ADT 2010 Annual Report Download - page 274

Download and view the complete annual report

Please find page 274 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO THE FINANCIAL STATEMENTS FOR THE FISCAL YEAR ENDED SEPTEMBER 24, 2010

(Continued)

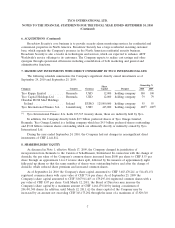

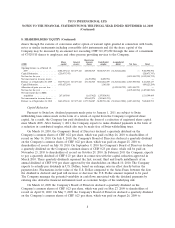

8. SHAREHOLDERS’ EQUITY (Continued)

shares through the exercise of conversion and/or option or warrant rights granted in connection with bonds,

notes or similar instruments including convertible debt instruments and (ii) the share capital of the

Company may be increased by an amount not exceeding CHF 343,175,292 through the issue of a maximum

of 47,929,510 shares to employees and other persons providing services to the Company.

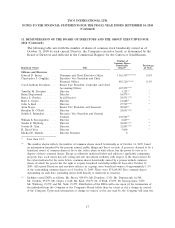

Reserve for

Share General treasury Contributed Accumulated

(CHF) capital reserve shares surplus deficit Net Loss Total

Opening balance as of March 12,

2009 .................. 4,088,387,212 817,677,442 288,080,519 36,028,517,705 (31,815,666,282) — 9,406,996,596

Capital Reduction ............ (220,475,747) (220,475,747)

Net loss for the year .......... (1,025,500,722) (1,025,500,722)

Net movement in treasury shares . . . (36,293,994) 36,293,994 —

Balance as of September 25, 2009 . . 3,867,911,465 817,677,442 251,786,525 36,064,811,699 (31,815,666,282) (1,025,500,722) 8,161,020,127

Capital Reduction ............ (451,627,204) 1,503,920 (450,123,284)

Allocation of prior year net loss . . . (1,025,500,722) 1,025,500,722 —

Net loss for the year .......... (1,405,483,760) (1,405,483,760)

Net movement due to BHS

acquisition .............. 267,185,980 (1,617,412) 1,247,830,901 1,513,399,469

Net movement in treasury shares . . . 823,615,274 (823,615,274) —

Balance as of September 24, 2010 . . 3,683,470,241 817,677,442 1,073,784,387 36,490,531,246 (32,841,167,004) (1,405,483,760) 7,818,812,552

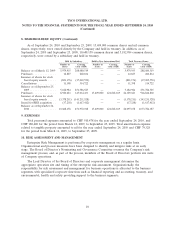

Capital Reduction

Pursuant to Swiss law, dividend payments made prior to January 1, 2011 are subject to Swiss

withholding taxes unless made in the form of a return of capital from the Company’s registered share

capital. As a result, the Company has paid dividends in the form of a reduction of registered share capital

since March 2009. After January 1, 2011, the Company expects to make dividend payments in the form of

a reduction in contributed surplus, which also may be made free of Swiss withholding taxes.

On March 10, 2010, the Company’s Board of Directors declared a quarterly dividend on the

Company’s common shares of CHF 0.22 per share, which was paid on May 26, 2010 to shareholders of

record on May 14, 2010. On July 8, 2010, the Company’s Board of Directors declared a quarterly dividend

on the Company’s common shares of CHF 0.22 per share, which was paid on August 25, 2010 to

shareholders of record on July 30, 2010. On September 9, 2010 the Company’s Board of Directors declared

a quarterly dividend on the Company’s common shares of CHF 0.23 per share, which will be paid on

November 23, 2010 to shareholders of record on October 29, 2010. In February 2011 the Company, expects

to pay a quarterly dividend of CHF 0.23 per share in connection with the capital reduction approved in

March 2010. These quarterly dividends represent the first, second, third and fourth installments of an

annual dividend of CHF 0.90 per share approved by the shareholders on March 10, 2010. The Company

expects to actually pay dividends in U.S. Dollars, based on exchange rates in effect shortly before the

payment date. Fluctuations in the value of the U.S. Dollar compared to the Swiss Franc between the date

the dividend is declared and paid will increase or decrease the U.S. Dollar amount required to be paid.

The Company manages the potential variability in cash flows associated with the dividend payments by

entering into derivative financial instruments used as economic hedges of the underlying risk.

On March 12, 2009 the Company’s Board of Directors declared a quarterly dividend on the

Company’s common shares of CHF 0.23 per share, which was paid on May 27, 2009 to shareholders of

record on April 30, 2009. On May 7, 2009 the Company’s Board of Directors declared a quarterly dividend

on the Company’s common shares of CHF 0.23 per share, which was paid on August 26, 2009 to

8