ADT 2010 Annual Report Download - page 270

Download and view the complete annual report

Please find page 270 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

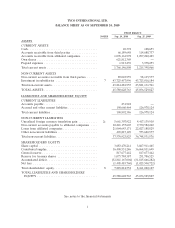

NOTES TO THE FINANCIAL STATEMENTS FOR THE FISCAL YEAR ENDED SEPTEMBER 24, 2010

(Continued)

2. SIGNIFICANT ACCOUNTING POLICIES (Continued)

inception of the hedge and are expected to remain highly effective over the life of the hedge

contract. All derivative financial instruments are reported on the balance sheets at fair value.

Derivatives used to economically hedge foreign currency denominated balance sheet items are

reported in foreign currency exchange results along with offsetting transaction gains and losses on

the items being hedged. Instruments that do not qualify for hedge accounting are marked to

market with changes recognized in current earnings.

e) Other liabilities

Other liabilities primarily represent the fair value of the guarantees and indemnifications under a

Tax Sharing Agreement. See Note 3.

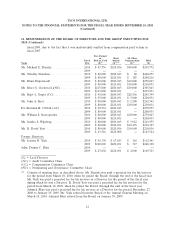

3. GUARANTEES

Tyco International Ltd. fully and unconditionally guarantees public debt facilities of approximately

CHF 4.1 billion and CHF 4.3 billion as of September 24, 2010 and September 25, 2009, respectively,

issued by Tyco International Finance S.A. (TIFSA), a subsidiary of the Company. Additionally, Tyco

International Ltd. is a co-obligor under TIFSA’s indentures dated as of June 9, 1998 and November 12,

2003.

Effective June 29, 2007, Tyco completed the spin-offs of Covidien Plc. (Covidien) and Tyco

Electronics Ltd. (Tyco Electronics), formerly the Healthcare and Electronics businesses, respectively,

into separate, publicly traded companies (the ‘‘Separation’’) in the form of a distribution to Tyco

shareholders. There are certain guarantees or indemnifications extended among Tyco, Covidien and

Tyco Electronics in accordance with the terms of the Separation and Distribution Agreement and the

Tax Sharing Agreement. The guarantees primarily relate to certain contingent tax liabilities included in

the Tax Sharing Agreement. At the time of the separation, Tyco recorded a liability necessary to

recognize the fair value of such guarantees and indemnifications. In the absence of observable

transactions for identical or similar guarantees, the Company determined the fair value of these

guarantees and indemnifications utilizing expected present value measurement techniques. Significant

assumptions utilized to determine fair value included determining a range of potential outcomes,

assigning a probability weighting to each potential outcome and estimating the anticipated timing of

resolution. The probability weighted outcomes were discounted using the Company’s incremental

borrowing rate. The liability necessary to reflect the fair value of the guarantees and indemnifications

under the Tax Sharing Agreement is CHF 546,299,418 (of which CHF 153,523,360 is included in

accrued and other current liabilities and the remaining amount in other non-current liabilities) on the

Company’s balance sheet as of September 24, 2010. The liability was CHF 568,902,574 as of

September 25, 2009, which was recorded in other non-current liabilities on the balance sheet. During

2010, the Company reclassified CHF 153,523,360 from other non-current liabilities to accrued and

other current liabilities as it expects to make a payment within the next twelve months to Covidien and

Tyco Electronics related to resolution of certain IRS audit matters. The guarantees primarily relate to

certain contingent tax liabilities included in the Tax Sharing Agreement.

In addition, Tyco historically provided support in the form of financial and/or performance

guarantees to various Covidien and Tyco Electronics operating entities. In connection with the

separation, the Company worked with the guarantee counterparties to cancel or assign these guarantees

to Covidien or Tyco Electronics. To the extent these guarantees were not assigned prior to the

4