BMW 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71 COMBINED GROUP AND COMPANY MANAGEMENT REPORT

rates) also influence fuel prices, which, in turn, directly

influence the purchasing behaviour of our customers.

The BMW Group counters this by developing and selling

efficient and economical engines and by developing al-

ternative drive technologies.

Liquidity risks

Good liquidity management ensures the BMW Group’s

solvency at all times. Were strategic and sector-spe-

cific risks, operational risks and financial risks to oc-

cur,

this could have an adverse impact on the Group’s

liquidity.

A target liquidity concept was put in place several years

ago, drawing on the experience gained during the

financial crisis, and is adhered to rigorously. As well as

maintaining a liquidity reserve, access to liquid funds

by Group entities is ensured by a broad diversification

of refinancing sources. The liquidity position is

moni-

tored continuously at a separate entity level and

managed by means of a cash flow requirements and

sourcing forecast system in place throughout the Group.

Liquidity risks can arise in the form of rising refinanc-

ing costs on the one hand and restricted access to funds

on the other. Most of the Financial Services segment’s

credit financing and lease business is refinanced on

capital markets. The BMW Group has good access to

financial markets thanks to its excellent creditworthi-

ness and, as in previous years, was able to raise funds

at good conditions in 2012, reflecting a diversified

refinancing strategy and the solid liquidity base of the

BMW Group. Internationally recognised rating agencies

have confirmed the BMW Group’s strong

creditwor-

thiness.

There is a general risk that ratings could be

downgraded,

in which case the cost of refinancing

con-

ditions would increase; at present this risk is deemed

to

be low.

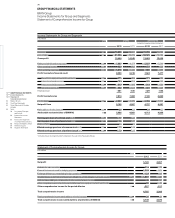

Risks relating to Financial Services

The main categories of risk relating to the provision of

financial services are credit and counterparty risk,

re-

sidual value risk, interest rate risk, liquidity risk and

operational risk. In order to evaluate and manage these

risks, a variety of internal methods has been developed

based on regulatory environment requirements (such

as Basel II) and which comply with national and inter-

national

standards.

A set of strategic principles and rules derived from

regulatory requirements serves as the basis for risk

management within the Financial Services segment.

At

the heart of the risk management process is a clear

division into front- and back-office activities and a com-

prehensive internal control system.

In order to ensure that the segment is capable of bear-

ing the risks to which it is exposed (i.e. its “risk-bearing

capacity”), we monitor the segment’s total exposure to

major risks. This involves measuring unexpected losses

using a variety of value-at-risk techniques adapted to

each relevant risk category. These losses are aggregated

(after factoring in correlation effects) and compared

with resources available to cover risks (i.e. equity). The

segment’s risk-bearing capacity is monitored continu-

ously with the aid of an integrated limit system which

also differentiates between the various risk categories.

The segment’s total risk exposure was covered at all

times during the past year by the available risk-coverage

volumes.

Use of the “matched funding principle” to finance the

Financial Services segment’s operations eliminates

liquidity risks to a large extent. Regular measurement

and monitoring ensure that cash inflows and outflows

from transactions in varying maturity cycles and cur-

rencies will offset each other. The relevant procedures

are incorporated in the BMW Group’s target liquidity

concept.

Interest rate risks relate to potential losses caused by

changes in market interest rates and can arise when

fixed interest rate periods for assets and liabilities

recognised in the balance sheet do not match. Interest-

rate risks in the Financial Services line of business are

managed by raising refinancing funds with matching

maturities and by employing interest rate derivatives.

For risk management purposes, all interest-related asset

or liability exposures are aggregated on a cash flow

basis taking account of subsequent changes, e. g. in the

case of early termination of a contract.

Interest rate

risks

are managed on the basis of a value-at-risk approach

and stipulated limits. Limits are set using a benchmark-

oriented approach that focuses on

interest rate

arrange-

ments contained in the original contracts. Compliance

with prescribed limits is tested regularly. Sensitivity

analyses and stress scenarios showing the potential im-

pact of

interest rate

changes on earnings are also used

as tools to manage

interest rate

risks. These

interest rate

positions are aggregated for the BMW Group as a whole

and measured with a value-at-risk methodology and

taking other Group positions into account (structured

as far as possible on a risk-neutral basis).