The Hartford 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

The fair value of AFS securities was relatively consistent with December 31, 2014, as the impact of widening credit spreads and an

increase in interest rates was partially offset by the reinvestment of short-term assets into fixed maturities, as well as the purchase of U.S.

Treasuries with the proceeds received from repurchase agreements. The Company has reduced its allocation to tax-exempt municipal

bonds in favor of other investments that provide greater after-tax economic return potential given current market conditions and the

Company’s tax position. During 2015, the Company increased its investment in the financial services sector through purchases of

primarily investment grade corporate securities while reducing it's exposure to the energy sector as a result of the continued volatility in

oil prices. These changes are discussed further below.

Energy Exposure

Market values of securities in the energy sector continued to experience volatility throughout 2015. The continued price volatility has

caused credit spreads to widen for corporate and sovereign issuers that generate a large portion of their revenues from energy. The

impact is more pronounced on issuers with below investment grade credit. Ultimately, the impact on these issuers will be determined by

the severity and duration of the decline in prices and the ability of the issuers to hedge price declines, adjust their cost structure or find

other sources of revenue.

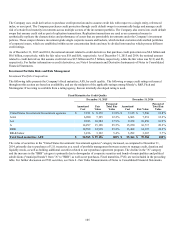

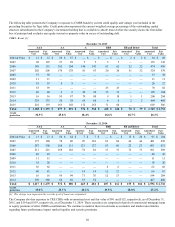

The Company's direct exposure within its investment portfolio to the energy sector totals approximately 3% of total invested assets as of

December 31, 2015 and is primarily comprised of corporate debt. As a result of continued volatility in prices, the Company reduced its

exposure to the energy sector during 2015 by an amortized cost of approximately $1 billion. The Company's energy sector investments

as of December 31, 2015 are primarily comprised of investment grade securities and the exposure is diversified by issuer, as well as in

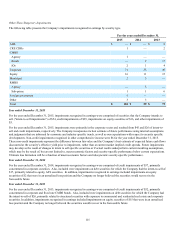

different sub-sectors of the energy market. The following table summarizes the Company's exposure to the energy sector by security type

and credit quality.

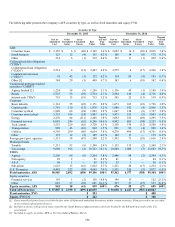

December 31, 2015 December 31, 2014

Cost or

Amortized

Cost Fair Value

Cost or

Amortized

Cost Fair Value

Corporate and equity securities, AFS

Investment grade corporate $ 2,058 $ 2,068 $ 2,818 $ 3,043

Below investment grade corporate 218 181 274 252

Equity, AFS 16 13 23 21

Total corporate and equity securities, AFS 2,292 2,262 3,115 3,316

Foreign govt./govt. agencies, AFS

Investment grade 248 251 322 334

Below investment grade 6 6 36 32

Total foreign govt./govt. agencies, AFS [1] 254 257 358 366

Fixed maturities, FVO

Investment grade 2 2 10 10

Below investment grade 4 4 14 14

Total fixed maturities, FVO 6 6 24 24

Short-term investments 10 10 41 41

Total energy exposure [2] $ 2,562 $ 2,535 $ 3,538 $ 3,747

[1] Includes sovereigns for which oil exports are greater than 4% of gross domestic product.

[2] Excludes equity securities, FVO with cost and fair value of $45 and $45, respectively, as of December 31, 2014, that are hedged with total return

swaps. The Company did not hold any equity securities, FVO within the energy sector as of December 31, 2015.

The Company manages the credit risk associated with the energy sector within the investment portfolio on an on-going basis using

macroeconomic analysis and issuer credit analysis. The Company considers alternate scenarios including oil prices remaining at low

levels for an extended period and/or declining significantly below current levels. For additional details regarding the Company’s

management of credit risks, see the Credit Risk Section of this MD&A. The Company has evaluated all available-for-sale securities for

potential other-than-temporary impairments as of December 31, 2015 and 2014, and concluded that for the securities in an unrealized

loss position, it is more likely than not that we will recover our entire amortized cost basis in the securities. In addition, the Company

does not currently have the intent-to-sell, nor will we be required to sell, the securities discussed above. For additional details regarding

the Company’s impairment process, see the Other-Than-Temporary Impairments Section of this MD&A.