ADT 2010 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

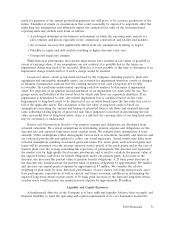

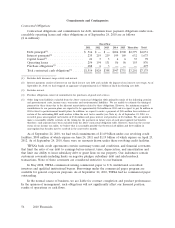

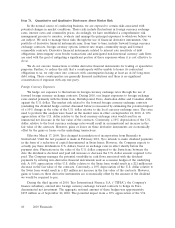

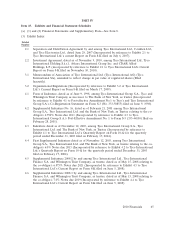

Commitments and Contingencies

Contractual Obligations

Contractual obligations and commitments for debt, minimum lease payment obligations under non-

cancelable operating leases and other obligations as of September 24, 2010 are as follows

($ in millions):

Fiscal Year

2011 2012 2013 2014 2015 Thereafter Total

Debt principal(1) .................... $ 516 $ — $ — $656 $500 $2,379 $4,051

Interest payments(2) ................. 235 219 219 199 169 632 1,673

Capital leases(3) .................... 215566 35 78

Operating leases ................... 254 194 131 86 56 155 876

Purchase obligations(4) ............... 488 6 3 — — — 497

Total contractual cash obligations(5) ...... $1,514 $424 $358 $947 $731 $3,201 $7,175

(1) Excludes debt discount, swap activity and interest.

(2) Interest payments consist of interest on our fixed interest rate debt and exclude the impact of our interest rate swaps. As of

September 24, 2010, we had swapped an aggregate of approximately $1.5 billion of fixed for floating rate debt.

(3) Excludes interest.

(4) Purchase obligations consist of commitments for purchases of goods and services.

(5) Other long-term liabilities excluded from the above contractual obligation table primarily consist of the following: pension

and postretirement costs, income taxes, warranties and environmental liabilities. We are unable to estimate the timing of

payment for these items due to the inherent uncertainties related to these obligations. However, the minimum required

contributions to our pension plans are expected to be approximately $64 million in 2011 and we expect to pay $6 million in

2011 related to postretirement benefit plans. In addition, we expect to make a payment of $156 million for resolution of

certain of the outstanding IRS audit matters within the next twelve months (see Note 6). As of September 24, 2010, we

recorded gross unrecognized tax benefits of $318 million and gross interest and penalties of $63 million. We are unable to

make a reasonably reliable estimate of the timing for the payments in future years of such unrecognized tax benefits;

therefore, such amounts have been excluded from the above contractual obligation table. However, based on the current

status of our income tax audits, we believe that is reasonably possible that between $18 million and $140 million in

unrecognized tax benefits may be resolved in the next twelve months.

As of September 24, 2010, we had total commitments of $1.69 billion under our revolving credit

facilities, $500 million of which expires on June 24, 2011 and $1.19 billion of which expires on April 25,

2012. As of September 24, 2010, there were no amounts drawn under these revolving credit facilities.

TIFSA’s bank credit agreements contain customary terms and conditions, and financial covenants

that limit the ratio of our debt to earnings before interest, taxes, depreciation, and amortization and

that limit our ability to incur subsidiary debt or grant liens on our property. Our indentures contain

customary covenants including limits on negative pledges, subsidiary debt and sale/leaseback

transactions. None of these covenants are considered restrictive to our business.

In May 2008, TIFSA commenced issuing commercial paper to U.S. institutional accredited

investors and qualified institutional buyers. Borrowings under the commercial paper program are

available for general corporate purposes. As of September 24, 2010, TIFSA had no commercial paper

outstanding.

In the normal course of business, we are liable for contract completion and product performance.

In the opinion of management, such obligations will not significantly affect our financial position,

results of operations or cash flows.

56 2010 Financials