BMW 2012 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

21 General Economic Environment

24 Review of Operations

44 BMW Stock and Capital Market

47 Disclosures relevant for takeovers

and explanatory comments

50 Financial Analysis

50 Internal Management System

52 Earnings Performance

54 Financial Position

57 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

65 Internal Control System and

explanatory comments

66 Risk Management

74 Outlook

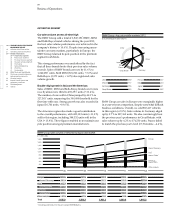

Exchange rates remain volatile, but only marginally

changed on a year-end comparison

The world’s currency markets were heavily influenced

again in 2012 by the impact of the sovereign debt crisis.

Although the US dollar exchange rate was practically

unchanged on a year-end comparison (US dollar 1.30 to

the euro), the escalation of the euro crisis in summer

2012 temporarily caused a sharp rise in the value of the

US dollar.

Since the rate of the Chinese renminbi is more or less

coupled to that of the US dollar, the volatility of the

Chinese currency generally reflects that of the US dollar

to the euro. A continuation of the gradual appreciation

of the renminbi of 1 % to 2 % was also noticeable in 2012.

The British pound increased moderately in value against

the euro and finished the year at GBP 0.81 to the euro,

thus continuing to recover from its low point during the

financial crisis. The Japanese yen fell to a rate of 114 yen

to the euro, in advance of the expansionary monetary

and fiscal policies expected to be adopted by the new

government.

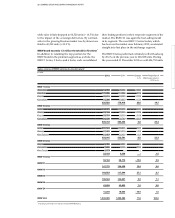

Higher prices for major raw materials

Political uncertainties regarding further developments

in various conflicts in the Middle East kept the price

of Brent oil – the most relevant for Europe – at a high

level, namely US dollar 112 per barrel on average for the

year. By contrast, the price of WTI oil – the most relevant

parameter for the USA – was somewhat lower in 2012

(average price of US dollar 94 per barrel). The upshot

was a further rise in energy prices, particularly in Europe.

By contrast, the price of steel decreased worldwide, re-

flecting the economic downturn. Prices of non-ferrous

and precious metals continued to be highly volatile,

generally in an upward direction.

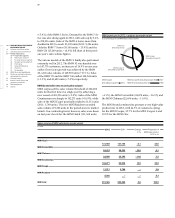

Car markets in 2012

The number of passenger cars and light commercial ve-

hicles sold worldwide rose to 72.6 million units (+ 5.7 %)

in 2012, primarily on the back of increased demand in

the USA and China. This time, however, demand in the

USA provided the strongest momentum, with the mar-

ket growing by 13.4 % to 14.5 million units. After a pe-

riod of exceptionally rapid growth in China, including

several years of double-digit growth, the passenger car

market expanded by a relatively moderate 9.4 % in 2012

to approximately 13.3 million units.

In Europe, the number of new registrations fell once

again in 2012 (12.5 million units; – 7.8 %). The decrease

in Germany was less pronounced, with new registra-

tions down by 2.9 % to approximately 3.1 million units.

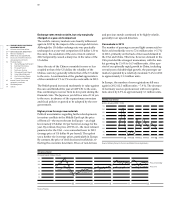

Steel price trend

(Index: January 2008 = 100)

170

160

150

140

130

120

110

100

90

80

08 09 10 11 12

Source: Working Group for the Iron and Metal Processing Industry

Oil price trend

Price per barrel of Brent Crude

140

120

100

80

60

40

20

08 09 10 11 12

Source: Reuters

Price in €

Price in US Dollar