BMW 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

78 GROUP FINANCIAL STATEMENTS

78 Income Statements

78 Statement of

Comprehensive Income

80 Balance Sheets

82 Cash Flow Statements

84 Group Statement of Changes

in Equity

86 Notes

86 Accounting Principles

and Policies

100 Notes to the Income

Statement

107 Notes to the Statement

of Comprehensive Income

108

Notes to the Balance Sheet

129 Other Disclosures

145 Segment Information

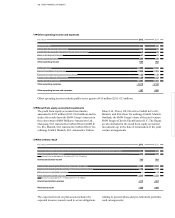

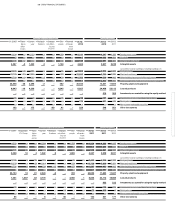

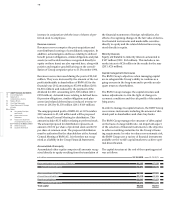

in € million 31. 12. 2012 31. 12. 2011

Total of future minimum lease payments

due within one year 5 25

due between one and five years 23 171

due later than five years 52 49

80 245

Interest portion of the future minimum lease payments

due within one year 3 8

due between one and five years 8 47

due later than five years 17 17

28 72

Present value of future minimum lease payments

due within one year 2 17

due between one and five years 15 124

due later than five years 35 32

52 173

21

22

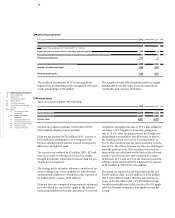

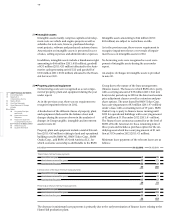

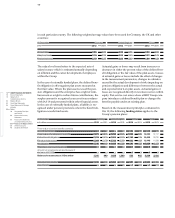

Intangible assets

Intangible assets mainly comprise capitalised develop-

ment

costs on vehicle and engine projects as well as

subsidies for tool costs, licences, purchased develop-

ment projects, software and purchased customer bases.

Amortisation on intangible assets is presented in cost

of sales, selling expenses and administrative expenses.

In addition, intangible assets include a brand-name right

amounting to € 44 million (2011: € 43 million), goodwill

of € 33 million (2011: € 33 million) allocated to the

Auto-

motive cash-generating unit (CGU) and goodwill of

€ 336 million (2011: € 336 million) allocated to the Finan-

cial Services CGU.

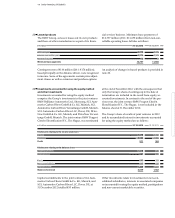

Property, plant and equipment

No borrowing costs were recognised as a cost compo-

nent of property, plant and equipment during the year

under report.

As in the previous year, there was no requirement to

recognise impairment losses in 2012.

A break-down of the different classes of property, plant

and equipment disclosed in the balance sheet and

changes during the year are shown in the analysis of

changes in Group tangible, intangible and investment

assets in note 20.

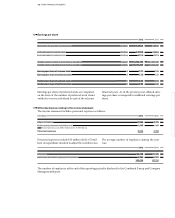

Property, plant and equipment include a total of € 46 mil-

lion

(2011: € 45 million) relating to land and operational

buildings used by BMW AG, BMW Tokyo Corp., BMW

Osaka Corp., and BMW of North America LLC, for

which economic ownership is attributable to the BMW

Intangible assets amounting to € 44 million (2011:

€ 43 million) are subject to restrictions on title.

As in the previous year, there was no requirement to

recognise impairment losses or reversals of impair-

ment

losses on intangible assets in 2012.

No borrowing costs were recognised as a cost com-

ponent of intangible assets during the year under

report.

An analysis of changes in intangible assets is provided

in note 20.

Group due to the nature of the lease arrangements

(finance leases). The leases to which BMW AG is party,

with a carrying amount of € 39 million (2011: € 41 mil-

lion) run for periods up to 2028 at the latest and contain

price adjustment clauses as well as extension and pur-

chase options. The asset leased by BMW Tokyo Corp.

has a carrying amount of € 3 million (2011: € – million)

under a lease with a remaining term of 19 years. BMW

Osaka Corp. is party to finance leases running until

2022 for operational buildings with a carrying amount

of € 2 million at 31 December 2012 (2011: € – million).

The finance lease contract accounted for at the level of

BMW of North America LLC has a remaining term of

three years and includes a purchase option for the un-

derlying asset which has a carrying amount of € 1 mil-

lion at 31 December 2012 (2011: € 1 million).

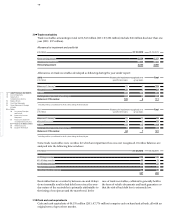

Minimum lease payments of the relevant leases are as

follows:

The decrease in minimum lease payments is primarily due to the early termination of finance leases relating to the

Hams Hall production plant.