ADT 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Risk Assessment of Compensation Programs

The Compensation Committee has assessed the company’s executive and broad-based

compensation programs to evaluate whether they drive behaviors that are demonstrably within the risk

management parameters it deems prudent. It has concluded that our compensation policies and

practices do not create risks that are reasonably likely to have a material adverse effect on the

company. Tyco’s management assessed the company’s executive and broadǁbased compensation and

benefits programs on a global basis to determine if the programs’ provisions and operations create

undesired or unintentional risk of a material nature. This risk assessment process included a review of

overall program policies and practices; design of long-term incentive compensation plans; design of

incentive compensation programs, including local bonus plans and sales incentive plans; and sufficiency

of control features. The review focused on plans that had the potential to provide material payouts. In

most cases, the significant incentive compensation policies and practices are centrally designed and

administered, and are substantially similar to those overseen by the Compensation Committee. Field

sales personnel are paid primarily on a sales commission basis, but all of our senior executives are paid

under the programs and plans for nonǁsales employees. Certain internal groups have different or

supplemental compensation programs tailored to their specific operations and goals, and programs may

differ by country due to variations in local laws and customs. In addition, Tyco’s compensation structure

has embedded risk mitigation features. For example, the emphasis on long-term equity awards as a

significant component of compensation mitigates the risk that managers may unduly focus on

short-term results. In addition, policies such as stock ownership, share retention and pay recoupment

serve as significant risk mitigators. Finally, the Compensation Committee’s authority to approve

performance metrics, targets, minimum thresholds and maximum award caps provide discipline and

help eliminate the incentive for excessive risk-taking behavior.

Based on the foregoing, we believe that our compensation policies and practices do not create

inappropriate or unintended material risk to the company as a whole. We also believe that our

incentive compensation arrangements provide incentives that do not encourage inappropriate

risk-taking; are compatible with effective internal controls and the risk management policies; and are

supported by the oversight and administration of the Compensation Committee with regard to

executive compensation programs.

Stock Ownership Guidelines

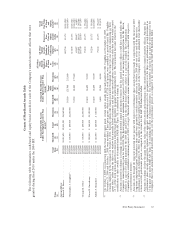

In 2003, the Board established stock ownership and share retention guidelines for all Senior

Officers. The Board believes that executives who own and hold a significant amount of Company stock

are aligned with long-term shareholder interests. The guidelines apply to all of our named executive

officers and certain additional senior executives. The Compensation Committee reviews compliance

with our stock ownership guidelines annually.

The current stock ownership requirement for our named executive officers is five times for

Messrs. Gursahaney and Oliver, six times for Mr. Coughlin and Ms. Reinsdorf and ten times for

Mr. Breen. Tyco shares that count towards meeting the stock ownership requirement include restricted

stock, RSUs, DSUs, performance share units, shares acquired through our 401(k) plan or the Employee

Stock Purchase Program, and shares otherwise owned by the executive. We do not require that the

stock ownership guidelines be attained within a certain period of time. Instead, the Compensation

Committee reviews executive stock ownership regularly to ensure that our senior executives are making

progress towards meeting their goals or maintaining their requisite ownership.

Tyco’s current stock retention guidelines require that our named executive officers and other senior

executives retain a specified percentage of net (after-tax) shares acquired from the exercise of stock

options or the vesting of restricted shares. Specifically, our named executive officers must retain 75% of

all net shares until they attain their target stock ownership goal. Once that goal is attained, they must

2011 Proxy Statement 61