BMW 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

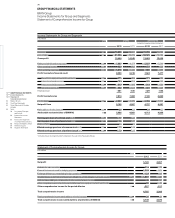

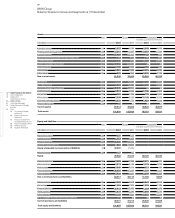

78 GROUP FINANCIAL STATEMENTS

78 Income Statements

78 Statement of

Comprehensive Income

80 Balance Sheets

82 Cash Flow Statements

84 Group Statement of Changes

in Equity

86 Notes

86 Accounting Principles

and Policies

100 Notes to the Income

Statement

107 Notes to the Statement

of Comprehensive Income

108

Notes to the Balance Sheet

129 Other Disclosures

145 Segment Information

Foreign currency translation

The financial statements of consolidated companies

which are drawn up in a foreign currency are translated

using the functional currency concept (IAS 21 The

Effects of Changes in Foreign Exchange Rates) and the

modified closing rate method. The functional currency

of a subsidiary is determined as a general rule on the

basis of the primary economic environment in which

it operates and corresponds therefore usually to the

relevant local currency. Income and expenses of foreign

subsidiaries are translated in the Group Financial State-

ments at the average exchange rate for the year, and

assets and liabilities are translated at the closing rate.

Exchange differences arising from the translation of

shareholders’ equity are offset directly against accumu-

lated other equity. Exchange differences arising from

the use of different exchange rates to translate the

income statement are also offset directly against accu-

mulated other equity.

Foreign currency receivables and payables in the single

entity accounts of BMW AG and subsidiaries are re-

corded, at the date of the transaction, at cost. At the end

of the reporting period, foreign currency receivables

and payables are translated at the closing exchange rate.

The resulting unrealised gains and losses as well as the

subsequent realised gains and losses arising on settle-

4

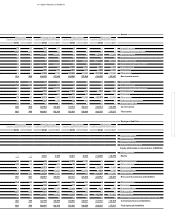

Consolidation principles

The equity of subsidiaries is consolidated in accord-

ance with IFRS 3 (Business Combinations). IFRS 3

requires that all business combinations are accounted

for using the acquisition method, whereby identifia-

ble assets and liabilities acquired are measured at

their fair value at acquisition date. An excess of acqui-

sition cost over the Group’s share of the net fair value

of identifiable assets, liabilities and contingent lia-

bilities is recognised as goodwill as a separate balance

sheet line item and allocated to the relevant cash-

generating unit (CGU). Goodwill of € 91 million which

arose prior to 1 January 1995 remains netted against

reserves.

Receivables, payables, provisions, income and expenses

Delhi, BMW Osaka Corp., Osaka, BMW Receivables 1

Inc., Whitby, BMW Receivables 2 Inc., Whitby, and

BMW Receivables Limited Partnership, Whitby, were

consolidated for the first time in the financial year 2012.

The following mergers took place during the financial

year 2012: Alphabet B.V., Rijswijk, with Alphabet

Nederland B. V., Breda; Alphabet Belgium Short Term

Rental N. V., Aartselaar, with Alphabet Belgium Long

Term Rental N. V., Aartselaar; ETS Garcia S. A., Paris,

with BMW France S. A., Montigny-le-Bretonneux;

Alphabet Italia S. p. A., Milan with Alphabet Italia Fleet

Management S. p. A., Rome; and Alphabet Fleet Ser-

vices España S. L., Madrid, with Alphabet España Fleet

Management S. A. U., Madrid. As a result of these

and profits between consolidated companies (intragroup

profits) are eliminated on consolidation.

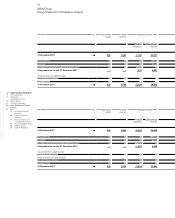

Under the equity method, investments are measured

at the BMW Group’s share of equity taking account

of fair value adjustments. Any difference between the

cost of investment and the Group’s share of equity

is accounted for in accordance with the acquisition

method. Investments in other companies are ac-

counted

for as a general rule using the equity method

when significant influence can be exercised (IAS 28

Investments in Associates). As a general rule, there is

a rebuttable assumption that the Group has signifi-

cant

influence if it holds between 20 % and 50 % of the

associated company’s voting power.

mergers Alphabet B. V., Rijswijk, Alphabet Belgium

Short Term Rental N. V., Aartselaar, ETS Garcia S. A.,

Paris, Alphabet Italia S. p. A., Milan, and Alphabet Fleet

Services España S. L., Madrid, ceased to be consoli-

dated companies. Furthermore, BMW Overseas Enter-

prises N. V., Willemstad, was wound up and ceased to

be a consolidated company.

The group reporting entity also changed by comparison

to the previous year as a result of the first-time con-

solidation of six special purpose trusts and one special

purpose securities fund and the deconsolidation of

three special purpose trusts and three special purpose

securities funds.

3