BMW 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284

|

|

112

78 GROUP FINANCIAL STATEMENTS

78 Income Statements

78 Statement of

Comprehensive Income

80 Balance Sheets

82 Cash Flow Statements

84 Group Statement of Changes

in Equity

86 Notes

86 Accounting Principles

and Policies

100 Notes to the Income

Statement

107 Notes to the Statement

of Comprehensive Income

108

Notes to the Balance Sheet

129 Other Disclosures

145 Segment Information

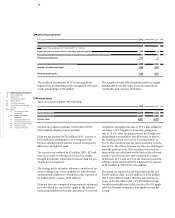

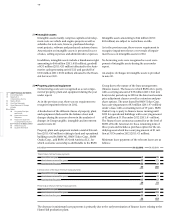

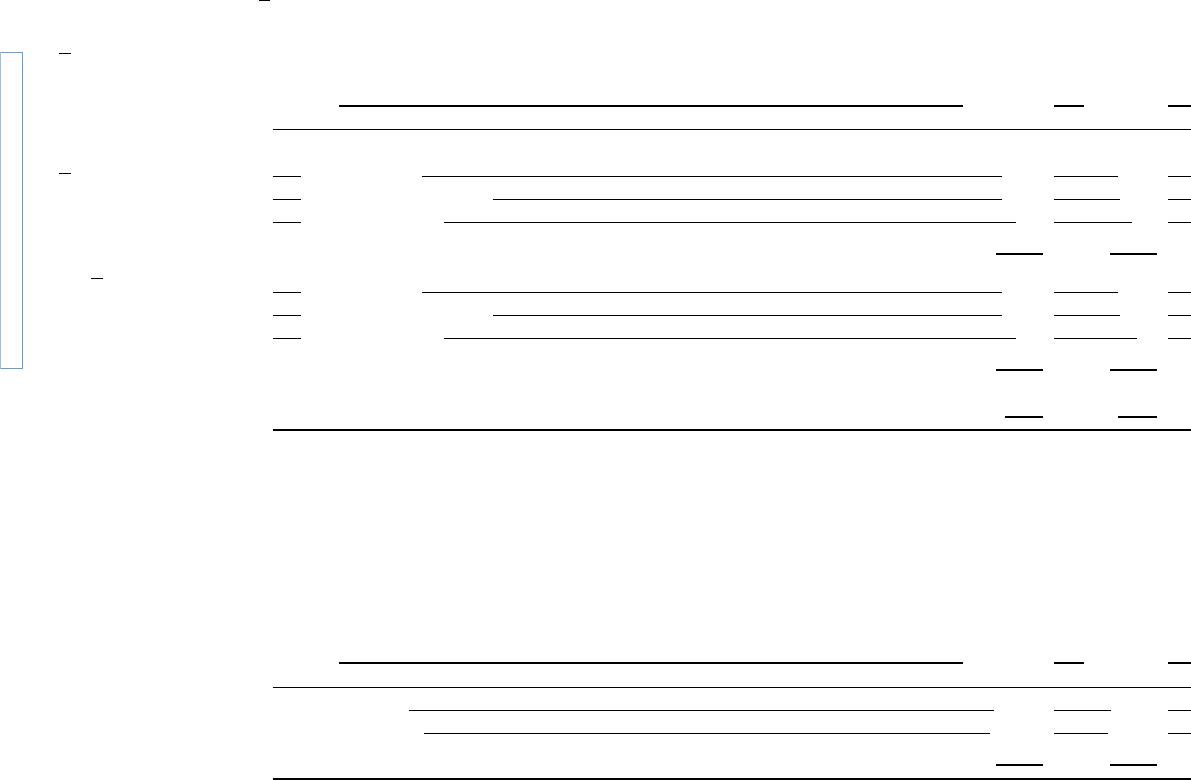

in € million 31. 12. 2012 31. 12. 2011

Gross investment in finance leases

due within one year 4,580 4,217

due between one and five years 8,938 7,933

due later than five years 118 102

13,636 12,252

Present value of future minimum lease payments

due within one year 4,094 3,725

due between one and five years 8,060 7,233

due later than five years 110 92

12,264 11,050

Unrealised interest income 1,372 1,202

25

Receivables from sales financing

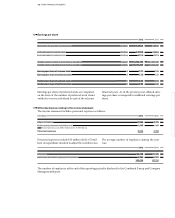

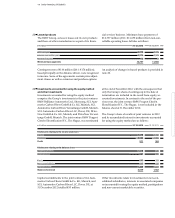

Receivables from sales financing, totalling € 52,914 mil-

lion (2011: € 49,345 million), comprise € 40,650 million

(2011: € 38,295 million) for credit financing for retail

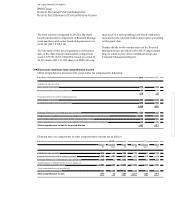

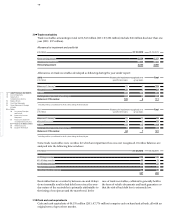

Additions to investments in non-consolidated subsidiar-

ies relate primarily to a capital increase at the level of,

and purchase of the remaining shares of, BMW Peugeot

Citroën Electrification B. V., The Hague, on the one

hand and to a capital increase at the level of BMW Dis-

tribution S. A. S., Montigny-le-Bretonneux on the other.

Additions to participations relate primarily to the pur-

chase of available-for-sale marketable securities.

The impairment loss of € 9 million on investments in non-

consolidated subsidiaries relates mainly to an

invest-

ment in a dealership which was written down after being

tested for impairment.

customers and dealers and € 12,264 million (2011:

€ 11,050 million) for finance leases. Finance leases are

analysed as follows:

Disposals of investments in non-consolidated subsidiar-

ies primarily result from the first-time consolidation of

BMW India Financial Services Private Ltd., New Delhi,

and PT BMW Indonesia, Jakarta.

Impairment losses on participations – recognised with

income statement effect – related mainly to the invest-

ment in SGL Carbon SE, Wiesbaden, which was written

down after being tested for impairment.

A break-down of the different classes of other invest-

ments disclosed in the balance sheet and changes during

the year are shown in the analysis of changes in Group

tangible, intangible and investment assets in note 20.

in € million 31. 12. 2012 31. 12. 2011

Gross carrying amount 54,593 50,961

Allowance for impairment – 1,679 – 1,616

Net carrying amount 52,914 49,345

Contingent rents recognised as income (generally

relating to the distance driven) amounted to € 3 million

(2011: € 2 million). Write-downs on finance leases

amounting to € 149 million (2011: € 77 million) were

measured and recognised on the basis of specific credit

risks. Non-guaranteed residual values that fall to the

benefit of the lessor amounted to € 85 million (2011:

€ –

million).

Receivables from sales financing include € 32,309 mil-

lion

(2011: € 29,331 million) with a remaining term of

more than one year.

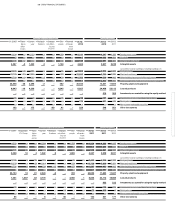

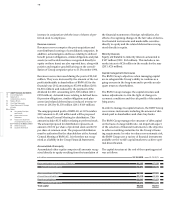

Allowance for impairment and credit risk