ADT 2010 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

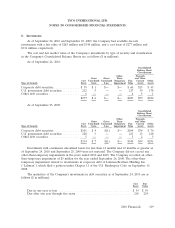

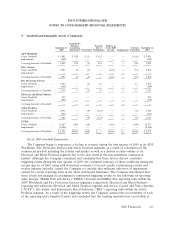

11. Debt (Continued)

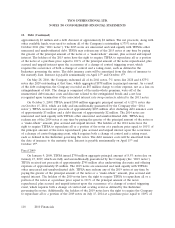

approximately $3 million and a debt discount of approximately $2 million. The net proceeds, along with

other available funds, were used to redeem all of the Company’s outstanding 6.375% notes due

October 2011 (the ‘‘2011 notes’’). The 2015 notes are unsecured and rank equally with TIFSA’s other

unsecured and unsubordinated debt. TIFSA may redeem any of the 2015 notes at any time by paying

the greater of the principal amount of the notes or a ‘‘make-whole’’ amount, plus accrued and unpaid

interest. The holders of the 2015 notes have the right to require TIFSA to repurchase all or a portion

of the notes at a purchase price equal to 101% of the principal amount of the notes repurchased, plus

accrued and unpaid interest upon the occurrence of a change of control triggering event, which

requires the occurrence of both a change of control and a rating event, each as defined in the

Indenture governing the notes. The debt issuance costs will be amortized from the date of issuance to

the maturity date. Interest is payable semiannually on April 15th and October 15th.

On May 28, 2010, the Company redeemed all of its 2011 notes, 7% notes due 2028 and 6.875%

notes due 2029 outstanding at that time, which aggregated $878 million in principal amount. As a result

of the debt redemption, the Company recorded an $87 million charge to other expense, net as a loss on

extinguishment of debt. The charge is comprised of the make-whole premium, write-off of the

unamortized debt issuance costs and discount related to the extinguished bonds and a net loss

recognized upon termination of the associated interest rate swap contracts related to the 2011 notes.

On October 5, 2009, TIFSA issued $500 million aggregate principal amount of 4.125% notes due

on October 15, 2014, which are fully and unconditionally guaranteed by the Company (the ‘‘2014

notes’’). TIFSA received net proceeds of approximately $495 million after deducting debt issuance costs

of approximately $3 million and a debt discount of approximately $2 million. The 2014 notes are

unsecured and rank equally with TIFSA’s other unsecured and unsubordinated debt. TIFSA may

redeem any of the 2014 notes at any time by paying the greater of the principal amount of the notes or

a ‘‘make-whole’’ amount, plus accrued and unpaid interest. The holders of the 2014 notes have the

right to require TIFSA to repurchase all or a portion of the notes at a purchase price equal to 101% of

the principal amount of the notes repurchased, plus accrued and unpaid interest upon the occurrence

of a change of control triggering event, which requires both a change of control and a rating event,

each as defined in the Indenture governing the notes. The debt issuance costs will be amortized from

the date of issuance to the maturity date. Interest is payable semiannually on April 15th and

October 15th.

Fiscal 2009

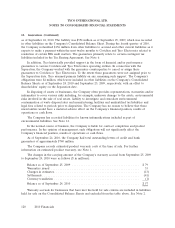

On January 9, 2009, TIFSA issued $750 million aggregate principal amount of 8.5% notes due on

January 15, 2019, which are fully and unconditionally guaranteed by the Company (the ‘‘2019 notes’’).

TIFSA received net proceeds of approximately $745 million after underwriting discounts and offering

expenses of approximately $5 million. The 2019 notes are unsecured and rank equally with TIFSA’s

other unsecured and unsubordinated debt. TIFSA may redeem any of the 2019 notes at any time by

paying the greater of the principal amount of the notes or a ‘‘make-whole’’ amount, plus accrued and

unpaid interest. The holders of the 2019 notes have the right to require TIFSA to repurchase all or a

portion of the notes at a purchase price equal to 101% of the principal amount of the notes

repurchased, plus accrued and unpaid interest upon the occurrence of a change of control triggering

event, which requires both a change of control and a rating event as defined by the Indenture

governing the notes. Additionally, the holders of the 2019 notes have the right to require the Company

to repurchase all or a portion of the 2019 notes on July 15, 2014 at a purchase price equal to 100% of

118 2010 Financials