ADT 2010 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PROPOSAL NUMBER FIVE—ALLOCATION OF FISCAL YEAR 2010 RESULTS AND APPROVAL

OF ORDINARY DIVIDEND

Proposal 5(a)—Allocation of Fiscal Year 2010 Results

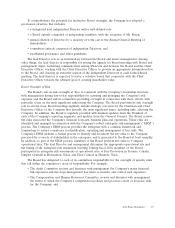

The Board of Directors proposes that the Company’s loss in its statutory accounts as shown below

be carried forward to fiscal year 2011. Although the Company had net income of $1.1 billion on a

U.S. GAAP consolidated basis, on a standalone Swiss GAAP basis, which is the basis for the

Company’s Swiss statutory financial statements, it had a loss of CHF 1.4 billion. The following table

shows the appropriation of loss in Swiss francs and U.S. dollars (converted from Swiss francs as of

September 24, 2010) as proposed by the Board:

Swiss francs U.S. dollars

(in millions) (in millions)

Net loss ................................... CHF 1,405.5 $ 1,425.2

Accumulated deficit, beginning of period ........... 32,841.2 33,301.9

Accumulated deficit, carried forward .............. CHF34,246.7 $34,727.1

The Board of Directors proposes that the Company’s loss of CHF 1,405.5 million be carried

forward in accordance with the table above. Under Swiss law, the allocation of the Company’s balance

sheet results is customarily submitted to shareholders for resolution at each annual general meeting.

The Board unanimously recommends that shareholders vote FOR carrying the fiscal 2010 loss

forward.

Proposal 5(b)—Approval of an Ordinary Cash Dividend

The Board of Directors proposes that ordinary cash dividend in the amount of $1.00 per share be

made out of the Company’s ‘‘contributed surplus’’ equity position in its statutory accounts. Payment of

the dividend will be made in four equal quarterly installments of $0.25 in May 2011, August 2011,

November 2011 and February 2012 at such times and with such record dates as shall be determined by

our Board of Directors. Dividend payments shall be made with respect to the outstanding share capital

of the Company on the record date for the applicable dividend payment, which amount excludes any

shares held by the Company or any of its subsidiaries. The deduction to Tyco’s contributed surplus in

its statutory accounts, which is required to be made in Swiss francs, shall be determined based on the

aggregate amount of the dividend and shall be calculated based on the USD / CHF exchange rate in

effect on the date of the Annual General Meeting. The U.S. dollar amount of the dividend shall be

capped at an amount such that the aggregate reduction to the Company’s contributed surplus shall not

exceed CHF 925 million (or $2.00 per share based on the USD / CHF exchange rate of approximately

CHF 0.97 per $1.00 in effect on January 10, 2011). To the extent that a dividend payment would exceed

the cap, the U.S. dollar per share amount of the current or future dividends shall be reduced on a pro

rata basis so that the aggregate amount of all dividends paid does not exceed the cap. In addition, the

aggregate reduction in contributed surplus shall be increased for any shares issued, and decreased for

any shares acquired, after the Annual General Meeting and before the record date for the applicable

dividend installment payment. The Board’s proposal is accompanied by a report by the auditor,

Deloitte AG (Z¨

urich), as state supervised auditing enterprise, who will be present at the meeting. The

auditor’s report states that the proposed dividend complies with Swiss law.

The Board unanimously recommends that shareholders vote FOR the approval of the payment of

an ordinary cash dividend in the amount of $1.00 per share to be made out of the Company’s

contributed surplus in four equal quarterly installments of $0.25 in May 2011, August 2011, November

2011 and February 2012, at such times and with such record dates as shall be determined by the

Board of Directors.

2011 Proxy Statement 17