ADT 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16DEC201011085777

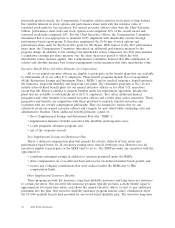

Process Overview: How the Compensation Committee Designs and Establishes Executive Compensation

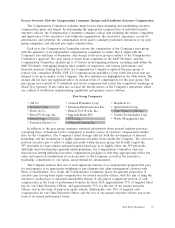

The Compensation Committee evaluates many factors when designing and establishing executive

compensation plans and targets. In determining the appropriate compensation of individual named

executive officers, the Compensation Committee considers critical data including the relative complexity

and importance of the executive’s role within the organization, the executive’s experience, record of

performance and potential, the compensation levels paid to similarly positioned executives at our peer

group companies, and internal pay equity considerations.

Each year, the Compensation Committee reviews the composition of the Company’s peer group

with the assistance of its independent compensation consultant to ensure that it aligns with the

Company’s size and lines of businesses. Any change to the peer group is subject to the Compensation

Committee’s approval. The peer group is drawn from companies in the S&P 500 Index, and the

Compensation Committee analyzes up to 17 factors in determining inclusion, including rank within the

S&P 500 Index, overlapping business lines, number of employees, and various performance and

financial measures. During fiscal 2010, the Compensation Committee updated the peer group to

replace four companies (FedEx, UPS, L3 Communications and Masco Corp.) with five peers that are

deemed to be more similar to the Company. The five additions are highlighted in the table below. The

change did not have any significant affect on median levels of compensation for the peer group. The

peer group now consists of 17 industrial and service companies that reflect the competitive landscape in

which Tyco operates. It also takes into account the diverse nature of the Company’s operations, which

are a blend of world-class manufacturing capabilities and premier service delivery.

Peer Group Companies

• 3M Co. • General Dynamics Corp. •

• Danaher Corp. • Honeywell International, Inc. • Sprint Nextel Corp.

Time Warner Cable Inc.

Raytheon Co.

• Deere & Co. • Illinois Tool Works, Inc. •

• DirecTV Group, Inc. • Ingersoll-Rand PLC • United Technologies Corp.

• Eaton Corp. • ITT Corp. • Waste Management, Inc.

• Emerson Electric Co. • Johnson Controls Inc.

In addition to the peer group, summary statistical information about general industry practices

(excepting those of financial service companies) is another source of executive compensation market

data for the Committee. The Company’s talent strategy calls for both the development of internal

leadership and the recruitment of highly experienced leaders from outside the Company. Tyco does not

position executive pay to reflect a single percentile within the peer group, but broadly targets the

50th percentile for base salaries and performance-based pay at or slightly above the 50th percentile.

Although these benchmarks represent useful guidelines, the Compensation Committee exercises

discretion in setting individual executive compensation packages so that they appropriately reflect the

value and expected contributions of each executive to the Company, as well as the executive’s

leadership, commitment to our values, and potential for advancement.

The Company believes that one of most important features of a compensation program that pays

for performance is an appropriate weighting of pay elements that align management’s interest with

those of shareholders. As a result, the Compensation Committee places the greatest proportion of

executive pay in long-term equity compensation for named executive officers, with the aim of tying the

executive’s realized pay to sustained shareholder returns. It also places a significant portion of cash

compensation in the form of performance bonuses. In fiscal 2010, approximately 71% of targeted direct

pay for our Chief Executive Officer, and approximately 74% for the rest of our named executive

officers, was in the form of long term equity awards. Additionally, over 50% of targeted cash

compensation for our Chief Executive Officer and the rest of our named executive officers was in the

form of an annual performance bonus.

2011 Proxy Statement 47