ADT 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases

of Equity Securities

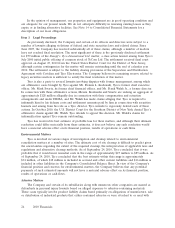

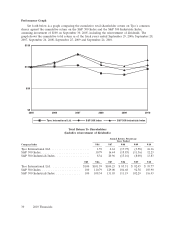

The number of registered holders of Tyco’s common shares as of November 5, 2010 was 26,561.

Tyco common shares are listed and traded on the New York Stock Exchange (‘‘NYSE’’) under the

symbol ‘‘TYC.’’ The following table sets forth the high and low closing sales prices of Tyco common

shares as reported by the NYSE, and the dividends declared on Tyco common shares, for the quarterly

periods presented below. Effective March 17, 2009, Tyco changed its jurisdiction of incorporation from

Bermuda to the Canton of Schaffhausen, Switzerland. In connection with the change of domicile, the

par value of Tyco’s common shares increased from $0.80 per share to 8.53 Swiss francs (CHF) per

share (or $7.21 based on the exchange rate in effect on March 17, 2009). The Change of Domicile was

approved at a special general meeting of shareholders held on March 12, 2009. The following steps

occurred in connection with the Change of Domicile, which did not result in a change to total

shareholders’ equity:

(1) approximately 21 million shares held directly or indirectly in treasury were cancelled;

(2) the par value of common shares was increased from $0.80 to CHF 8.53 through an

approximate 1-for-9 reverse share split, followed by the issuance of approximately eight fully

paid up shares so that the same number of shares were outstanding before and after the

Change of Domicile, which reduced share premium and increased common shares; and

(3) the remaining amount of share premium was eliminated with a corresponding increase to

contributed surplus.

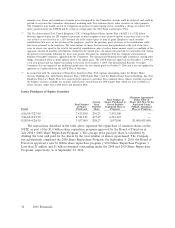

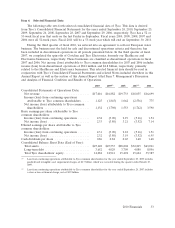

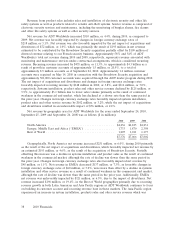

Year Ended September 24, 2010 Year Ended September 25, 2009

Market Price Market Price

Dividends Declared Dividends Declared

Range Range

Per Common Per Common

Quarter High Low Share(1) High Low Share(1)

First ................... $37.08 $33.32 $0.22 $35.02 $15.65 $0.20

Second ................. 38.19 33.95 0.19 24.57 17.43 0.21

Third ................... 40.54 35.00 0.21 28.86 18.88 0.21

Fourth .................. 39.79 34.43 0.24 34.87 25.55 0.23

$0.86 $0.85

(1) The dividends declared in 2010 and the second through fourth quarters of 2009 are the U.S. dollar equivalent of Swiss

francs converted at the U.S. dollar/Swiss franc exchange rate shortly before the payment dates. As a Swiss company,

dividends paid by Tyco are subject to shareholder approval. Shareholders approved annual dividends of CHF 0.93 and

CHF 0.90 at the shareholder meetings held on March 12, 2009 and March 11, 2010, respectively. At the time of approval,

the equivalent U.S. dollar amount of these dividends were $0.80 and $0.84, respectively.

Dividend Policy

Pursuant to Swiss law, dividend payments made prior to January 1, 2011 are subject to Swiss

withholding taxes unless made in the form of a return of capital from our registered share capital. As a

result, we have paid dividends in the form of a reduction of registered share capital, denominated in

Swiss francs since March 2009. Notwithstanding the Swiss denomination of annual dividends we have

made payments of dividends in U.S. dollars based on exchange rates in effect shortly before the

payment date. Fluctuations in the value of the U.S. dollar compared to the Swiss franc between the

date the dividend is declared and paid increase or decrease the U.S. dollar amount required to be paid.

We have managed the variability in cash flows associated with the dividend payments by entering into

derivative financial instruments used as economic hedges of the underlying risk. Our last dividend

28 2010 Financials