BMW 2012 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136

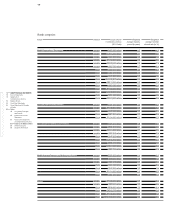

78 GROUP FINANCIAL STATEMENTS

78 Income Statements

78 Statement of

Comprehensive Income

80 Balance Sheets

82 Cash Flow Statements

84 Group Statement of Changes

in Equity

86 Notes

86 Accounting Principles

and Policies

100 Notes to the Income

Statement

107 Notes to the Statement

of Comprehensive Income

108

Notes to the Balance Sheet

129 Other Disclosures

145 Segment Information

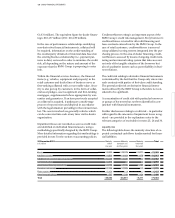

Fair value gains and losses recognised on derivatives and

recorded initially in accumulated other equity are re-

classified to cost of sales when the derivatives mature.

A net positive amount of € 1 million (2011: net negative

amount of € 2 million) attributable to forecasting errors

(and the resulting over-hedging of currency exposures)

was recognised within the line item “Financial Result” in

the financial year 2012. These forecasting errors, which all

related to the year under report, arise primarily as a result

of changes in sales forecasts in foreign currencies. In addi-

tion, cash flow hedges of raw materials gave rise to a net

expense of € 8 million (2011: € – million) from forecasting

errors and net income of € 67 million (2011: net expense

of € 52 million) from ineffectiveness, which were also rec-

ognised

within the line item “Financial Result”.

At 31 December 2012 the BMW Group held derivative

instruments (mainly option and forward currency con-

tracts) with terms of up to 72 months (2011: 54 months),

as a general rule in order to hedge currency risks at-

tached to future transactions. These derivative instru-

ments

are intended to hedge forecast sales denominated

in a foreign currency over the coming 72 months. The

income statement impact of the hedged cash flows will

be recognised as a general rule in the same periods in

which external revenues are recognised. It is expected

that € 26 million of net gains, recognised in equity at

the end of the reporting period, will be recognised in

the income statement in 2013.

The difference between the gains / losses on hedging

instruments (mostly interest rate swaps) and the results

recognised on hedged items represents the ineffective

portion of fair value hedges.

Fair value hedges are mainly used to hedge the market

prices of bonds, other financial liabilities and receivables

from sales financing.

At 31 December 2012 the BMW Group held derivative

instruments (mostly interest rate swaps) with terms

of up to 25 months (2011: 60 months) to hedge interest

rate risks. These derivative instruments are intended

to

hedge interest rate risks arising on financial instru-

ments with variable interest payments over the coming

25 months. The income statement impact of the hedged

cash flows will be recognised as a general rule in the

same periods over which the relevant interest rates are

fixed. It is not expected that any net gains or net losses,

recognised in equity at the end of the reporting period,

will be reclassified to the income statement in 2013.

At 31 December 2012, the BMW Group held derivative

instruments (mostly commodity swaps) with terms of

up to 60 months (2011: 55 months) to hedge raw mate-

rials price risks attached to future transactions over the

coming 60 months. The income statement impact of

the hedged cash flows will be recognised as a general

rule in the same period in which the derivative instru-

ment

matures. It is expected that € 5 million of net

gains, recognised in equity at the end of the reporting

period, will be recognised in the income statement in

2013.

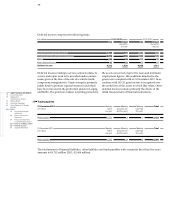

Fair value hedges

The following table shows gains and losses on hedging

instruments and hedged items which are deemed to

be part of a fair value hedge relationship:

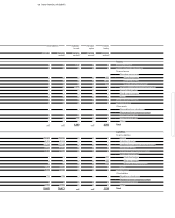

Bad debt risk

Notwithstanding the existence of collateral accepted,

the carrying amounts of financial assets generally take

account of the maximum credit risk arising from the

possibility that the counterparties will not be able to

fulfil their contractual obligations. The maximum credit

risk for irrevocable credit commitments relating to

credit card business amounts to € 969 million (2011:

in € million 31. 12. 2012 31. 12. 2011

Gains / losses on hedging instruments designated as part of a fair value hedge relationship 127 213

Gains / loss from hedged items – 140 – 225

Ineffectiveness of fair value hedges – 13 –12

in € million 2012 2011

Balance at 1 January – 750 – 127

Total changes during the year 952 – 623

of which recognised in the income statement during the period under report 532 – 68

Balance at 31 December 202 – 750

fact that the impact is not material, the BMW Group

does not discount assets for the purposes of determin-

ing impairment losses.

Cash flow hedges

The effect of cash flow hedges on accumulated other

equity was as follows: