The Hartford 2015 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

14. Income Taxes (continued)

F-80

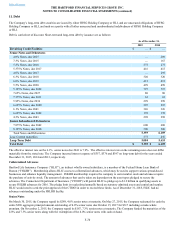

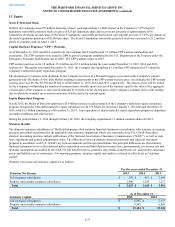

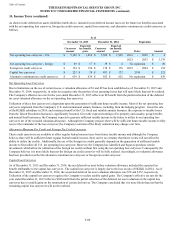

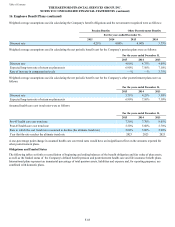

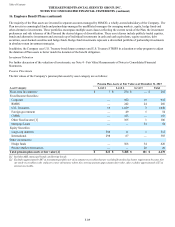

As shown in the deferred tax assets (liabilities) table above, included in net deferred income taxes are the future tax benefits associated

with the net operating loss carryover, foreign tax credit carryover, capital loss carryover, and alternative minimum tax credit carryover as

follows:

As of

December 31, 2015 December 31, 2014 Expiration

Carryover

amount

Expected

tax benefit,

gross Carryover

amount

Expected

tax benefit,

gross Dates Amount

Net operating loss carryover - U.S. $ 5,182 $ 1,814 $ 5,508 $ 1,928 2016 - 2020 $ 4

2023 - 2033 $ 5,178

Net operating loss carryover - foreign $ 89 $ 17 $ 39 $ 8 No expiration $ 89

Foreign tax credit carryover $ 154 $ 154 $ 178 $ 178 2019 - 2024 $ 154

Capital loss carryover $ 222 $ 78 $ 491 $ 172 2019 $ 222

Alternative minimum tax credit carryover $ 639 $ 639 $ 652 $ 652 No expiration $ 639

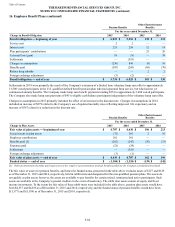

Net Operating Loss Carryover

Due to limitations on the use of certain losses, a valuation allowance of $1 and $9 has been established as of December 31, 2015 and

December 31, 2014, respectively, in order to recognize only the portion of net operating losses that will more likely than not be realized.

The Company's effective tax rate for the year ended December 31, 2015 reflects an $8 benefit from the partial reduction of the deferred

tax asset valuation allowance on the net operating loss carryover.

Utilization of these loss carryovers is dependent upon the generation of sufficient future taxable income. Most of the net operating loss

carryover originated from the Company's U.S. and international annuity business, including from the hedging program. Given the sale

of the HLIKK subsidiary in 2014, and continued runoff of the U.S. fixed and variable annuity business, the exposure to taxable losses

from the Talcott Resolution business is significantly lessened. Given the expected earnings of its property and casualty, group benefits

and mutual fund businesses, the Company expects to generate sufficient taxable income in the future to utilize its net operating loss

carryover net of the recorded valuation allowance. Although the Company projects there will be sufficient future taxable income to fully

recover the remainder of the loss carryover, the Company's estimate of the likely realization may change over time.

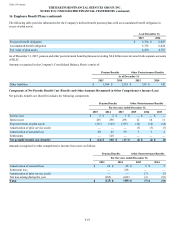

Alternative Minimum Tax Credit and Foreign Tax Credit Carryover

These credit carryovers are available to offset regular federal income taxes from future taxable income and although the Company

believes there will be sufficient future regular federal taxable income, there can be no certainty that future events will not affect the

ability to utilize the credits. Additionally, the use of the foreign tax credits generally depends on the generation of sufficient taxable

income to first utilize all U.S. net operating loss carryover. However, the Company has identified and began to purchase certain

investments which allow for utilization of the foreign tax credits without first using the net operating loss carryover. Consequently, the

Company believes it is more likely than not the foreign tax credit carryover will be fully realized. Accordingly, no valuation allowance

has been provided on either the alternative minimum tax carryover or foreign tax credit carryover.

Capital Loss Carryover

As of December 31, 2015 and December 31, 2014, the net deferred tax asset before valuation allowance included the expected tax

benefit attributable to the capital loss carryover. The capital loss carryover is largely due to the loss on sale of HLIKK in 2014. As of

December 31, 2015 and December 31, 2014, the associated deferred tax asset valuation allowance was $78 and $172, respectively.

Utilization of the capital loss carryover requires the Company to realize taxable capital gains. The Company's effective tax rate for the

year ended December 31, 2015 reflects a $94 benefit from the partial reduction of the deferred tax asset valuation on the capital loss

carryover due to taxable gains on the termination of certain derivatives. The Company concluded that it is more likely than not that the

remaining capital loss carryovers will not be realized.