ADT 2010 Annual Report Download - page 168

Download and view the complete annual report

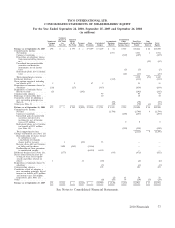

Please find page 168 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation and Summary of Significant Accounting Policies

Basis of Presentation—The Consolidated Financial Statements include the consolidated accounts of

Tyco International Ltd., a corporation organized under the laws of Switzerland, and its subsidiaries

(Tyco and all its subsidiaries, hereinafter collectively referred to as the ‘‘Company’’ or ‘‘Tyco’’). The

financial statements have been prepared in United States dollars (‘‘USD’’) and in accordance with

generally accepted accounting principles in the United States (‘‘GAAP’’). Certain information described

under article 663-663h of the Swiss Code of Obligations has been presented in the Company’s Swiss

statutory financial statements for the period ended September 24, 2010. Unless otherwise indicated,

references in the Consolidated Financial Statements to 2010, 2009 and 2008 are to Tyco’s fiscal year

ended September 24, 2010, September 25, 2009 and September 26, 2008, respectively.

Effective June 29, 2007, Tyco completed the spin-offs of Covidien and Tyco Electronics, formerly

the Healthcare and Electronics businesses, respectively, into separate, publicly traded companies (the

‘‘Separation’’) in the form of a distribution to Tyco shareholders. During 2008, the Company incurred

pre-tax costs related to the Separation of $275 million. Of this amount, $4 million is included in selling,

general and administrative expenses for 2008. Additionally, $258 million in 2008 is related to loss on

early extinguishment of debt and is included in other expense, net. Separation costs included in interest

expense, net during 2008 were $47 million related to the write-off of unamortized credit facility fees.

Also during 2010, 2009 and 2008, $8 million of income, $14 million of expense and $34 million of

income, respectively, relating to the Tax Sharing Agreement is included in other expense, net.

Revenue related to the sale of electronic tags and labels utilized in retailer anti-theft systems is

classified as revenue from product sales. In reporting periods prior to the first quarter of fiscal 2010,

revenue related to the sale of electronic tags and labels utilized in retailer anti-theft systems was

misclassified as service revenue. Such item had no effect on net revenue, operating income (loss), net

income (loss) and cash flows. No changes have been made to previously filed financial statements or in

the comparative amounts presented herein, as the effect in prior periods is not material. Revenue

related to the sale of such electronic tags and labels reflected as service revenue was $286 million and

$364 million in 2009 and 2008, respectively, and related cost of services was $176 million and

$221 million in 2009 and 2008, respectively.

The Company has a 52 or 53-week fiscal year that ends on the last Friday in September. Fiscal

years 2010, 2009 and 2008 were all 52-week years. Fiscal 2011 will be a 53-week year which will end on

September 30, 2011.

Principles of Consolidation—Tyco is a holding company which conducts its business through its

operating subsidiaries. The Company consolidates companies in which it owns or controls more than

fifty percent of the voting shares or has the ability to control through similar rights. Also, the Company

consolidates variable interest entities in which the Company bears a majority of the risk of the entities’

expected losses or stands to gain from a majority of the entities’ expected returns. All intercompany

transactions have been eliminated. The results of companies acquired or disposed of during the year

are included in the Consolidated Financial Statements from the effective date of acquisition or up to

the date of disposal. References to the segment data are to the Company’s continuing operations.

Use of Estimates—The preparation of the Consolidated Financial Statements in conformity with

GAAP requires management to make estimates and assumptions that affect the reported amount of

assets and liabilities, disclosure of contingent assets and liabilities and reported amounts of revenues

and expenses. Significant estimates in these Consolidated Financial Statements include restructuring

charges, allowances for doubtful accounts receivable, estimates of future cash flows associated with

80 2010 Financials