BMW 2012 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21 COMBINED GROUP AND COMPANY MANAGEMENT REPORT

Significant downturn in global economy

As expected, the global economy suffered a perceptible

downturn in 2012. The source of the downward trend

lay clearly in Europe, where economic output fell dur-

ing

the period under report in both the eurozone and

the United Kingdom. By contrast, the US economy

remained relatively stable throughout 2012 despite the

fact that the growth rate was still down on the historic

average. Growth rates in the major emerging markets

fell

short of expectations.

High sovereign debt levels in industrial countries

con-

tinue to pose a structural risk for the worldwide economy.

The future course of the debt crisis in Europe will de-

pend

partly on the course of action taken by

policy-

makers, but also on the way the situation is perceived

on the world’s capital markets. In view of early elections

in Italy, Spain’s outstanding decision to apply for support

from the European Stability Mechanism (ESM), dis-

cussions on a further debt cut for Greece and the per-

formance of the French economy, renewed turbulence

cannot be ruled out.

Economic performance is also being held down by high

debt levels in the USA, Japan and the UK. The two po-

litical sides in the USA reached a compromise at the

turn of the new year, reducing the looming threat of a

drop in consumer spending due to tax increases and

expenditure cuts in 2013 to approximately one third of

the originally planned magnitude, equivalent to some

1.5 % of economic output. In December 2012, the newly

elected government in Japan announced the initiation

of further government-funded stimulus programmes,

despite the high level of state debt.

Central banks worldwide have reacted to the risk of an

impending economic downturn by continuing their

expansive monetary policies on a massive scale. So far,

however, only share and raw material prices have really

benefited and been propped up at a high level. Despite

these moves, there is still no sign of a genuine revival in

demand in industrial countries.

The eurozone’s economy contracted overall by 0.4 % in

2012. Germany was the only major country in the euro-

zone that managed to register any real growth (+ 0.7 %).

France’s gross domestic product (GDP) practically stag-

nated at a rate of + 0.1 %. By contrast, Italy (– 2.2 %) and

Spain (– 1.4 %) slipped into recession. The UK economy –

Europe’s largest outside the eurozone – reached the pre-

vious year’s level.

The USA recorded a growth rate of 2.2 % in 2012, thanks

to the recovery of the employment and property mar-

kets. Despite uncertainties about possible fiscal changes

in 2013, domestic demand remained stable up to the

year-end.

The Japanese economy grew by 1.8 % as a result of the

high level of investment and the production catch-up

effect caused by the previous year’s catastrophe. Even

here, however, the growth rate slowed down sharply

over the course of the year.

China, too, lost some momentum in 2012, growing

by only 7.8 % compared to the previous year’s 9.3 %,

but nevertheless remained the most dynamic of the

world’s major economies. The growth rate in India

fell from 6.9 % in 2011 to 5.1 % in 2012. The most pro-

nounced slow-down was registered in Brazil, where

growth dropped to 1.1 % and hence to a mere quar-

ter of the previous year’s rate (2011: + 4.4 %). Russia’s

GDP also grew more slowly than one year earlier

(+ 3.4 %).

General Economic Environment

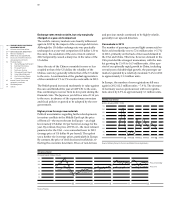

Exchange rates compared to the euro

(Index: 31 December 2007 = 100)

140

130

120

110

100

90

80

70

08 09 10 11 12

Source: Reuters

British Pound

Chinese

Renminbi

Japanese Yen

US Dollar