMW Group’s Financial Services business.

Apart from issuing commercial paper on the money

market, the BMW Group’s financing companies also

issue bearer bonds. In addition, retail customer and

dealer financing receivables on the one hand and

leasing rights and obligations on the other are secu-

ritised

in the form of asset-backed securities (ABS)

financing arrangements. Financing instruments em-

ployed by our

banks in Germany and the USA (e. g.

customer deposits) are also used as a supplementary

source of financing. Owing to the increased use of inter-

national money and capital markets to raise funds,

the

The cash outflow for operating activities of the Financial

Services segment is influenced primarily by cash flows

relating to leased products and receivables from sales

financing and totalled € 4,192 million in 2012 (2011:

€ 1,897 million). Cash outflow for investing activities to-

talled € 32 million (2011: cash inflow of € 204 million).

scale of funds raised

in the form of loans from interna-

tional banks is relatively

small.

As in previous years, operations were refinanced in 2012

at an attractive level. Thanks to the best rating in the

European automobile industry and the high level of ac-

ceptance it enjoys on capital markets, the BMW Group’s

refinancing activities were not affected by financial mar-

ket volatility in 2012. In addition to the issue of bonds

and loan notes on the one hand and private placements

on the other, we were also able to issue commercial

paper at good conditions. Additional funds were also

raised via new securitised instruments and the prolon-

gation of existing instruments. As in previous years,

all issues were highly sought after by private and institu-

tional investors.

During the year, the BMW Group issued four bench-

mark

bonds with a total issue volume of € 4 billion on

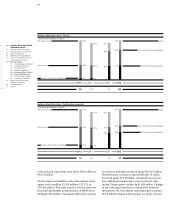

Net financial assets of the Automotive segment com-

prise the following:

in € million 31. 12. 2012 31. 12. 2011

Cash inflow from operating activities 9,167 8,110

Cash outflow for investing activities – 5,530 – 5,725

Net investment in marketable securities 172 781

Free cash flow Automotive segment 3,809 3,166

in € million 31. 12. 2012 31. 12. 2011

Cash and cash equivalents 7,484 5,829

Marketable securities and investment funds 2,205 1,801

Intragroup net financial receivables 5,862 6,404

Financial assets 15,551 14,034

Less: external financial liabilities* – 2,224 – 1,747

Net financial assets 13,327 12,287

* Excluding derivative financial instruments