BMW 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

21 General Economic Environment

24 Review of Operations

44 BMW Stock and Capital Market

47 Disclosures relevant for takeovers

and explanatory comments

50 Financial Analysis

50 Internal Management System

52 Earnings Performance

54 Financial Position

57 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

65 Internal Control System and

explanatory comments

66 Risk Management

74 Outlook

Analysis of the Group Financial Statements

Group Internal Management System

Taking into account the interests and expectations of

capital providers is an important aspect of value-based

management within the BMW Group. Only companies

generating profits on a sustainable basis that exceed the

cost of equity and debt capital employed are capable of

ensuring long-term growth, an increase in value for capi-

tal providers, jobs and, ultimately, corporate autonomy.

The BMW Group’s internal management system is

multi-

layered. The principal key financial performance indica-

tor at Group level is value added. Business is managed

at segment level on the basis of segment-specific rates of

return. The system is complemented by value-based

and return-based performance indicators measured in

conjunction with project decisions.

Capital employed comprises Group equity, the financial

liabilities of the Automotive and Motorcycles segments

and pension provisions. Value added is determined on

the basis of the average level of capital employed for a

particular year, measured as the average capital employed

at the beginning of the year, at quarter-ends and at the

end of the year.

In line with employed capital, earnings for RoCE pur-

poses corresponds to Group earnings before tax and

interest expense incurred in conjunction with the pen-

sion provision and on the financial liabilities of the

Automotive and Motorcycles segments (earnings before

interest and taxes).

The cost of capital rate is the minimum rate of return

expected by capital providers in return for the capital

employed by the Group. Since capital employed com-

prises an equity capital element (e. g. share capital) and

a debt capital element (e. g. bonds), the overall cost of

capital rate is determined on the basis of the weighted

average rates for equity and debt capital.

The cost of equity capital corresponds to the minimum

rate of return expected by an equity capital provider

investing in BMW stock. This minimum rate of return

Value added as top-level key financial

performance indicator

Value added reflects the amount of earnings over and

above the cost of capital, and gives an indication of

whether the Group is meeting the minimum require-

ments for the rate of return expected by capital

pro-

viders. A positive value added means that a company is

creating more additional value than the cost of capital

and it is therefore an important measure of financial

success.

Value added Group = earnings amount – cost of capital

= earnings amount – (cost of capital rate ×

capital employed)

is determined using the Capital Asset Pricing Model

(CAPM) and corresponds to the interest rate on long-

term, risk-free securities (e. g. German federal bonds)

plus a risk premium for the specific risk involved in in-

vesting in BMW AG.

The cost of debt capital is calculated on the basis of the

average interest rates relevant for long-term financial

liabilities and pension obligations.

For the purposes of measuring the average cost of capi-

tal rate, equity and debt cost rates are weighted on the

basis of a notional ratio derived from fixed, targeted

market values for equity and debt capital. Stability in

managing the business over time is ensured by keeping

the cost of capital rate within a pre-defined range and

by refraining from revising it unless there have been

significant

changes in circumstances.

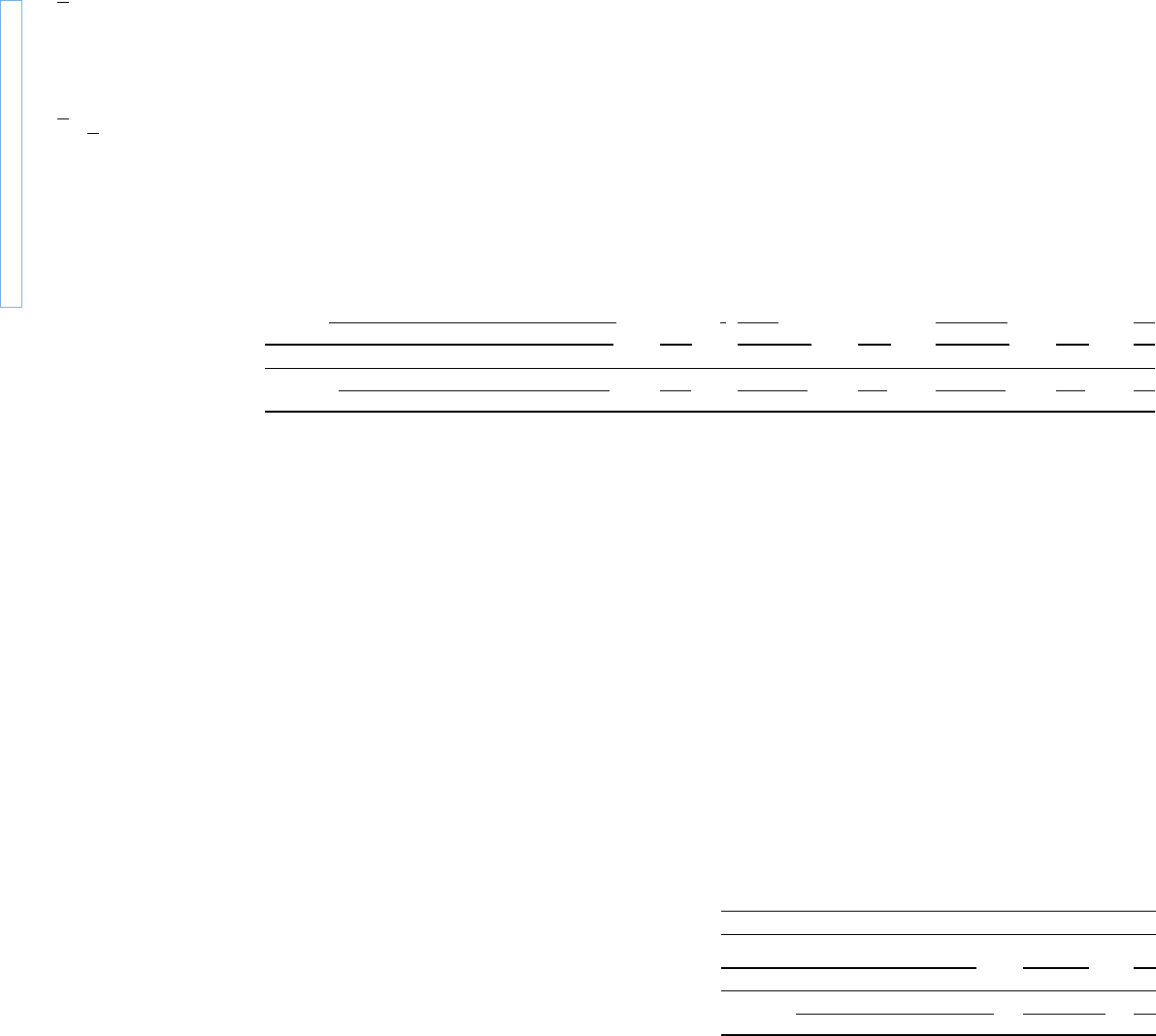

Cost of capital rate (before tax)

in %

2012 2011

BMW Group 12 12

in € million Earnings amount Cost of capital (EC + DC) Value added Group

2012 2011 2012 2011 2012 2011

BMW Group 8,128 7,637 4,221 3,575 3,907 4,062