BMW 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

18 COMBINED GROUP AND COMPANY

MANAGEMENT REPORT

18 A Review of the Financial Year

21 General Economic Environment

24 Review of Operations

44 BMW Stock and Capital Market

47 Disclosures relevant for takeovers

and explanatory comments

50 Financial Analysis

50 Internal Management System

52 Earnings Performance

54 Financial Position

57 Net Assets Position

59 Subsequent Events Report

59 Value Added Statement

61 Key Performance Figures

62 Comments on BMW AG

65 Internal Control System and

explanatory comments

66 Risk Management

74 Outlook

Income tax expense for the year totalled € 2,697 million

(2011: € 2,476 million), giving an effective tax rate of

34.5 % (2011: 33.5 %). Tax increases as a result of non-

deductible expenses relate mainly to the impact of non-

recoverable withholding taxes on intra-group dividends

and transfer price issues.

Revenues of the Automotive segment grew by 11.0 % to

€ 70,208 million (2011: € 63,229 million) due to increased

sales volumes. The strong sales volume performance

is also reflected in the profit before tax figure, which de-

spite higher personnel and non-personnel expenses,

improved from € 6,823 million in 2011 to € 7,195 million

in 2012.

In the Motorcycles segment, the number of BMW and

Husqvarna brand motorcycles sold increased by 3.1 %,

while segment revenues rose by 3.8 %. The pre-tax seg-

ment

result fell by € 35 million to € 6

million. This dete-

rioration includes the negative impact

of the planned

sale of the Husqvarna Group entities to Pierer Industrie

AG. For further information see note 32 of the Group

Financial Statements.

Financial Services segment revenues grew by 11.7 % to

€ 19,550 million. The pre-tax segment result fell by

€ 229 million to € 1,561 million (2011: € 1,790 million).

The previous year’s result included exceptional income

of € 439 million arising on the reduction of provisions

for residual value and bad debt risks. Business with

end-of-contract leasing vehicles gave rise to an excep-

tional gain of € 124 million in 2012.

The Other Entities segment recorded a pre-tax loss of

€ 6 million compared to one of € 168 million in the pre-

vious year. The main reason for the improvement in

earnings is the lower expense for allocations to provi-

sions

in 2012.

Inter-segment eliminations down to the level of profit

before tax gave rise to a net expense of € 937 million

(2011: net expense of € 1,103 million).

Financial position*

The consolidated cash flow statements for the Group

and the Automotive and Financial Services segments

show the sources and applications of cash flows for

the

financial years 2011 and 2012, classified into cash

flows from operating, investing and financing ac-

tivities.

Cash and cash equivalents in the cash flow

statements correspond to the amount disclosed in

the balance sheet.

Cash flows from operating activities are determined in-

directly, starting with Group and segment net profit.

By contrast, cash flows from investing and financial ac-

tivities are based on actual payments and receipts.

The BMW Group used various sources of funds for in-

ternal

financing purposes. In addition to the issue of

interest-bearing debt, cash funds are also allocated

in-

ternally in line with business requirements, including

the use of dividends and similar transactions. In this

context, it is possible that cash funds may be transferred

from one segment to another. Up to the first quarter

2012, these cash inflows and outflows were reported in

the Cash Flow Statements of the Automotive and Finan-

cial Services segments as part of cash flows from oper-

ating activities. Due to the increasing importance of

inter-segment transactions, the method of presentation

was changed with effect from the second quarter 2012.

Intragroup inter-segment dividends and similar

trans-

actions are now reported as part of cash flows from

financing activities. The reclassification from operating

activities to financing activities resulted in the previous

year in an increase in the operating cash flow. The pre-

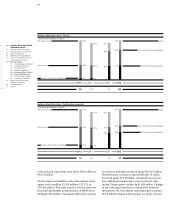

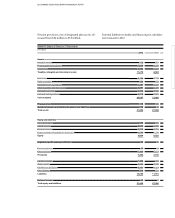

Revenues by segment

in € million

2012 2011

Automotive 70,208 63,229

Motorcycles 1,490 1,436

Financial Services 19,550 17,510

Other Entities 5 5

Eliminations – 14,405 – 13,359

Group 76,848 68,821

Profit / loss before tax by segment

in € million

2012 2011

Automotive 7,195 6,823

Motorcycles 6 41

Financial Services 1,561 1,790

Other Entities – 6 – 168

Eliminations – 937 – 1,103

Group 7,819 7,383

* Previous year’s figures adjusted