BMW 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

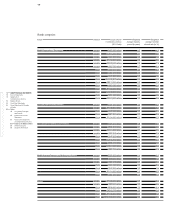

78 GROUP FINANCIAL STATEMENTS

78 Income Statements

78 Statement of

Comprehensive Income

80 Balance Sheets

82 Cash Flow Statements

84 Group Statement of Changes

in Equity

86 Notes

86 Accounting Principles

and Policies

100 Notes to the Income

Statement

107 Notes to the Statement

of Comprehensive Income

108

Notes to the Balance Sheet

129 Other Disclosures

145 Segment Information

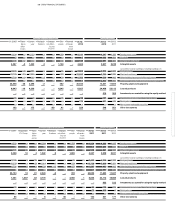

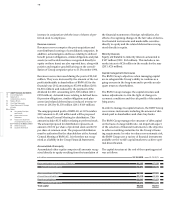

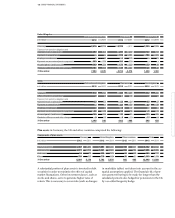

in € million 31. 12. 2012 31. 12. 2011

Equity attributable to shareholders of BMW AG 30,295 27,038

Proportion of total capital 30.4 % 28.5 %

Non-current financial liabilities 39,095 37,597

Current financial liabilities 30,412 30,380

Total financial liabilities 69,507 67,977

Proportion of total capital 69.6 % 71.5 %

Total capital 99,802 95,015

increase in conjunction with the issue of shares of pre-

ferred stock to employees.

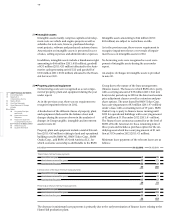

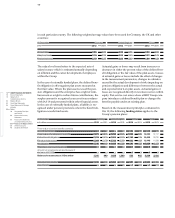

Revenue reserves

Revenue reserves comprise the post-acquisition and

non-distributed earnings of consolidated companies. In

addition, actuarial gains and losses relating to defined

benefit pension obligations, similar obligations and plan

assets (as well as deferred taxes recognised directly in

equity on these items) are also reported here, along with

positive and negative goodwill arising on the consoli-

dation of Group companies prior to 31 December 1994.

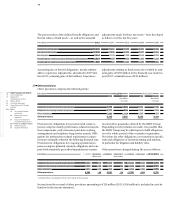

Revenue reserves increased during the year to € 28,340

million. They were increased by the amount of the net

profit attributable to shareholders of BMW AG for the

financial year 2012 amounting to € 5,096 million (2011:

€ 4,881 million) and reduced by the payment of the

dividend for 2011 amounting to € 1,508 million (2011:

€ 852 million). Actuarial losses relating to defined bene-

fit pension obligations, similar obligations and plan

assets (and related deferred taxes) reduced revenue re-

serves in 2012 by € 1,350 million (2011: € 419 million).

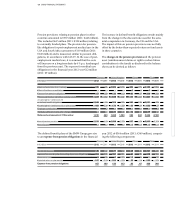

The unappropriated profit of BMW AG at 31 December

2012 amounts to € 1,640 million and will be proposed

to the Annual General Meeting for distribution. This

amount includes € 135 million relating to preferred stock.

The amount proposed for distribution represents an

amount of € 2.52 per share of preferred stock and € 2.50

per share of common stock. The proposed distribution

must be authorised by the shareholders at the Annual

General Meeting of BMW AG. It is therefore not recog-

nised as a liability in the Group Financial Statements.

Accumulated other equity

Accumulated other equity comprises all amounts recog-

nised directly in equity resulting from the translation of

the financial statements of foreign subsidiaries, the

effects of recognising changes in the fair value of deriva-

tive financial instruments and marketable securities

directly in equity and the related deferred taxes recog-

nised directly in equity.

Minority interests

Equity attributable to minority interests amounted to

€ 107 million (2011: € 65 million). This includes a mi-

nority

interest of € 26 million in the results for the year

(2011: € 26 million).

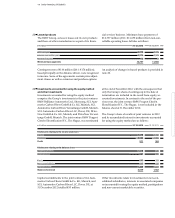

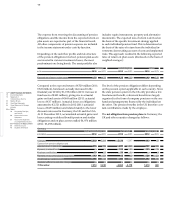

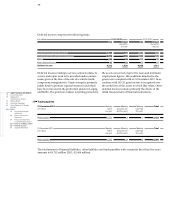

Capital management disclosures

The BMW Group’s objectives when managing capital

are to safeguard the Group’s ability to continue as a

going concern in the long-term and to provide an ade-

quate return to shareholders.

The BMW Group manages the capital structure and

makes adjustments to it in the light of changes in

economic conditions and the risk profile of the under-

lying assets.

In order to manage its capital structure, the BMW Group

uses various instruments including the amount of divi-

dends paid to shareholders and share buy-backs.

The BMW Group manages the structure of debt capital

on the basis of a target debt ratio. An important aspect

of the selection of financial instruments is the objective

to achieve matching maturities for the Group’s

financ-

ing requirements. In order to reduce non-systematic risk,

the BMW Group uses a variety of financial instruments

available on the world’s capital markets to achieve opti-

mal diversification.

The capital structure at the end of the reporting period

was as follows: