ADT 2010 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

evidence if vendor-specific objective evidence is not available, or estimated selling price if neither

vendor-specific evidence nor third-party evidence is available. The guidance requires arrangements

under which multiple revenue generating activities to be performed be allocated at inception. The

residual method under the existing accounting guidance has been eliminated. The guidance expands the

disclosure requirements related to multiple-deliverable revenue arrangements. The guidance becomes

effective for revenue arrangements entered into or materially modified beginning in the first quarter of

fiscal 2011. The guidance applies on a prospective basis. The Company believes that the guidance will

not have a material impact on its financial position, results of operations or cash flows.

In June 2009, the FASB issued authoritative guidance which amended the existing guidance for the

consolidation of variable interest entities, to address the elimination of the concept of a qualifying

special purpose entity. The guidance also replaces the quantitative-based risks and rewards calculation

for determining which enterprise has a controlling financial interest in a variable interest entity with an

approach focused on identifying which enterprise has the power to direct the activities of a variable

interest entity, and the obligation to absorb losses of the entity or the right to receive benefits from the

entity. Additionally, the guidance requires any enterprise that holds a variable interest in a variable

interest entity to provide enhanced disclosures that will provide users of financial statements with more

transparent information about an enterprise’s involvement in a variable interest entity. The guidance is

effective for Tyco in the first quarter of fiscal 2011. The Company believes that the guidance will not

have a material impact on its financial position, results of operations or cash flows.

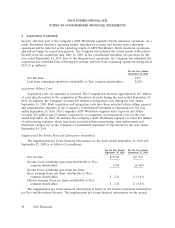

2. Divestitures

The Company has continued to assess the strategic fit of its various businesses and has pursued

divestiture of certain businesses which do not align with its long-term strategy.

During the third quarter of 2010, the Board of Directors approved a plan to pursue a tax-free

spin-off of Tyco’s Electrical and Metal Products business. On November 9, 2010, the Company

announced an agreement to sell a 51% interest in its Electrical and Metal Products business. In

connection with this announcement, the Company no longer plans to pursue the tax-free spin-off of our

Electrical and Metal Products business as proposed on April 27, 2010. See Note 25.

During the fourth quarter of 2009, the Company approved a plan to sell its French security

business, which was part of the Company’s ADT Worldwide segment. This business has been classified

as held for sale as of September 25, 2009; however, its results of operations were presented in

continuing operations as the criteria to be presented as discontinued operations were not met. During

the second quarter of 2010, the Company completed the sale and recorded a $53 million pre-tax gain

within restructuring, asset impairment and divestiture charges, net in the Company’s Consolidated

Statement of Operations.

During the third quarter of 2008, the Company approved a plan to sell a business in its Safety

Products segment. This business had been classified as held for sale in the Company’s historical

Consolidated Balance Sheet. During the second quarter of 2009, due to a change in strategy by

management, the Company decided not to sell the business. As a result, the business no longer satisfied

the requirements to be classified as held for sale. The Company measured the business at the lower of

its (i) carrying amount before it was classified as held for sale, adjusted for depreciation and

amortization expense that would have been recognized had the business been continuously classified as

held and used, or (ii) fair value at the date the decision not to sell was made. The Company recorded a

2010 Financials 89