ADT 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

partially offset by a decrease in the Latin American region due to the continued slowdown in

commercial and retailer end markets. Net revenue in the Rest of World geographies was also favorably

impacted by changes in foreign currency exchange rates of $110 million, or 10.9%.

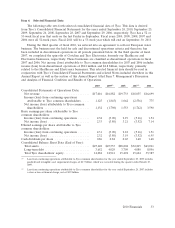

Attrition rates decreased during 2010 as compared to 2009 as shown in the following table:

For the Fiscal Year Ended

September 24, September 25, September 26,

2010 2009 2008

Attrition ................................ 12.8% 13.3%(1) 12.9%(1)

(1) Attrition rates for the years ended September 25, 2009 and September 26, 2008 have been recast to reflect the divestiture

of our French security business, which resulted in reductions of 0.1% in the amounts previously reported for September 25,

2009 and September 26, 2008, respectively.

Operating income increased by approximately $1.3 billion during 2010 as compared to 2009.

Operating income for 2009 was negatively affected by goodwill impairment charges of $959 million

recorded at our ADT EMEA and Sensormatic Retail Solutions reporting units and intangible asset

impairment charges of $64 million. Operating income in 2010 was positively impacted by the shift to

higher margin recurring revenue. Additionally, 2010 operating income was favorably impacted by the

net impact of savings realized through previous restructuring actions, savings realized through cost

containment actions, and a curtailment gain of $12 million recognized when certain defined benefit

pension plans were frozen in the United Kingdom. These increases were partially offset by an increase

in the amortization of intangible assets primarily relating to the Broadview Security acquisition. During

2010, $60 million of net restructuring charges were incurred, of which $14 million related to

restructuring actions associated with the acquisition of Broadview Security, as compared to $103 million

of restructuring charges, net during 2009. Fiscal year 2010 also included a $45 million gain on

divestitures, net primarily related to the sale of our French security business, and $32 million of

acquisition and integration costs related to the acquisition of Broadview Security, as compared to a $6

loss and nil of divestiture and acquisition costs, respectively, during 2009. Changes in foreign currency

exchange rates favorably impacted operating income by $30 million.

Net revenue for ADT Worldwide decreased $736 million, or 9.4%, during 2009 as compared to

2008. This decrease was primarily driven by the unfavorable impact of changes in foreign currency

exchange rates of $614 million. Revenue was positively affected by $152 million for the net impact of

acquisitions and divestitures. Revenue from product sales decreased 16.8% and service revenue

decreased 5.5%. Recurring revenue declined 3.5% during 2009 primarily as a result of changes in

foreign currency exchange rates, which unfavorably impacted recurring revenue by 7.5%, but was offset

by growth in North America and Asia. Product sales and installation and other service revenue declined

15.6% partially due to a result of changes in foreign currency exchange rates, which unfavorably

impacted system installation and service revenue by 8.3%, and lower sales volume due to weakness in

the commercial markets, including the retailer end market. Geographically, revenue in North America

decreased $46 million, or 1.1%, resulting from reduced spending primarily in the commercial markets,

including the retailer end market. Revenue in EMEA decreased $528 million, or 22.0%, largely as a

result of foreign currency exchange rates, which had an unfavorable impact of $328 million. The

remaining decrease in EMEA was primarily a result of a decline in product sales, systems installation

and service revenue due to a slowdown in the commercial markets, including the retailer end market.

Revenue declined $162 million, or 13.8%, in the Rest of World geographies, which was primarily due to

the unfavorable impact of changes in foreign currency exchange rates of $223 million partially offset by

growth in Asia and Latin America.

Operating income in 2009 decreased $1.1 billion as compared to 2008. Based on the deterioration

in the commercial markets, including the retailer end market discussed above, the Company recorded a

goodwill impairment charge of $959 million related to its ADT EMEA reporting unit and intangible

2010 Financials 39