ADT 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

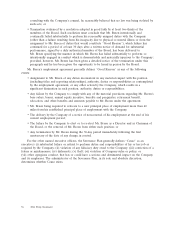

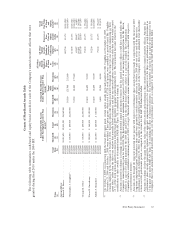

Executive Compensation Tables

The following table sets forth information regarding the compensation of our named executive

officers, who are Edward D. Breen, the Chairman and Chief Executive Officer; Christopher J.

Coughlin, the Executive Vice President and Chief Financial Officer; George R. Oliver, President, Safety

Products and Electrical & Metal Products; Naren K. Gursahaney, President, ADT Worldwide, and

Judith A. Reinsdorf, Executive Vice President and General Counsel. Salary and bonus include amounts

that may be deferred at the named executive officer’s election.

Summary Compensation Table

Change in

Pension

Value and

Non-Equity Nonqualified

Incentive Deferred

Stock/Unit Option Plan Compensation All Other

Name and Salary Bonus Awards Awards Compensation Earnings Compensation Total

Principal Position Year ($) ($)(1) ($)(2) ($)(2) ($)(3) ($)(4) ($)(5) ($)

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j)

Current Officers

Edward D. Breen ....2010 $1,625,000 $ — $4,419,090 $4,515,932 $4,062,500 $3,842,000 $1,399,351 $19,863,873

Chairman and Chief 2009 $1,625,000 $ — $4,317,984 $4,313,724 $1,869,000 $4,542,000 $1,127,677 $17,795,385

Executive Officer 2008 $1,625,000 $ — $ — $ — $3,250,000 $1,542,000 $1,293,683 $ 7,710,683

Christopher J. Coughlin . 2010 $ 800,000 $ — $3,416,580 $4,497,948 $1,600,000 $ — $ 307,226 $10,621,754

Executive Vice 2009 $ 800,000 $ — $1,439,328 $1,437,908 $ 736,000 $ — $ 309,188 $ 4,722,424

President and Chief 2008 $ 800,000 $ — $ — $ — $1,600,000 $ — $ 332,197 $ 2,732,197

Financial Officer

George R. Oliver .....2010 $ 599,989 $ — $1,104,233 $ 956,008 $1,200,000 $ — $ 175,564 $ 4,035,794

President, Safety 2009 $ 589,990 $282,000 $1,007,808 $1,006,613 $ 168,000 $ — $ 231,832 $ 3,286,243

Products 2008 $ 593,739 $ — $ 498,288 $ 458,112 $1,146,000 $ — $ 213,111 $ 2,909,250

Naren K. Gursahaney . 2010 $ 560,000 $ — $1,104,233 $ 956,008 $1,080,800 $ — $ 176,974 $ 3,878,015

President, ADT 2009 $ 560,000 $146,000 $1,007,808 $1,006,613 $ 392,000 $ — $ 189,109 $ 3,301,530

Worldwide 2008 $ 560,000 $ — $ 498,288 $ 458,112 $ 638,000 $ — $ 199,627 $ 2,354,027

Judith A. Reinsdorf . . . 2010 $ 525,000 $ — $ 921,578 $ 796,339 $ 840,000 $ — $ 185,452 $ 3,268,369

Executive Vice

President and

General Counsel

(1) Bonus: Amounts shown in column (d) reflect special awards paid to Messrs. Oliver and

Gursahaney in fiscal 2009 in recognition of their contributions toward achievement of cash

conversion and free cash flow generation goals in fiscal 2009.

(2) Stock/Unit Awards and Option Awards: The amounts in columns (e) and (f) reflect the fair value

of equity awards granted in fiscal 2010, 2009 and 2008, which consisted of stock options, restricted

stock units (RSUs) and performance share units. These amounts represent the fair value of the

entire amount of the award calculated in accordance with Financial Accounting Standards Board

ASC Topic 718, excluding the effect of estimated forfeitures. For stock options, amounts are

computed by multiplying the fair value of the award (as determined under the Black-Scholes

option pricing model) by the total number of options granted. For RSUs, fair value is computed by

multiplying the total number of shares subject to the award by the closing market price of Tyco

common stock on the date of grant. For performance share units, fair value is based on a model

that considers the closing market price of Tyco common stock on the date of grant, the range of

shares subject to such stock award, and the estimated probabilities of vesting outcomes. The value

of performance share units included in the table assumes target performance. The following

amounts represent the maximum potential performance share value by individual for fiscal 2010:

Mr. Breen—$8,838,180; Mr. Coughlin—$6,833,160; Mr. Oliver—$2,208,465; Mr. Gursahaney—

$2,208,465; Ms. Reinsdorf—$1,843,155.

64 2011 Proxy Statement