BMW 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59 COMBINED GROUP AND COMPANY MANAGEMENT REPORT

and expenses relating to equity accounted investments

and recognised directly in equity, net of deferred tax,

increased equity by € 82 million. The dividend payment

decreased equity by € 1,508 million. Minority interests

went up by € 42 million. Other changes amounted to

€ 7 million.

A portion of the Authorised Capital created at the

Annual General Meeting held on 14 May 2009 in con-

junction with the Employee Share Scheme was used

during the financial year under report to issue shares

of preferred stock to employees, thereby increasing sub-

scribed

capital to € 656 million. An amount of € 18

mil-

lion was transferred to capital reserves in conjunction

with this share capital increase. The equity ratio of the

BMW Group improved overall by 1.1 percentage points

to 23.1 %. The equity ratio of the Automotive segment

was 40.9 % (2011: 41.1 %) and that of the Financial Ser-

vices segment was 8.6 % (2011: 8.7 %).

Pension provisions increased by 81.6 % to € 3,965 million

mainly as a result of lower discount factors used in Ger-

many, the UK and the USA. In the case of pension plans

with fund assets, the fair value of fund assets is offset

against the defined benefit obligation.

Current and non-current other provisions increased by

€ 542 million to € 6,795 million.

Current and non-current financial liabilities went up

by € 1,530 million to € 69,507 million. Within financial

liabilities, there were increases in bonds (+4.5 %), cus-

tomer deposits (banking) (+8.1 %) and liabilities to

banks (+12.9 %). By contrast, liabilities for commercial

paper decreased by € 901 million.

Trade payables amounted to € 6,433 million and were

thus 20.5 % higher than one year earlier, mainly

attributable to the expansion of business operations.

Other liabilities increased by 2.6 % to € 10,196 million.

Overall, the earnings performance, financial position

and net assets position of the BMW Group continued to

develop very positively during the financial year under

report.

Compensation report

The compensation of the Board of Management com-

prises both a fixed and a variable component. Benefits

are also payable – primarily in the form of pension

benefits – at the end of members’ mandates. Further

details, including an analysis of remuneration by each

individual, are disclosed in the Compensation Report,

which can be found in the section “Statement on

Corporate Governance”. The Compensation Report is

a sub-section of the Combined Group and Company

Management Report.

Events after the end of the reporting period

No events have occurred after the balance sheet date

which could have a major impact on the earnings

performance, financial position and net assets of the

BMW Group.

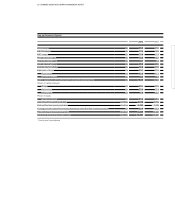

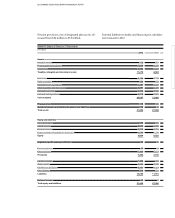

Value added statement

The value added statement shows the value of work per-

formed

less the value of work bought in by the BMW

Group during the financial year. Depreciation and

amortisation, cost of materials and other expenses are

treated as bought-in costs in the value added calcula-

tion. The allocation statement applies value added to

each of the participants involved in the value added

process. It should be noted that the gross value added

amount treats depreciation as a component of value

added which, in the allocation statement, is treated as

internal financing.

Net valued added by the BMW Group in 2012 rose by

6.8 % to € 18,975 million. The increase over the previous

year was attributable to the higher level of revenues.

The bulk of the net value added (45.0 %) is applied to em-

ployees. The proportion applied to providers of finance

fell to 10.7 %, mainly due to the lower refinancing costs

on international capital markets for the financial

ser-

vices side of the business. The government / public sector

(including deferred tax expense) accounted for 17.3 %.

The proportion of net value added applied to

share-

holders, at 8.7 %, was higher than in the previous year.

Minority interests take a 0.1 % share of net value added.

The remaining proportion of net value added (18.2 %)

will be retained in the Group to finance future operations.