BMW 2012 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284

|

|

23 COMBINED GROUP AND COMPANY MANAGEMENT REPORT

The percentage drops in France (– 14.0 %), Italy (– 20.0 %)

and Spain (– 13.4 %) reached double figures in each

case. Of the major car markets in Europe, only Great

Britain was able to buck the trend, with the number of

new vehicles registered up by 5.3 % to approximately

2 million units.

Japan’s car market grew exceptionally strongly in 2012,

jumping by 28 % to 5.2 million units, mainly due to eco-

nomic revival in the wake of the Fukushima catastrophe

in the previous year, manifested in a production catch-

up effect and increased demand for spare parts.

The Russian market demonstrated its generally robust

state of health with new registrations up by around 9 %

to 2.7 million units. India’s car market also continued

to display an upward trend (2.8 million units; + 10 %).

Brazil saw its car market climb by 3.4 % to 3.6 million

units, largely due to the initiation of a new state-funded

stimulus programme.

Motorcycle markets in 2012

International motorcycle markets in the 500 cc plus class

continued to fare divergently in 2012. Overall this

mar-

ket segment contracted worldwide by 1 % compared

to the previous year. In Europe (– 9 %), the impact of the

sovereign debt crisis was felt most sharply in the region’s

southern countries, including sharp market downturns

in Italy (– 20 %) and Spain (– 22 %). Great Britain (– 5 %)

and France (– 2 %) recorded more moderate declines.

In a contrasting trend, the 500 cc plus class market in

Germany grew by 4 % compared to one year earlier. The

corresponding segment in the USA also registered a

moderate increase (+ 2 %) in the period under report.

Brazil was 6 % up on the previous year. The motorcycle

market in Japan continued to steer a course of recovery

in 2012, growing strongly by 18 %.

The financial services market in 2012

All of the world’s major central banks adhered to their

adopted course, ensuring that commercial banks had

access to large volumes of liquidity. Marked rises in

refinancing costs in a number of countries within the

eurozone triggered various political measures that

helped to stabilise the financial markets.

Price levels on international used car markets continued

to develop inconsistently in 2012. While North America,

Germany and Great Britain were largely stable, adverse

economic developments in some southern European

countries caused used car prices to fall in the region.

Despite the debt crisis in Europe and the resulting nega-

tive impact on unemployment figures, credit risk levels

for retail, dealer and importer financing business did

not worsen overall. By contrast, the situation in southern

Europe continues to be difficult in the face of adverse

economic conditions.

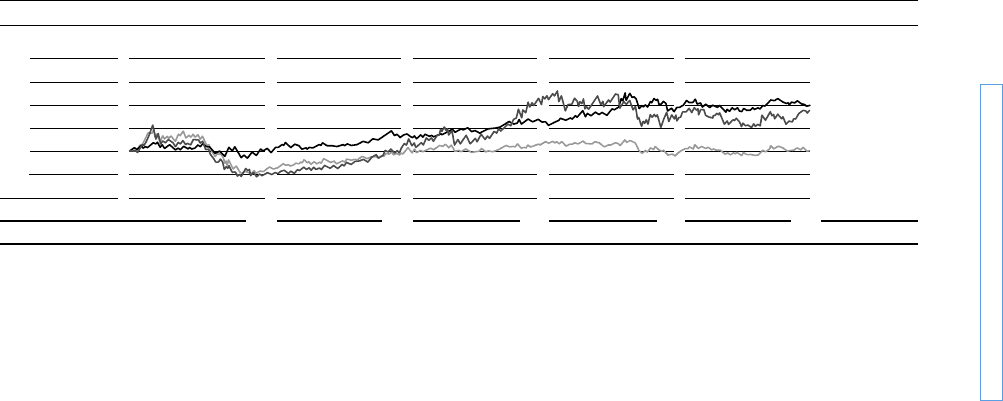

Precious metals price trend

(Index: 31 December 2007 = 100)

300

250

200

150

100

50

08 09 10 11 12

Source: Reuters

Palladium

Gold

Platinum