ADT 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal 2010 Annual Incentive Compensation Design Summary

Performance Actual

Performance Measure Weights Target Performance

Messrs. Breen and Coughlin, and Ms. Reinsdorf

•Earnings per Share from continuing operations before

special items (‘‘EPS’’) ........................ 45% $2.53 per share $2.73 per share

•Adjusted Free Cash Flow (‘‘Adjusted FCF’’) before

special items ............................... 45% $ 1.00 billion $ 1.57 billion

•Total Revenue (excluding Electrical and Metal Products

revenue) .................................. 10% $ 15.85 billion $ 15.91 billion

Mr. Oliver

•Corporate split equally between Earnings Per Share and

Adjusted FCF .............................. 20% See above See above

•Combined Operating Income of Safety Products,

Electrical and Metal Products and the International

Fire business before special items ................ 35% $ 429 million $ 465 million

•Combined Revenue of Safety Products, Electrical and

Metal Products and the International Fire business . . . . 15% $ 2.75 billion $ 2.87 billion

•Safety Products Working Capital Days ............ 10% 86.0 days 78.3 days

•Electrical and Metal Products Working Capital Days .. 10% 80.6 days 92.7 days

•International Fire Adjusted Free Cash Flow before

special items ............................... 10% $ 79 million $ 129 million

Mr. Gursahaney

•Corporate split equally between Earnings Per Share and

Adjusted FCF .............................. 20% See above See above

•ADT Worldwide Operating Income before special items . 35% $ 1.05 billion $ 1.12 billion

•ADT Worldwide Adjusted FCF before special items . . . 30% $ 0.92 billion $ 1.17 billion

•ADT Worldwide Total Revenue .................. 15% $ 7.29 billion $ 7.33 billion

Description of Performance Measures: For compensation purposes, EPS from continuing

operations, Adjusted FCF, and operating income are adjusted to exclude the effects of events that the

Compensation Committee deems do not reflect the performance of the named executive officers. The

categories of special items are identified at the time the performance measure is approved at the

beginning of the fiscal year, although the Compensation Committee may at its discretion make

adjustments during the fiscal year. Special items include gains, losses or cash outlays that may mask the

underlying operating results and/or business trends of the Company or business segment, as applicable.

For fiscal 2010, the approved categories of adjustments included adjustments related to (i) business

acquisitions and disposals; (ii) debt refinancing; (iii) legacy legal and tax matters, (iv) goodwill and

intangible asset impairments, (v) tax law changes, (vi) certain unbudgeted capital expenditures;

(vii) restructuring charges; and (viii) realignments of segment and corporate costs. At the beginning of

the fiscal year, the Compensation Committee also decided that it would be appropriate to limit the

effects of the volatility inherent in the Electrical and Metal Products business segment on the

performance measures applicable to the corporate level. For compensation purposes, this had the effect

of increasing the Company’s Adjusted FCF. Adjusted FCF is calculated by first adjusting cash flow from

operations by removing the effects of the sale of accounts receivable programs, cash paid for purchase

accounting and holdback liabilities, and voluntary pension contributions and then deducting net capital

expenditures (including accounts purchased from the ADT dealer network), and then adding back the

special items that increased or decreased cash flows. Working capital days are generally calculated by

dividing annualized average working capital by revenue of the applicable unit.

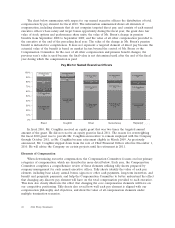

The table below shows the maximum and target annual incentive compensation opportunities for

fiscal 2010, and the actual payments earned by each of our named executive officers. These amounts

are reported in the ‘‘Non-Equity Incentive Plan Compensation’’ column of the ‘‘Summary

Compensation’’ table.

50 2011 Proxy Statement