ADT 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

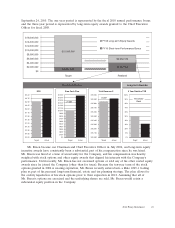

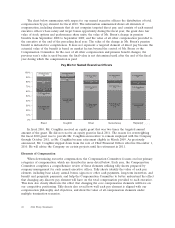

Fiscal 2010 Performance Bonus Summary

Named executive officer Maximum(1) Target Actual

Edward Breen ..................................... $4,062,500 $2,031,250 $4,062,500

Christopher Coughlin ................................ $1,600,000 $ 800,000 $1,600,000

George Oliver ..................................... $1,200,000 $ 600,000 $1,200,000

Naren Gursahaney .................................. $1,120,000 $ 560,000 $1,080,800

Judith Reinsdorf ................................... $ 840,000 $ 420,000 $ 840,000

(1) In December 2009, the Compensation Committee established and the Board approved potential

maximum annual incentive compensation payouts of 0.50% of adjusted net income for Mr. Breen,

subject to a cap of $5.0 million imposed by the 2004 SIP, and 0.25% for the other named executive

officers, subject to a cap of $2.5 million. The Compensation Committee further established a

maximum payout of 200% of target incentive opportunity.

The Board approved award payouts for each of our named executive officers in November 2010.

The Board approved the payments based on the achievement of the minimum adjusted net income

performance threshold of $450 million, and the achievement of the quantitative performance measures

shown in the ‘‘Fiscal 2010 Annual Incentive Compensation Design Summary’’ table above.

Long-Term Incentive Awards

As discussed above, a key element in the compensation of our named executive officers is

long-term equity incentive awards (‘‘LTI compensation’’), which tie a significant portion of

compensation to Company performance. The Compensation Committee believes that LTI compensation

serves the Company’s executive compensation philosophy in several ways. It helps attract, retain and

motivate talent. It aligns the interests of the named executive officers with the interests of shareholders

by linking a significant portion of the officer’s total pay opportunity to share price. It provides

long-term accountability for named executive officers, and it offers the incentive of performance-based

opportunities for capital accumulation in lieu of a pension plan for most of the Company’s executive

management. For a description of the material terms of stock options and performance share units

granted for fiscal 2010 under the 2004 SIP, see the narrative following the ‘‘Grants of Plan-Based

Awards’’ table.

Fiscal 2010 Annual Equity Award

Since the Company separated its healthcare (Covidien) and electronics (Tyco Electronics)

businesses in 2007 (the ‘‘Separation’’), the Compensation Committee has implemented a multi-year

plan to better align the compensation of the Company’s executives with the post-Separation peer group.

From fiscal 2008 to fiscal 2010, the Compensation Committee reduced LTI award levels for named

executive officers by an average of approximately 25% on an annualized basis, based on grant date fair

value. In fiscal 2010, our named executive officers and other key leaders received one-half of their

long-term equity awards in stock options and the other half in performance share units. These awards

are 100% linked to shareholder value creation. The stock options will vest ratably over a four-year

period and will only return value if the Company’s stock price appreciates. Performance share units will

pay out at the end of their three-year performance period only if Tyco’s total shareholder return is

within the upper 65% of the S&P 500 Industrials Index.

Fiscal 2011 Annual Equity Award

For fiscal 2011, the Compensation Committee retained the same mix of performance share units

and stock options for the Chief Executive Officer and added restricted stock units as a component of

LTI compensation for our other named executive officers (other than Mr. Coughlin, who did not

receive a grant for fiscal 2011). After careful consideration of industry trends and the performance of

2011 Proxy Statement 51