ADT 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$69 million, or 0.4%, for net acquisitions and divestitures, which primarily related to the acquisition of

Broadview Security partially offset by the sale of our French security business.

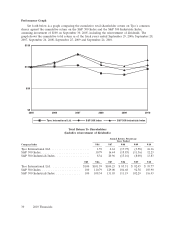

Operating income during 2010 was $1.6 billion, compared to an operating loss of $1.5 billion

during 2009. Operating income in 2009 was negatively affected by goodwill and intangible asset

impairment charges of approximately $2.7 billion and legacy legal settlement charges of approximately

$125 million during 2009. Operating income in 2010 was favorably impacted by efficiencies gained from

cost containment actions taken in fiscal 2010 and 2009 and restructuring actions taken in prior years.

Restructuring and asset impairment charges decreased to $145 million during 2010 from $232 million

during 2009. Operating income during 2010 was favorably impacted by net gains on divestitures of $40

million as compared to a loss on divestitures of $15 million during 2009. We also incurred acquisition

and integration charges of $35 million during 2010 related to our acquisition of Broadview Security.

Changes in foreign currency exchange rates favorably impacted operating income by $80 million during

2010.

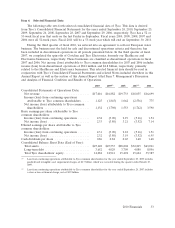

As of September 24, 2010, our cash balance was $1.8 billion, as compared to $2.4 billion as of

September 25, 2009. We generated approximately $2.6 billion of cash from operating activities, which

was more than offset by: $600 million of cash used for acquisitions net of cash acquired, primarily

related to our acquisition of Broadview Security; accounts purchased by ADT and capital expenditures

of $1.3 billion; approximately $900 million to repurchase our common shares; dividends paid of

$416 million; and a net debt repayment of $204 million. We expect to continue to use our cash to fund

internal growth opportunities, improve productivity across all of our businesses, make acquisitions that

strategically fit within our ADT Worldwide, Fire Protection Services and Flow Control businesses and

return capital to shareholders. On September 8, 2010, our Board of Directors approved a new

$1.0 billion share repurchase program (‘‘2010 repurchase program’’) as the remaining capacity under

our existing $1.0 billion share repurchase program was substantially utilized by the end of August 2010.

We did not repurchase any shares under the new program during 2010.

In 2010, we also continued our portfolio refinement efforts by exiting areas that have not provided,

and are not expected to provide, an adequate return on investment and by taking advantage of

restructuring opportunities that are expected to provide future cost savings. During 2010, we incurred

approximately $145 million of restructuring and asset impairment charges, substantially completing our

2009 restructuring program. During fiscal 2010, we identified additional opportunities for cost savings

through restructuring activities in fiscal 2011. We expect to incur restructuring and restructuring related

charges of approximately $150 million in fiscal 2011.

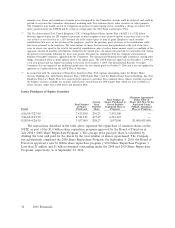

Over the last few years, we have explored alternatives for under-performing or non-strategic

businesses, including divestiture. We sold our French security business, which was part of our ADT

Worldwide segment, resulting in a pre-tax gain of $53 million during 2010. The gain and results of

operations of the French security business are presented in continuing operations as the criteria for

discontinued operations have not been met. As discussed above, during the first quarter of fiscal 2011,

we announced our intention to sell a 51% interest in our Electrical and Metal Products business. See

Notes 25 to the Consolidated Financial Statements. Additionally, during the third quarter of fiscal 2010,

our Board of Directors approved a plan to sell our European water business, which is part of our Flow

Control segment. The business met the held for sale and discontinued operations criteria and has been

included in discontinued operations for all periods presented. On September 30, 2010, we received the

necessary consents and approval to complete the sale of this business and received net cash proceeds of

approximately $267 million. We expect to recognize a gain on the transaction.

36 2010 Financials