ADT 2010 Annual Report Download - page 272

Download and view the complete annual report

Please find page 272 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO THE FINANCIAL STATEMENTS FOR THE FISCAL YEAR ENDED SEPTEMBER 24, 2010

(Continued)

4. COMMITMENTS AND CONTINGENCIES (Continued)

agencies. The Company has and will continue to communicate with the DOJ and SEC to provide

updates on the baseline review and follow-up investigations, including, as appropriate, briefings

concerning additional instances of potential improper payments identified by the Company in the

course of its ongoing compliance activities. The baseline review revealed that some business practices

may not comply with Tyco and FCPA requirements, and in February 2010, the Company initiated

discussions with the DOJ and SEC aimed at resolving these matters. Active discussions remain ongoing

and the Company cannot predict the timing of their resolution or their outcome and cannot estimate

the range of potential loss or the form of penalty that may result from an adverse resolution. It is

possible that the Company may be required to pay material fines, consent to injunctions on future

conduct, consent to the imposition of a compliance monitor, or suffer other criminal or civil penalties

or adverse impacts, including being subject to lawsuits brought by private litigants, each of which could

have a material adverse effect on the Company’s financial position, results of operations or cash flows.

Covidien and Tyco Electronics agreed, in connection with the separation, to cooperate with the

Company in its responses regarding these matters. Any judgment required to be paid or settlement or

other cost incurred by the Company in connection with the FCPA investigations would be subject to the

liability sharing provisions of the Separation and Distribution Agreement, which assigned liabilities

primarily related to the former Healthcare and Electronics businesses of the Company to Covidien or

Tyco Electronics, respectively, and provides that the Company will retain liabilities primarily related to

its continuing operations. Any liabilities not primarily related to a particular segment will be shared

equally among the Company, Covidien and Tyco Electronics.

In addition to the foregoing, the Company is subject to claims and suits, including from time to

time, contractual disputes and product and general liability claims, incidental to present and former

operations, acquisitions and dispositions. With respect to many of these claims, the Company either

self-insures or maintains insurance through third-parties, with varying deductibles. While the ultimate

outcome of these matters cannot be predicted with certainty, the Company believes that the resolution

of any such proceedings, whether the underlying claims are covered by insurance or not, will not have a

material adverse effect on the Company’s financial condition, results of operations or cash flows beyond

amounts recorded for such matters.

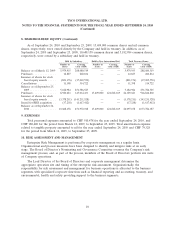

5. DIVESTITURES

During 2010, the Board of Directors approved a plan to pursue a tax-free spin-off of Tyco’s

Electrical and Metal Products business. On November 9, 2010, the Company announced an agreement

to sell a 51% interest in its Electrical and Metal Products business. In connection with this

announcement, the Company no longer plans to pursue the tax-free spin-off of the Electrical and Metal

Products business as proposed on April 27, 2010. See Note 14.

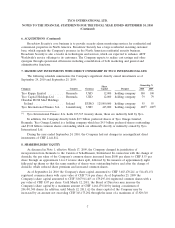

6. ACQUISITIONS

On May 14, 2010, the Company’s ADT Worldwide segment acquired all of the outstanding equity

of Brink’s Home Security Holdings, Inc (‘‘BHS’’ or ‘‘Broadview Security’’), a publicly traded company

that was formerly owned by The Brink’s Company, in a cash-and-stock transaction valued at

approximately $2.0 billion. To complete this transaction, the cash was paid by a subsidiary of the

Company and the stock was paid by the Company and a subsidiary that holds shares in the Company.

6