ADT 2010 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

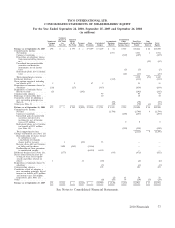

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

incurred. Except for pooled subscriber systems, depreciation is calculated using the straight-line method

over the estimated useful lives of the related assets as follows:

Buildings and related improvements . . 5 to 50 years

Leasehold improvements .......... Lesser of remaining term of the lease or

economic useful life

Subscriber systems .............. Accelerated method up to 15 years

Other machinery, equipment and

furniture and fixtures ........... 2 to 20 years

See below for discussion of depreciation method and estimated useful lives related to subscriber

systems.

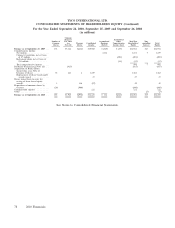

Subscriber System Assets and Related Deferred Revenue Accounts—The Company considers assets

related to the acquisition of new customers in its electronic security business in three asset categories:

internally generated residential subscriber systems, internally generated commercial subscriber systems

(collectively referred to as subscriber system assets) and customer accounts acquired through the ADT

dealer program (referred to as dealer intangibles). Subscriber system assets include installed property,

plant and equipment for which Tyco retains ownership and deferred costs directly related to the

customer acquisition and system installation. Subscriber system assets represent capitalized equipment

(e.g. security control panels, touchpad, motion detectors, window sensors and other equipment) and

installation costs associated with electronic security monitoring arrangements under which the Company

retains ownership of the security system assets in a customer’s residence or place of business.

Installation costs represent costs incurred to prepare the asset for its intended use. The Company pays

property taxes on the subscriber system assets and upon customer termination, may retrieve such assets.

These assets embody a probable future economic benefit as they generate future monitoring revenue

for the Company.

Costs related to the subscriber system equipment and installation are categorized as property, plant

and equipment rather than deferred costs. Deferred costs associated with subscriber system assets

represent direct and incremental selling expenses (i.e. commissions) related to acquiring the customer.

Commissions related to up-front consideration paid by customers in connection with the establishment

of the monitoring arrangement are determined based on a percentage of the up-front fees and do not

exceed deferred revenue. Such deferred costs are recorded as non-current assets and are included in

other assets within the Consolidated Balance Sheets.

Subscriber system assets and any deferred revenue resulting from the customer acquisition are

accounted for over the expected life of the subscriber. In certain geographical areas where the

Company has a large number of customers that behave in a similar manner over time, the Company

accounts for subscriber system assets and related deferred revenue using pools, with separate pools for

the components of subscriber system assets and any related deferred revenue based on the same month

and year of acquisition. The Company depreciates its pooled subscriber system assets (primarily in

North America) and related deferred revenue using an accelerated method with lives up to 15 years.

The accelerated method utilizes declining balance rates based on geographical area ranging from 160%

to 195% for residential subscriber pools and 145% to 265% for commercial subscriber pools and

converts to a straight-line methodology when the resulting depreciation charge is greater than that from

the accelerated method. The Company uses a straight-line method with a 14-year life for non-pooled

2010 Financials 83