BMW 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

21 General Economic Environment

24 Review of Operations

44 BMW Stock and Capital Market

47 Disclosures relevant for takeovers

and explanatory comments

50 Financial Analysis

50 Internal Management System

52 Earnings Performance

54 Financial Position

57 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

65 Internal Control System and

explanatory comments

66 Risk Management

74 Outlook

52

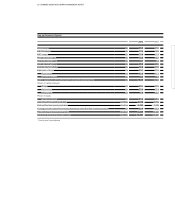

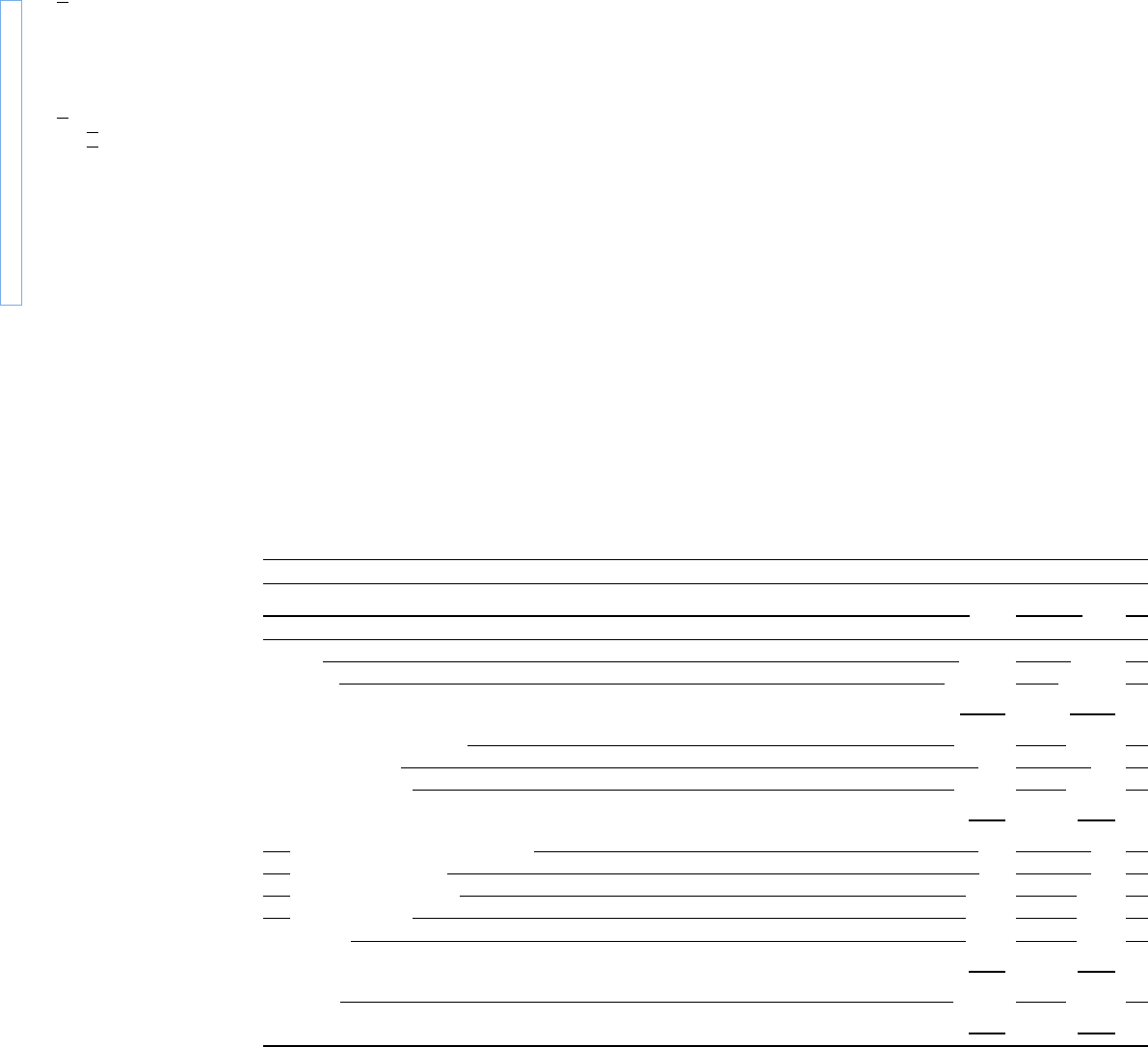

Group Income Statement

in € million

2012 2011

Revenues 76,848 68,821

Cost of sales – 61,354 – 54,276

Gross profit 15,494 14,545

Selling and administrative expenses – 7,007 – 6,177

Other operating income 829 782

Other operating expenses – 1,016 – 1,132

Profit before financial result 8,300 8,018

Result from equity accounted investments 271 162

Interest and similar income 753 763

Interest and similar expenses – 913 – 943

Other financial result – 592 – 617

Financial result – 481 – 635

Profit before tax 7,819 7,383

Income taxes – 2,697 – 2,476

Net profit 5,122 4,907

Value management used to control projects

Operations of the Automotive and Motorcycles seg-

ments

are shaped to a large extent by project work,

which have a substantial influence on future performance.

Project decisions are therefore a crucial component of

value-based management for the BMW Group.

Decisions are taken on the basis of project calculations

measured in terms of the cash flows a project is ex-

pected to generate. Calculations are made for the full

term of a project, i.e. for all years in which cash flows

are expected to arise. Project decisions are taken on

the basis of the capital value and internal rate of return

calculated for the project. These two measures are con-

sistent with the performance indicators employed in

the Group’s financial target system.

The capital value of a project indicates the extent to

which a project will be able to generate a positive con-

tribution to earnings over and above the cost of capital.

A project with a positive capital value enhances value

added and therefore results in an increase in the value

of the business. The internal rate of return corresponds

to the average RoCE of a project over its entire term.

It therefore provides a basis for assessing the extent to

which a project will be able to help the segment achieve

its targeted RoCE.

Project calculations are supplemented by a standardised

assessment of opportunities and risks. The criteria used

for taking decisions as well as the long-term impact of

periodic earnings is documented for all project decisions

and incorporated in the long-term Group forecast. This

system enables an analysis of the periodic reporting

impact of project decisions on earnings and rates of re-

turn over the term of each project. The overall result is a

self-contained controlling model.

Earnings performance

The BMW Group continued on its successful course in

2012 and posted another record year. The number

of BMW, MINI and Rolls-Royce brand cars sold rose by

10.6 % to 1,845,186 units, enabling the BMW Group

to retain pole position at the head of the premium

segment.

The BMW Group recorded a net profit of € 5,122 mil-

lion

(2011: € 4,907 million) for the financial year 2012.

The post-tax return on sales was 6.7 % (2011: 7.1 %).

Earnings per share of common and preferred stock

were € 7.77 and € 7.79 respectively (2011: € 7.45 and € 7.47

respectively).

Group revenues rose by 11.7 % to € 76,848 million (2011:

€ 68,821 million), reflecting in particular the expan-