The Hartford 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

Pandemic Risk

Pandemic risk is the exposure to loss arising from widespread influenza or other pathogens or bacterial infections that create an

aggregation of loss across the Company's insurance or asset portfolios. Consistent with industry practice, the Company assesses

exposure to pandemics by analyzing the potential impact from a variety of pandemic scenarios based on conditions consistent with

historical outbreaks of flu-like viruses such as the “Severe” 1918 Spanish Flu, the Asian flu of 1957, the Hong Kong flu of 1968, and the

2009 outbreak of the swine flu. For pandemic risk, the Company generally limits its estimated pre-tax loss from a single 250 year event

to less than 10% of total available capital resources. In evaluating these scenarios, the Company assesses the impact on group life

policies, short-term and long term disability, annuities, COLI, property & casualty claims, and losses in the investment portfolio

associated with market declines in the event of a widespread pandemic. While ERM has a process to track and manage these limits, from

time to time, the estimated loss for pandemics may fluctuate above or below these limits due to changes in modeled loss estimates,

exposures, or statutory surplus. Currently, the Company's estimated pre-tax loss for pandemic is less than 10% of total available capital

resources and is based on a single 250 year event.

Reinsurance as a Risk Management Strategy

The Hartford utilizes reinsurance to transfer risk to affiliated and unaffiliated insurers. Reinsurance is used to manage aggregation of risk

as well as to transfer certain risk to reinsurance companies based on specific geographic or risk concentrations. All reinsurance processes

are aligned under a single enterprise reinsurance risk management policy. Reinsurance purchasing is a centralized function across

Commercial Lines, Personal Lines and Talcott Resolution to support a consistent strategy and to ensure that the reinsurance activities are

fully integrated into the organization's risk management processes.

A variety of traditional reinsurance products are used as part of the Company's risk management strategy, including excess of loss

occurrence-based products that protect property and workers compensation exposures, and individual risk or quota share arrangements,

that protect specific classes or lines of business. The Company has no significant finite risk contracts in place and the statutory surplus

benefit from all such prior year contracts is immaterial. Facultative reinsurance is used by the Company to manage policy-specific risk

exposures based on established underwriting guidelines. The Hartford also participates in governmentally administered reinsurance

facilities such as the Florida Hurricane Catastrophe Fund (“FHCF”), the Terrorism Risk Insurance Program established under The

Terrorism Risk Insurance Program Reauthorization Act of 2015 (“TRIPRA”) and other reinsurance programs relating to particular risks

or specific lines of business.

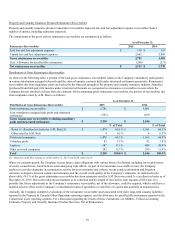

Reinsurance for Catastrophes

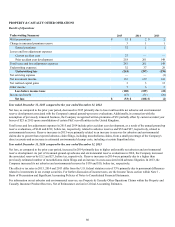

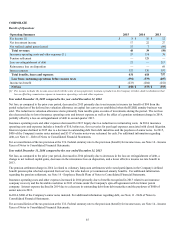

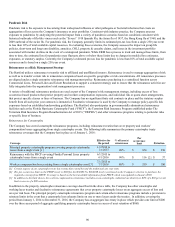

The Company has several catastrophe reinsurance programs, including reinsurance treaties that cover property and workers’

compensation losses aggregating from single catastrophe events. The following table summarizes the primary catastrophe treaty

reinsurance coverages that the Company has in place as of January 1, 2016:

Coverage Effective for

the period % of layer(s)

reinsurance

Per

occurrence

limit Retention

Principal property catastrophe program covering property catastrophe

losses from a single event [1]

1/1/2016 to

1/1/2017 90% $ 850 $ 350

Reinsurance with the FHCF covering Florida Personal Lines property

catastrophe losses from a single event

6/1/2015 to

6/1/2016 90% $ 116 [2] $ 37

Workers compensation losses arising from a single catastrophe event [3]

7/1/2015 to

7/1/2016 80% $ 350 $ 100

[1] Certain aspects of our catastrophe treaty have terms that extend beyond the traditional one year term.

[2] The per occurrence limit on the FHCF treaty is $116 for the 6/1/2015 to 6/1/2016 treaty year based on the Company's election to purchase the

required coverage from FHCF. Coverage is based on the best available information from FHCF, which was updated in January 2016

[3] In addition to the limit shown, the workers compensation reinsurance includes a non-catastrophe, industrial accident layer, 80% of a $30 per event

limit in excess of a $20 retention.

In addition to the property catastrophe reinsurance coverage described in the above table, the Company has other catastrophe and

working layer treaties and facultative reinsurance agreements that cover property catastrophe losses on an aggregate excess of loss and

on a per risk basis. The principal property catastrophe reinsurance program and certain other reinsurance programs include a provision to

reinstate limits in the event that a catastrophe loss exhausts limits on one or more layers under the treaties. In addition, covering the

period from January 1, 2014 to December 31, 2016, the Company has an aggregate loss treaty in place which provides one limit of $200

over the three-year period of aggregate qualifying property catastrophe losses in excess of a net retention of $860.