ADT 2010 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

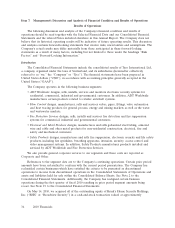

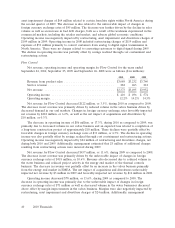

realized through cost containment actions, and to a lesser extent, a curtailment gain of approximately

$7 million recognized when certain defined benefit pension plans were frozen in the United Kingdom.

During 2010, $34 million of restructuring and divestiture charges, net were incurred as compared to

$45 million of restructuring charges during 2009. Changes in foreign currency exchange rates favorably

impacted operating income by $11 million. The net increase in operating income was partially offset by

the decreased sales volume discussed above.

Net revenue for Fire Protection Services decreased $403 million, or 10.6%, during 2009 as

compared to 2008. This decrease was primarily due to the impact of unfavorable changes in foreign

currency exchange rates of $293 million, or 7.7%. Additionally, revenue declined due to the weakness

in the commercial market and adverse global economic conditions. Geographically, revenue in our

international fire businesses decreased by $286 million, or 16.8%, largely due to the impact of

unfavorable changes in foreign currency exchange rates discussed above as well as weakness in the

European commercial markets. Additionally, revenue in our North America SimplexGrinnell business

decreased by $117 million, 5.5%, primarily due to a decline in systems installation and upgrade activity

in the sprinkler business.

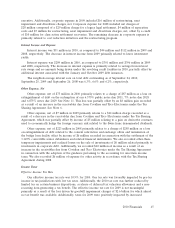

Operating income decreased $263 million during 2009 as compared to 2008. The decrease was

primarily due to a $180 million goodwill impairment in EMEA recorded during 2009 compared to a

$9 million goodwill impairment in Latin America recorded during 2008. The decrease was further

driven by the decline in sales volume discussed above as well as an increase in bad debt charges, both

as a result of the weakness experienced in the commercial markets and adverse global economic

conditions. There were restructuring, asset impairment and divestiture charges of $45 million in 2009 as

compared to $26 million in 2008. Additionally, operating income decreased due to the unfavorable

impact of changes in foreign currency exchange rates of $10 million. The decline in operating income

was partially offset by savings realized through cost containment and restructuring actions.

Electrical and Metal Products

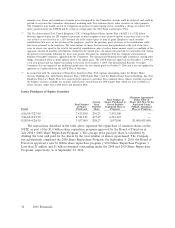

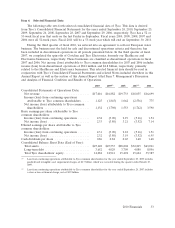

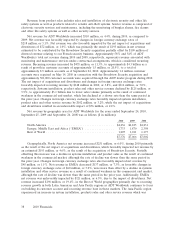

Net revenue, goodwill impairment, operating income (loss) and operating margin for Electrical and

Metal Products for the years ended September 24, 2010, September 25, 2009 and September 26, 2008

were as follows ($ in millions):

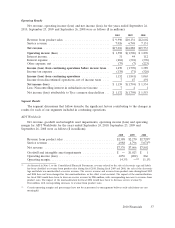

2010 2009 2008

Revenue from product sales .............................. $1,394 $1,389 2,266

Service revenue ....................................... 5 3 6

Net Revenue ......................................... $1,399 $1,392 2,272

Goodwill impairment ................................... $ — $ 935 $ —

Operating income (loss) ................................. 100 (938) 342

Operating margin ..................................... 7.1% —(1) 15.1%

(1) Certain operating margins and percentage changes have not been presented as management believes such calculations are

not meaningful.

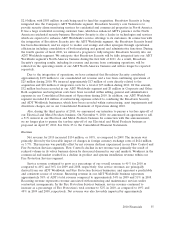

Net revenue for Electrical and Metal Products increased $7 million, or 0.5%, during 2010

compared to 2009. The increase in revenue was primarily due to favorable changes in foreign currency

exchange rates of $37 million, or 2.7%, and $24 million, or 1.7%; due to the favorable net impact of

acquisitions and divestitures. These increases were partially offset by a decline in volume of armored

cable products and, to a lesser extent, steel products. Higher selling prices for armored cable products

were almost entirely offset by lower selling prices for steel products.

Operating income increased approximately $1.0 billion during 2010 as compared to 2009.

Operating income for 2009 was negatively affected by goodwill impairment charges of $935 million

42 2010 Financials