BMW 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57 COMBINED GROUP AND COMPANY MANAGEMENT REPORT

European capital markets. Bonds were also issued in

Canadian dollars, British pounds, Norwegian krone, In-

dian rupees, South Korean won and other currencies

for a total amount of € 5.1 billion.

A total of eight ABS transactions were executed in 2012,

including two public transactions in the USA and one

each in Germany and South Africa with a total volume

equivalent to € 2.3 billion. Further funds were also raised

via new ABS conduit transactions in Japan, Australia

and the UK totalling € 1.7 billion.

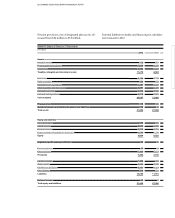

The regular issue of commercial paper also strengthens

our financial base. The following table provides an over-

view of existing money and capital market programmes

of the BMW Group at 31 December 2012:

visions (81.6 %), trade payables (20.5 %), non-current

financial liabilities (4.0 %) and other provisions (8.7 %).

Deferred tax liabilities (7.1 %) and current other lia-

bilities (3.3 %) decreased.

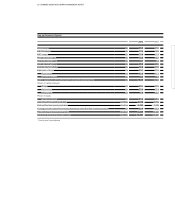

At € 5,207 million, the carrying amount of intangible as-

sets was € 31 million lower than at the end of the pre-

vious year. Within intangible assets, capitalised develop-

ment costs decreased by € 41 million to € 4,347 million.

Development costs recognised as assets during the year

under report totalled € 1,089 million (+12.0 %) and

were

therefore higher than one year earlier. The propor-

tion of research and development costs recognised as

assets was 27.6 % (2011: 28.8 %). The corresponding am-

ortisation expense was € 1,130 million (2011: € 1,209 mil-

lion). Goodwill was unchanged from the previous year

and stood at € 369 million.

Property, plant and equipment rose sharply to

€ 13,341 million. Capital expenditure of € 4,028 mil-

lion

was 55.0 % higher than in the previous year (2011:

€ 2,598 million). The main focus was on product invest-

ments

for production start-ups and infrastructure

improvements. Depreciation on property, plant and

equipment totalled € 2,298 million. Total capital ex-

penditure on intangible assets and property, plant and

equipment

as a percentage of revenues increased to

6.8 % (2011: 5.4 %).

Leased products climbed by € 1,356 million or 5.9 % as

a result of increased business volumes. Adjusted for ex-

change rate factors, the increase was 6.1 %.

Receivables from sales financing increased by 7.2 % to

€ 52,914 million due to higher business volumes. Of

this amount, customer and dealer financing accounted

for € 40,650 million (6.1 %) and finance leases for

€ 12,264 million (11.0 %).

Compared to the end of the previous financial year,

in-

ventories went up only marginally by € 87 million

(+0.9 %) to € 9,725 million. Adjusted for exchange rate

factors, the increase was 1.3 %.

Financial assets went up by 24.0 % to € 6,760 million,

largely due to higher levels of marketable securities

and investment fund shares as well as increases in fair

values of currency derivatives.

Liquid funds went up by 9.1 % to € 11,025 million and

comprise cash and cash equivalents, marketable securi-

ties and investment fund shares (the last two items re-

ported as financial assets).

Programme Amount utilised

Euro Medium Term Notes € 25.5 billion

Commercial paper € 4.7 billion

The BMW Group’s liquidity position is extremely robust,

with cash funds totalling € 11.0 billion on hand at 31 De-

cember 2012. A syndicated credit line of € 6 billion is

also in place. The credit line, which is being made avail-

able at attractive conditions by a consortium of 39 inter-

national banks, has a term up to October 2017 and can

be extended by one year.

Further information with respect to financial liabilities

is provided in the notes to the Group Financial State-

ments

33 and 37.

Net assets position

The Group balance sheet total increased by € 8,421 mil-

lion to stand at € 131,850 million at 31 December 2012.

Adjusted for changes in exchange rates, the balance

sheet total increased by 7.5 %.

The main factors behind the increase on the assets

side of the balance sheet were receivables from sales

financing (7.2 %), property, plant and equipment

(14.2 %), leased products (5.9 %) and financial assets

(24.0 %). By contrast, trade receivables went down by

22.6 % thanks to proactive receivables management.

Inventories increased marginally (0.9 %) compared to

the previous year.

On the equity and liabilities side of the balance sheet,

the increase related to equity (12.2 %), pension pro-