BMW 2012 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

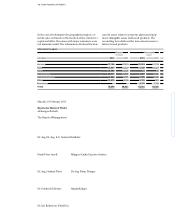

141 GROUP FINANCIAL STATEMENTS

43

42

Other risks

A further exposure relates to the residual value risk on

vehicles returned to the BMW Group at the end of lease

contracts. The risk from financial instruments used in

this context was not material to the Group in the past

and /or at the end of the reporting period. A description

Explanatory notes to the cash flow statements

The cash flow statements show how the cash and cash

equivalents of the BMW Group and of the Automotive

and Financial Services segments have changed in the

course of the year as a result of cash inflows and cash

outflows. In accordance with IAS 7 (Statement of Cash

Flows), cash flows are classified into cash flows from

operating, investing and financing activities.

Cash and cash equivalents included in the cash flow

statement comprise cash in hand, cheques, and cash at

bank, to the extent that they are available within three

months from the end of the reporting period and are

sub-

ject to an insignificant risk of changes in value.

The cash flows from investing and financing activities are

based on actual payments and receipts. By contrast, the

cash flow from operating activities is derived indirectly

from the net profit for the year. Under this method,

changes in assets and liabilities relating to operating ac-

tivities are adjusted for currency translation effects and

changes in the composition of the Group. The changes

in balance sheet positions shown in the cash flow

state-

ment do not therefore agree directly with the amounts

shown in the Group and segment balance sheets.

Cash inflows and outflows relating to operating leases,

where the BMW Group is either lessee or lessor, are

aggregated and shown on the line “Change in leased

products” within cash flows from operating activities.

The net change in receivables from sales financing (in-

cluding finance leases, where the BMW Group is either

Related party relationships

In accordance with IAS 24 (Related Party Disclosures),

related individuals or entities which have the ability to

control the BMW Group or which are controlled by

the BMW Group, must be disclosed unless such parties

are not already included in the Group Financial State-

ments as consolidated companies. Control is defined as

ownership of more than one half of the voting power

of BMW AG or the power to direct, by statute or agree-

of the management of this risk is provided in the Com-

bined Group and Company Management Report. Infor-

mation regarding the residual value risk from operating

leases is provided in the section on accounting policies

in note 5.

lessee or lessor) is also reported within cash flows from

operating activities.

Income taxes paid and interest received are classified

as cash flows from operating activities in accordance

with IAS 7.31 and IAS 7.35. Interest paid is presented

on a separate line within cash flows from financing

activities. Dividends received in the financial year 2012

amounted to € 4 million (2011: € 1 million).

The BMW Group used various sources of funds for

internal financing purposes. In addition to the issue of

interest-bearing debt, cash funds are also allocated

internally in line with business requirements, including

the use of dividends and similar transactions. In this

context, it is possible that cash funds may be trans-

ferred from one segment to another. Up to the first

quarter 2012, these cash inflows and outflows were

reported in the Cash Flow Statements of the Automo-

tive and Financial Services segments as part of cash

flows from operating activities. Due to the increasing

importance of inter-segment transactions, the method

of presentation was changed with effect from the sec-

ond quarter 2012. Intragroup inter-segment dividends

and similar transactions are now reported as part

of cash flows from financing activities. The reclassifi-

cation from operating activities to financing activities

resulted in an increase in the operating cash flow.

The previous year’s figures were restated accordingly

(impact in 2011: € 1,033 million for the Automotive

segment, € 411 million for the Financial Services seg-

ment).

ment, the financial and operating policies of the man-

agement of the Group.

In addition, the disclosure requirements of IAS 24 also

cover transactions with associated companies, joint

ventures and individuals that have the ability to exercise

significant influence over the financial and operating

policies of the BMW Group. This also includes close rela-

tives and intermediary entities. Significant influence