BMW 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

21 General Economic Environment

24 Review of Operations

24 Automotive segment

30 Motorcycles segment

31 Financial Services segment

33 Research and development

36 Purchasing

37 Sales and Marketing

39 Workforce

41 Sustainability

44 BMW Stock and Capital Market

47 Disclosures relevant for takeovers

and explanatory comments

50 Financial Analysis

65 Internal Control System and

explanatory comments

66 Risk Management

74 Outlook

Multi-brand financing up sharply

Demand for multi-brand financing grew sharply in

2012 with a total of 163,945 new contracts signed

(+ 17.3 %). At the end of the reporting period, the multi-

brand financing line of business covered 417,408 con-

tracts (2011: 370,999 contracts: + 12.5 %).

Increased dealer financing volumes

The total volume of financing disbursed to the dealer

organisation amounted to € 12,669 million at 31 Decem-

ber 2012, an increase of 11.0 % compared to one year

earlier (2011: € 11,417 million).

Deposit volume again higher than at the end of

the previous year

Deposit business represents a significant component of

the BMW Group’s refinancing strategy. The Financial

Services segment’s deposit volume totalled € 13,018 mil-

lion (+ 8.1 %) at the end of the reporting period. By con-

trast, decreases were recorded for securities and credit

card business, with the number of securities custodian

accounts falling by 5.5 % to 23,042 and credit card con-

tracts down by 2.4 % to 281,464.

Dynamic growth for insurance business

In addition to its leasing and financing products, the

Financial Services segment also offers a wide range of

insurance services relating to individual mobility. New

business grew by 15.7 % to 979,776 contracts in 2012.

The insurance contract portfolio expanded by 7.6 %

compared to last year’s figure to stand at 2,158,892 con-

tracts

(2011: 2,007,268 contracts).

Risk profile largely unchanged

The BMW Group’s credit and residual value risk profile

remained largely unchanged. The loss ratio on lending

decreased further in the year under report, falling by

one basis point from 0.49 % in 2011 to 0.48 %. Average

losses on residual value risks also decreased slightly.

The Financial Services segment uses the value at risk

(VaR) methodology to measure the amount of unex-

pected loss for major risk categories (credit, residual

value and interest rate risks, operational risks and in-

surance business-related risks), based on a confidence

level of 99.98 % and a holding period of one year.

Awards for quality of service

The BMW Group’s Financial Services segment was again

the recipient of numerous international awards in

2012.

In the annual survey carried out by the market

research institute J. D. Power and Associates, our Finan-

cial Services business in the USA came first for the ninth

time in succession in the category “Dealer Financing

Satisfaction StudySM ”. The award presented by this in-

ternationally renowned market research institute is

acknowledgement of the high level of dealer satisfaction

achieved with our leasing and financing products.

Expansion of BMW Bank continued in line with plan

Further progress was made in 2012 to expand the BMW

Bank. With effect from August 2012, financial services

business in France was integrated directly with the BMW

Bank by means of a subsidiary. Financial Services

business in

Germany now covers entities in Germany,

France, Italy, Portugal and Spain.

Strong growth for fleet business

Alphabet International, with its wide range of multi-

brand products, is one of the top four fleet service pro-

viders in Europe. At the end of the reporting period,

Alphabet was managing a portfolio of 502,397 fleet

contracts, up 5.8 % on the previous year (2011: 474,717

contracts).

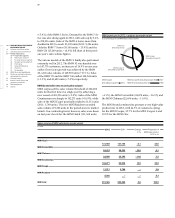

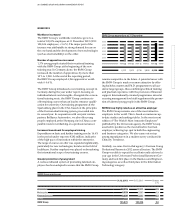

Contract portfolio retail customer financing of

Financial Services segment 2012

as a percentage by region

EU-Bank 32.8 Europe / Middle East / Africa 24.6

Americas 31.4 Asia / Pacific 11.2

EU-Bank

Americas

Asia / Pacific

Europe / Middle

East / Africa