The Hartford 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

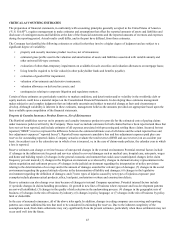

Property and Auto Physical Damage. These lines are fast-developing and paid and reported development techniques are used as these

methods use historical data to develop paid and reported loss development patterns, which are then applied to current paid and reported

losses by accident period to estimate ultimate losses. The Company relies primarily on reported development techniques although a

review of frequency and severity and the initial loss expectation based on the expected loss ratio is used for the most immature accident

months. The advantage of frequency / severity techniques is that frequency estimates are generally easier to predict and external

information can be used to supplement internal data in making severity estimates.

Personal Auto Liability. For auto liability, and bodily injury in particular, the Company performs a greater number of techniques than it

does for property and auto physical damage. In addition to traditional paid and reported development methods, the Company relies on

frequency/severity techniques and Berquist-Sherman techniques. Because the paid development technique is affected by changes in

claim closure patterns and the reported development method is affected by changes in case reserving practices, the Company uses

Berquist-Sherman techniques which adjust these patterns to reflect current settlement rates and case reserving techniques. The Company

generally uses the reported development method for older accident years as a higher percentage of ultimate losses are reflected in

reported losses than in cumulative paid losses and a combination of reported development, frequency/severity and Berquist-Sherman

methods for more recent accident years. Recent periods can be influenced by changes in case reserve practices and changing disposal

rates; the frequency/severity techniques are not affected as much by these changes and the Berquist-Sherman techniques specifically

adjust for these changes.

Auto Liability for Commercial Lines and Short-Tailed General Liability. The Company performs a variety of techniques, including the

paid and reported development methods and frequency / severity techniques. For older, more mature accident years, the Company finds

that reported development techniques are best. For more recent accident years, the Company typically prefers frequency / severity

techniques that make separate assumptions about loss activity above and below a selected capping level.

Long-Tailed General Liability, Bond and Large Deductible Workers’ Compensation. For these long-tailed lines of business, the Company

generally relies on the expected loss ratio and reported development techniques. The Company generally weights these techniques

together, relying more heavily on the expected loss ratio method at early ages of development and more on the reported development

method as an accident year matures.

Workers’ Compensation. Workers’ compensation is the Company’s single largest reserve line of business so a wide range of methods are

reviewed in the reserve analysis. Methods performed include paid and reported development, variations on expected loss ratio methods,

and an in-depth analysis on the largest states. In recent years, we have seen an acceleration of paid losses relative to historical patterns

and have adjusted our expected loss development patterns accordingly. This acceleration has largely been due to two factors. First, we

have seen a higher concentration of first dollar workers' compensation business and less excess of loss business over the past 10 years,

resulting in fewer longer-tailed, excess workers' compensation claims in recent accident years. Second, there has been an increase in

lump sum settlements across multiple accident years as management has executed on strategies to achieve mutually beneficial

settlements with claimants. Adjusting for the effect of an acceleration in payments, paid loss development techniques are generally

preferred for the workers' compensation line. Although paid techniques may be less predictive of the ultimate liability when a low

percentage of ultimate losses are paid as in early periods of development, given changes in the frequency of workers’ compensation

claims over time, the Company places greater reliance on paid methods with continued consideration of incurred methods, open claim

approaches, state-by-state analysis and the expected loss ratio approaches.

Professional Liability. Reported and paid loss developments patterns for this line tend to be volatile. Therefore, the Company typically

relies on frequency and severity techniques.

Assumed Reinsurance and All Other. For these lines, the Company tends to rely on the reported development techniques. In assumed

reinsurance, assumptions are influenced by information gained from claim and underwriting audits.

Allocated Loss Adjustment Expenses (ALAE). For some lines of business (e.g., professional liability and assumed reinsurance), ALAE

and losses are analyzed together. For most lines of business, however, ALAE is analyzed separately, using paid development techniques

and an analysis of the relationship between ALAE and loss payments.

Unallocated Loss Adjustment Expense (ULAE). ULAE is analyzed separately from loss and ALAE. For most lines of business, incurred

ULAE costs to be paid in the future are projected based on an expected cost per claim year and the anticipated claim closure pattern and

the ratio of paid ULAE to paid loss.