BMW 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

21 General Economic Environment

24 Review of Operations

44 BMW Stock and Capital Market

47 Disclosures relevant for takeovers

and explanatory comments

50 Financial Analysis

50 Internal Management System

52 Earnings Performance

54 Financial Position

57 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

65 Internal Control System and

explanatory comments

66 Risk Management

74 Outlook

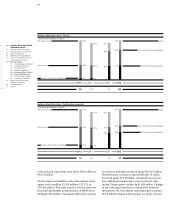

Comments on Financial Statements of BMW AG

The financial statements of BMW AG are drawn up in

accordance with the German Commercial Code (HGB)

and the German Stock Corporation Act (AktG).

BMW AG develops, manufactures and sells cars and

motorcycles manufactured by itself, foreign subsidiaries

and Magna Steyr. Sales activities are carried out through

the Company’s own branches, independent dealers,

subsidiaries and importers. The number of cars manu-

factured at German and foreign plants in 2012 rose by

7.1 % to 1,861,826 units. At 31 December 2012, BMW AG

had 74,571 employees, 2,941 more than one year

earlier.

Sales volume went up again in 2012, as a result of which

revenues grew by 6.9 % compared to the previous year.

The most significant increase was recorded in Asia.

Sales to Group sales companies accounted for € 43.9 bil-

lion

or approximately 74.7 % of total revenues of

€ 58.8 billion. The increase in cost of sales was slightly

less pronounced than the increase in revenues. As a

consequence, gross profit increased by € 866 million to

€ 12.6 billion.

Research and development expenses were 17.3 % higher

than in the previous year, driven primarily by activities

related to the electrification of the future product range.

The increase in net other operating income and expenses

in 2012 was attributable mainly to exceptional factors

in 2011 (income from retrospective changes to transfer

prices and from the reversal of warranty provisions) and

lower expenses for allocations to onerous commodity

and currency hedging contracts in 2012.

The financial result improved by € 566 million, mainly

as a result of the positive impact of fair value changes in

designated plan assets for pension and other long-term

personnel-related provisions and the offsetting nega-

tive effect of impairment losses recognised on

financial

assets.

The profit from ordinary activities increased from

€ 4,037 million to € 4,797 million.

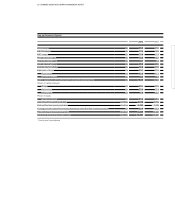

The expense for income taxes relates primarily to current

tax for the financial year 2012, and is lower than in the

previous year mainly as a result of a reduced amount of

expense recorded in conjunction with provisions for tax

field audit risks.

After deducting the expense for taxes, the Company re-

ports a net profit of € 3,131 million (2011: € 1,970 million).

Capital expenditure on intangible assets and property,

plant and equipment amounted to € 2,776 million (2011:

€ 2,032 million), an increase of 36.6 % over the previous

year. The main focus was on product investments for

production start-ups and infrastructure improvements.

Depreciation and amortisation amounted to € 1,613 mil-

lion (2011: € 1,578 million).

Investments went up from € 2,823 million to € 3,094 mil-

lion, mainly as a result of transfers to capital reserves at

the level of BMW Bank GmbH, Munich, and the acqui-

sition of shares in BMW Finance S.N.C., Guyancourt,

which were subsequently contributed to BMW Bank.

An impairment loss of € 143 million was recognised in

2012 on the investment in SGL Carbon SE, Wiesbaden.

At € 3,749 million, inventories remained at a similar level

to the previous year despite the expansion of business

operations during the year.

Cash and cash equivalents rose by € 1,754 million to

€ 4,618 million, reflecting good earnings, the concen-

tration

of liquidity at the level of BMW AG and a

re duction in investments in marketable securities in

favour of liquid funds. Financial receivables from sub-

sidiaries decreased.

Equity rose by € 1,642 million to € 9,864 million and the

equity ratio improved from 29.9 % to 30.9 %.

In order to secure obligations resulting from pre-retire-

ment part-time work arrangements and a part of the

Company’s pension obligations, assets have been trans-

ferred to BMW Trust e.V., Munich, in conjunction with

Contractual Trust Arrangements (CTA), on a trustee

basis. The assets concerned comprise mainly holdings in

investment fund assets and a receivable resulting from a

so-called “Capitalisation Transaction” (Kapitalisierungs-

geschäft).

Fund assets are offset against the related

guaranteed obligations. The resulting surplus of assets

over liabilities is reported in the BMW AG balance sheet

on the line “Surplus of pension and similar plan assets

over liabilities”.