ADT 2010 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

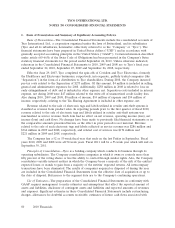

1. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

value of the underlying hedged item at inception of the hedge and are expected to remain highly

effective over the life of the hedge contract.

All derivative financial instruments are reported on the Consolidated Balance Sheets at fair value.

Derivatives used to economically hedge foreign currency denominated balance sheet items related to

operating activities are reported in selling, general and administrative expenses along with offsetting

transaction gains and losses on the items being hedged. Derivatives used to economically hedge

dividends declared in Swiss francs are reported in the Company’s Consolidated Statements of

Operations as part of other expense, net along with offsetting transaction gains and losses on the items

being hedged. Derivatives used to manage the exposure to changes in interest rates are reported in

interest expense along with offsetting transaction gains and losses on the items being hedged. Gains

and losses on net investment hedges are included in the cumulative translation adjustment component

of accumulated other comprehensive loss to the extent they are effective. Gains and losses on

derivatives designated as cash flow hedges are recorded in accumulated other comprehensive loss and

reclassified to earnings in a manner that matches the timing of the earnings impact of the hedged

transactions. The Company classifies cash flows associated with the settlement of derivatives consistent

with the nature of the transaction being hedged. The Company did not have any cash flow hedges

during 2010. The ineffective portion of all hedges, if any, is recognized currently in earnings as noted

above. Instruments that do not qualify for hedge accounting are marked to market with changes

recognized in current earnings.

Reclassifications—Certain prior period amounts have been reclassified to conform with the current

period presentation. Specifically, the Company has reclassified certain businesses which have satisfied

the criteria to be presented as discontinued operations to income from discontinued operations in the

Consolidated Statements of Operations and assets and liabilities held for sale within the Consolidated

Balance Sheets. See Note 2. Additionally, the Company has realigned certain business operations in the

first quarter of fiscal 2010, resulting in prior period segment amounts being recast. See Note 19.

Recently Adopted Accounting Pronouncements—In December 2008, the FASB issued authoritative

guidance for employers’ disclosures about postretirement benefit plan assets. The guidance requires

additional disclosures about plan assets related to an employer’s defined benefit pension or other post-

retirement plans to enable investors to better understand how investment decisions are made, the major

categories of plan assets, the inputs and valuation techniques used to measure the fair value of plan

assets, the effect of fair value measurements using significant unobservable inputs (Level 3) on changes

in plan assets for the period, and the significant concentrations of risk within plan assets. The

disclosure provisions of the guidance were adopted concurrent with the pension disclosures associated

with the Company’s annual valuation process during the fourth quarter of fiscal 2010. The adoption did

not impact the Company’s financial position, results of operations or cash flows. See Note 15.

In June 2008, the Financial Accounting Standards Board (‘‘FASB’’) ratified authoritative guidance

for determining whether instruments granted in share-based payment transactions are participating

securities. The guidance addresses whether instruments granted in share-based payment awards are

participating securities prior to vesting and, therefore, must be included in the earnings allocation in

calculating earnings per share under the two-class method. The guidance requires that unvested share-

based payment awards that contain non-forfeitable rights to dividends or dividend-equivalents be

treated as participating securities in calculating earnings per share. The guidance became effective for

Tyco in the first quarter of fiscal 2010, and was applied retrospectively to prior periods. The adoption

2010 Financials 87