The Hartford 2015 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

6. Investments and Derivative Instruments (continued)

F-57

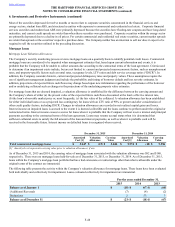

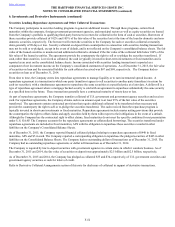

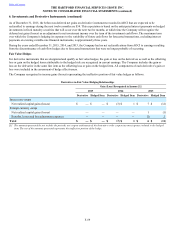

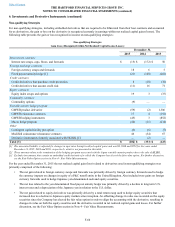

Change in Notional Amount

The net decrease in notional amount of derivatives since December 31, 2014 was primarily due to the following:

• The decline in notional amount related to the GMWB hedging instruments and the macro hedge program was primarily driven

by portfolio re-positioning, a decline in equity markets, and the expiration of certain options. The decline in the GMWB

product related notional amount was primarily driven by policyholder lapses and partial withdrawals.

• The decline in notional amount associated with interest rate derivatives was primarily driven by maturities of the derivatives.

• These declines were partially offset by an increase in notional amount related to credit derivatives that assume credit risk as a

means to earn credit spread while re-balancing within certain fixed maturity sectors.

• Additional increases in notional related to foreign currency swaps and forwards were primarily driven by the purchase of

foreign currency forwards to hedge Japanese yen-denominated cash and equity securities. In addition, the Company purchased

foreign currency forwards to hedge the currency impacts on changes in equity of a P&C runoff entity in the United Kingdom.

Change in Fair Value

The net improvement in the total fair value of derivative instruments since December 31, 2014 was primarily related to the following:

• The decrease in fair value of non-qualifying interest rate derivatives was primarily due to the termination of offsetting swaps

that were in a net gain position.

• The decrease in fair value related to the combined GMWB hedging program, which includes the GMWB product, reinsurance,

and hedging derivatives, was primarily driven by liability model assumption updates, and underperformance of the underlying

actively managed funds compared to their respective indices.

• The increase in fair value of fixed payout annuity hedges was primarily driven by the maturity of a currency swap, partially

offset by an increase in U.S. interest rates.

• The increase in the fair value associated with modified coinsurance reinsurance contracts, which are accounted for as embedded

derivatives and transfer to the reinsurer the investment experience related to the assets supporting the reinsured policies, was

primarily driven by widening credit spreads and an increase in interest rates.

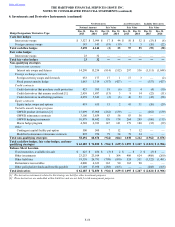

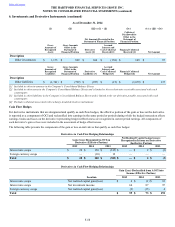

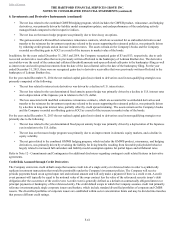

Offsetting of Derivative Assets/Liabilities

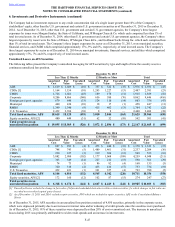

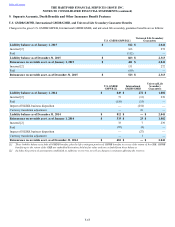

The following tables present the gross fair value amounts, the amounts offset, and net position of derivative instruments eligible for

offset in the Company's Consolidated Balance Sheets. Amounts offset include fair value amounts, income accruals and related cash

collateral receivables and payables associated with derivative instruments that are traded under a common master netting agreement, as

described in the preceding discussion. Also included in the tables are financial collateral receivables and payables, which are

contractually permitted to be offset upon an event of default, although are disallowed for offsetting under U.S. GAAP.

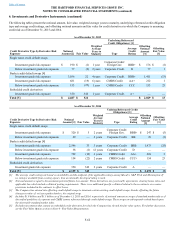

As of December 31, 2015

(i) (ii) (iii) = (i) - (ii) (iv) (v) = (iii) - (iv)

Net Amounts Presented in the

Statement of Financial Position

Collateral

Disallowed for

Offset in the

Statement of

Financial Position

Gross

Amounts of

Recognized

Assets

Gross Amounts

Offset in the

Statement of

Financial Position Derivative

Assets [1]

Accrued

Interest and

Cash Collateral

Received [2] Financial Collateral

Received [4] Net Amount

Description

Other investments $ 933 $ 756 $ 1 $ 176 $ 100 $ 77

Gross

Amounts of

Recognized

Liabilities

Gross Amounts

Offset in the

Statement of

Financial Position Derivative

Liabilities [3]

Accrued

Interest and

Cash Collateral

Pledged [3] Financial Collateral

Pledged [4] Net Amount

Description

Other liabilities $ (1,730) $ (818) $ (798) $ (114) $ (889) $ (23)